Taxpayer Bill of Rights Alabama Department of Revenue Form

Understanding the Utah Equalization Process

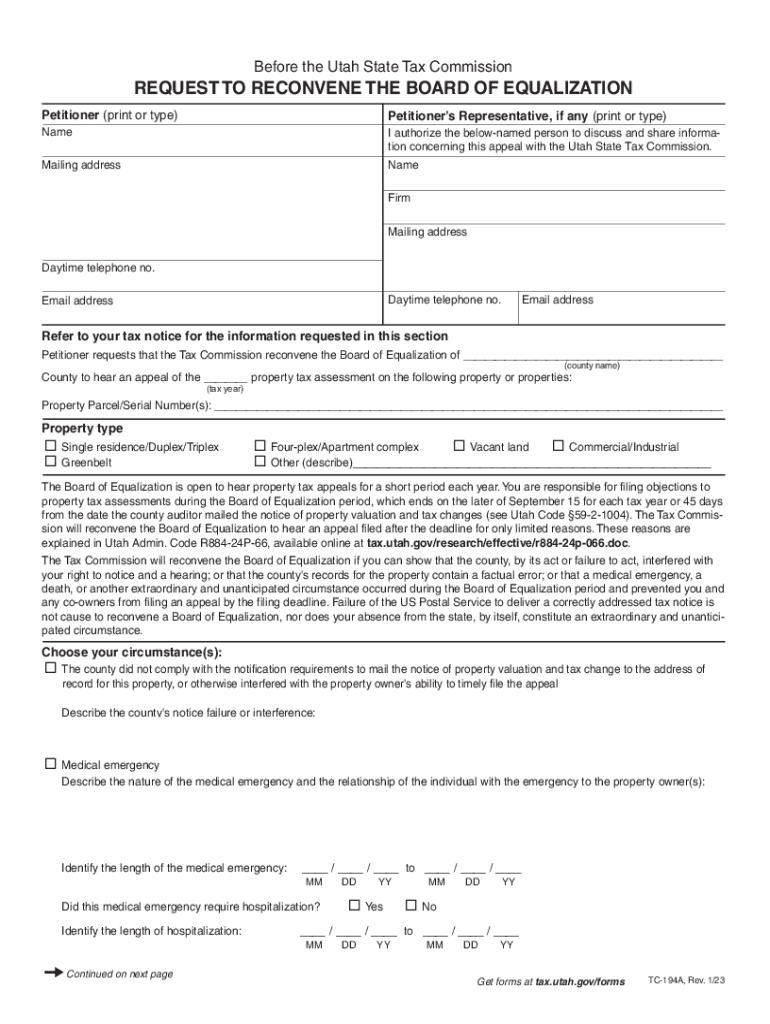

The Utah equalization process is a crucial mechanism for ensuring fair property tax assessments across the state. It allows property owners to request a review of their property tax valuation if they believe it is inaccurate. This process is essential for maintaining equity among taxpayers, as it helps to address discrepancies in property assessments that may arise due to various factors, including market fluctuations or assessment errors.

Steps to Complete the Utah Equalization Request

To initiate an equalization request in Utah, follow these steps:

- Gather necessary documentation, including your current property tax assessment and any evidence supporting your claim.

- Complete the Utah Board Equalization Form, ensuring all required fields are filled accurately.

- Submit the form to your local county board of equalization by the specified deadline, which is typically set for a few weeks after tax notices are mailed.

- Attend any scheduled hearings to present your case, if required.

Required Documents for Utah Equalization

When filing an equalization request, it is important to include the following documents:

- A copy of your current property tax assessment notice.

- Evidence supporting your claim, such as recent appraisals, comparable property sales, or photographs.

- Any additional documentation that may strengthen your case, like maintenance records or improvement receipts.

Eligibility Criteria for Filing an Equalization Request

To be eligible for filing a Utah equalization request, you must meet certain criteria:

- You must be the property owner or an authorized representative.

- Your property must be located within the jurisdiction of the local county board of equalization.

- The request must be submitted within the designated filing period, typically within 45 days of receiving your property tax notice.

Legal Framework Governing Utah Equalization

The equalization process in Utah is governed by state laws and regulations that ensure fair treatment of property owners. The Utah State Tax Commission oversees the equalization process, and compliance with these regulations is essential for a successful request. Understanding the legal framework can help property owners navigate the process more effectively and ensure their rights are protected.

Potential Outcomes of the Equalization Request

After submitting an equalization request, several outcomes are possible:

- The board may agree with your assessment and adjust your property value accordingly.

- Your request may be denied if the board finds that the original assessment is accurate.

- If you disagree with the board's decision, you may have the option to appeal to a higher authority, such as the Utah State Tax Commission.

Quick guide on how to complete taxpayer bill of rights alabama department of revenue

Complete Taxpayer Bill Of Rights Alabama Department Of Revenue effortlessly on any device

Online document management has gained traction with organizations and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documentation, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Handle Taxpayer Bill Of Rights Alabama Department Of Revenue on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Taxpayer Bill Of Rights Alabama Department Of Revenue without hassle

- Obtain Taxpayer Bill Of Rights Alabama Department Of Revenue and click Get Form to get started.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Modify and eSign Taxpayer Bill Of Rights Alabama Department Of Revenue and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer bill of rights alabama department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Utah equalization, and how does it relate to electronic signatures?

Utah equalization refers to the process of ensuring fair and equitable tax assessments in Utah. airSlate SignNow integrates with this process by providing an efficient platform for eSigning documents related to property taxes and equalization appeals, making the workflow smoother and more transparent.

-

How can airSlate SignNow help with Utah equalization processes?

With airSlate SignNow, you can easily create, send, and eSign documents necessary for Utah equalization. The platform simplifies the document management process, allowing you to focus on ensuring that your property taxes are assessed fairly and accurately.

-

What are the pricing options for airSlate SignNow for Utah equalization needs?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including those dealing with Utah equalization. You can choose from different subscription levels, ensuring you find an option that fits your budget while providing the features you need.

-

Are there specific features of airSlate SignNow that support the Utah equalization process?

Yes, airSlate SignNow includes features such as customizable templates, advanced security, and real-time tracking to support Utah equalization processes. These features facilitate quick approval and filing of crucial documents necessary for tax equalization without unnecessary delays.

-

Can airSlate SignNow integrate with other software for managing Utah equalization tasks?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, enabling you to manage your Utah equalization tasks effectively. Whether you're using CRM systems or accounting software, our integrations enhance your workflow and improve efficiency.

-

What benefits does airSlate SignNow provide for users involved in Utah equalization?

Users involved in Utah equalization can benefit from airSlate SignNow through enhanced document security, faster turnaround times, and improved compliance. The platform ensures that your eSigning process is legally binding and meets state requirements, which is critical in the equalization process.

-

How secure is airSlate SignNow for handling sensitive Utah equalization documents?

airSlate SignNow prioritizes security by employing robust encryption and compliance measures to protect your sensitive Utah equalization documents. We adhere to industry standards, ensuring that your data remains confidential and secure throughout the eSigning process.

Get more for Taxpayer Bill Of Rights Alabama Department Of Revenue

- Of name change 497327785 form

- Texas name change 497327786 form

- Texas service form

- Petition change name form

- Texas changing name form

- Texas notice hearing 497327790 form

- Texas installments fixed rate promissory note secured by residential real estate texas form

- Texas installments fixed rate promissory note secured by personal property texas form

Find out other Taxpayer Bill Of Rights Alabama Department Of Revenue

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney