Texas Installments Fixed Rate Promissory Note Secured by Personal Property Texas Form

What is the Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas

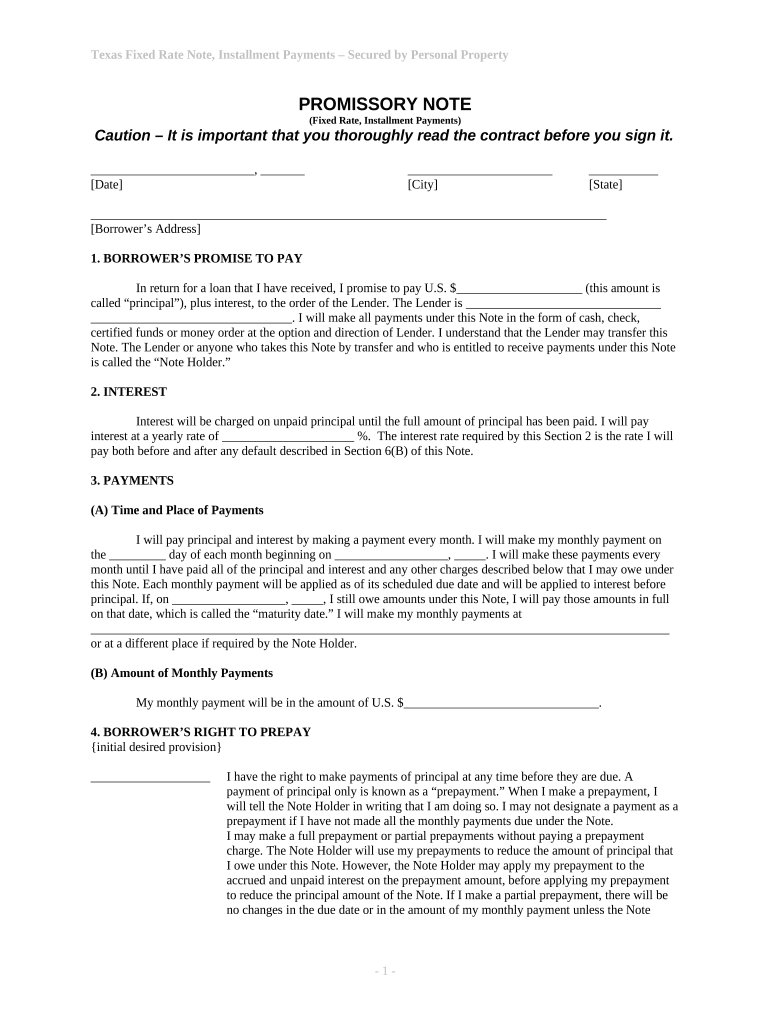

The Texas Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document that outlines the terms of a loan agreement between a borrower and a lender. This note specifies that the borrower will repay the loan in fixed installments over a defined period, with the loan secured by personal property. The document serves as a binding contract, ensuring that both parties understand their rights and obligations. It is particularly useful in transactions where personal property is used as collateral, providing security for the lender while allowing the borrower access to funds.

How to use the Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas

Using the Texas Installments Fixed Rate Promissory Note involves several steps. First, both the borrower and lender must agree on the loan amount, interest rate, and repayment schedule. Once these terms are established, the document should be filled out with accurate information, including the names of both parties, the description of the secured personal property, and the payment terms. After completing the note, both parties must sign it to make it legally binding. It is advisable to keep a copy of the signed document for future reference.

Steps to complete the Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas

Completing the Texas Installments Fixed Rate Promissory Note involves the following steps:

- Identify the parties involved: Clearly state the names and addresses of both the borrower and the lender.

- Specify the loan details: Include the loan amount, interest rate, and repayment terms.

- Describe the collateral: Provide a detailed description of the personal property securing the loan.

- Outline the payment schedule: Indicate when payments are due and the amount of each installment.

- Include any additional terms: Specify any other conditions or agreements between the parties.

- Sign and date the document: Both parties should sign the note to validate the agreement.

Key elements of the Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas

Several key elements make up the Texas Installments Fixed Rate Promissory Note. These include:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The fixed rate applied to the loan amount.

- Repayment Schedule: The timeline for making payments, including due dates.

- Collateral Description: A detailed account of the personal property securing the loan.

- Default Terms: Conditions under which the lender may take action if the borrower fails to repay.

Legal use of the Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas

The legal use of the Texas Installments Fixed Rate Promissory Note is grounded in Texas law, which recognizes the enforceability of written agreements between parties. To be legally binding, the note must contain clear terms and conditions that both parties understand and agree upon. It is essential to ensure that the document complies with relevant state laws regarding secured transactions and personal property. Proper execution and notarization may also enhance the document's legal standing.

State-specific rules for the Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas

Texas has specific rules governing the use of promissory notes secured by personal property. These rules include requirements for the description of the collateral, the necessity of a written agreement, and compliance with the Texas Business and Commerce Code. Additionally, the note should be executed in a manner that meets state requirements, which may involve notarization or witness signatures. Understanding these state-specific regulations is crucial for ensuring the validity and enforceability of the note.

Quick guide on how to complete texas installments fixed rate promissory note secured by personal property texas

Effortlessly Prepare Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas on any device using the airSlate SignNow applications for Android or iOS and simplify your document-related processes today.

Steps to Modify and Electronically Sign Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas with Ease

- Locate Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or by downloading it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that require reprinting documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas?

A Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas is a financial agreement where a borrower promises to repay a loan amount in fixed installments. This note is secured by personal property as collateral, providing lenders with a level of security. This type of promissory note is commonly used in Texas to ensure transparency and reliability in loan agreements.

-

How can I create a Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas using airSlate SignNow?

AirSlate SignNow allows you to create a Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas quickly and easily. You can start with our templates and customize them to fit your specific needs. Our platform guides you through each step, ensuring you can create a legally binding document efficiently.

-

What are the benefits of using airSlate SignNow for my Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas?

Using airSlate SignNow for your Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas offers multiple benefits. It streamlines the signing process, reduces paperwork, and allows for easy tracking of document status. Moreover, our user-friendly interface makes it accessible for individuals and businesses alike.

-

Are there any costs associated with creating a Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas?

Yes, there are costs associated with using airSlate SignNow to create a Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas, but our pricing is competitive and reflects the value of our services. We offer various plans that cater to different needs, ensuring you find an option that fits your budget while enjoying our features and support.

-

Can I integrate airSlate SignNow with other software for my Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage your Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas. This integration allows you to automate workflows and streamline your document management process, making it even more efficient.

-

Is my information secure when using airSlate SignNow for Texas Installments Fixed Rate Promissory Notes?

Security is a top priority for airSlate SignNow. When creating a Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas, your data is protected with industry-standard encryption methods. We strive to ensure that your information remains confidential and secure throughout the signing process.

-

What types of personal property can secure my Texas Installments Fixed Rate Promissory Note?

Various types of personal property can be used as collateral for a Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas. This may include vehicles, equipment, or any valuable asset that can be assigned as security for repayment. Properly identifying and documenting this personal property within the note is critical for protecting both parties.

Get more for Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas

Find out other Texas Installments Fixed Rate Promissory Note Secured By Personal Property Texas

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement