Automatic Extension of Time for Filing Louisiana Income Tax 2022

What is the automatic extension of time for filing Louisiana income tax?

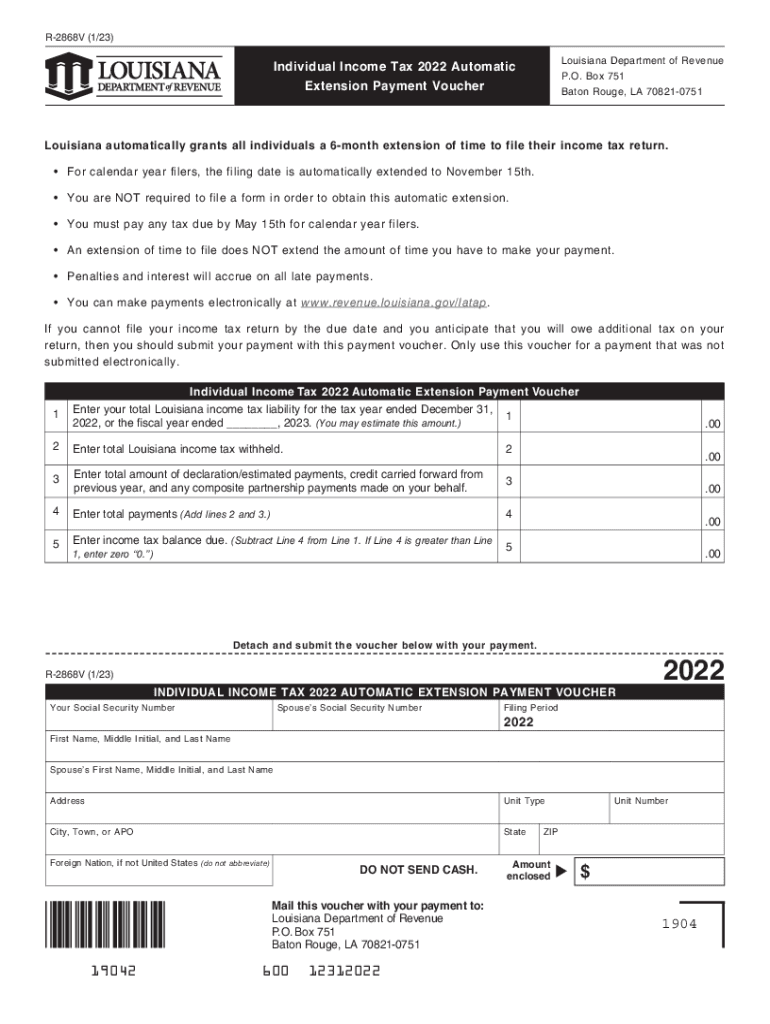

The automatic extension of time for filing Louisiana income tax allows taxpayers to receive an additional six months to submit their tax returns without incurring penalties. This extension is particularly beneficial for individuals and businesses who may need more time to gather necessary documentation or complete their filings accurately. It is important to note that while the extension provides extra time for filing, it does not extend the deadline for payment of any taxes owed.

Steps to complete the automatic extension of time for filing Louisiana income tax

Completing the automatic extension for filing Louisiana income tax involves several straightforward steps:

- Determine your eligibility for the extension based on your filing status and tax situation.

- Fill out the appropriate form, typically the R-2868V, ensuring all required information is accurately provided.

- Submit the form electronically through an approved e-filing service or by mailing it to the designated state tax office.

- Keep a copy of the submitted form for your records, along with any confirmation of submission.

- Prepare your tax return during the extension period and submit it by the new deadline.

Legal use of the automatic extension of time for filing Louisiana income tax

The automatic extension of time for filing Louisiana income tax is legally recognized, provided that taxpayers adhere to specific guidelines. To ensure compliance, individuals must submit the R-2868V form before the original filing deadline. This form serves as a formal request for an extension and must be completed accurately to avoid any issues. Failure to file or pay taxes owed by the extended deadline may result in penalties and interest charges.

Filing deadlines / Important dates

Understanding the key deadlines associated with the automatic extension of time for filing Louisiana income tax is crucial for compliance. The original filing deadline typically falls on May fifteenth for individual taxpayers. If the R-2868V form is submitted on or before this date, taxpayers are granted an extension until November fifteenth. It is essential to mark these dates on your calendar to ensure timely submission and avoid penalties.

Required documents

When applying for the automatic extension of time for filing Louisiana income tax, certain documents may be necessary to support your request. These typically include:

- Your previous year’s tax return for reference.

- Any W-2 or 1099 forms that report income.

- Documentation of any deductions or credits you plan to claim.

- Proof of estimated tax payments made for the year.

Eligibility criteria

To qualify for the automatic extension of time for filing Louisiana income tax, taxpayers must meet specific eligibility criteria. Generally, this extension is available to individual taxpayers, including those who file jointly or as head of household. However, certain conditions may apply, such as being a resident or non-resident of Louisiana. It is advisable to review the guidelines provided by the Louisiana Department of Revenue to confirm eligibility.

Quick guide on how to complete automatic extension of time for filing louisiana income tax

Effortlessly Prepare Automatic Extension Of Time For Filing Louisiana Income Tax on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle Automatic Extension Of Time For Filing Louisiana Income Tax on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Automatic Extension Of Time For Filing Louisiana Income Tax with Ease

- Find Automatic Extension Of Time For Filing Louisiana Income Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Automatic Extension Of Time For Filing Louisiana Income Tax to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct automatic extension of time for filing louisiana income tax

Create this form in 5 minutes!

How to create an eSignature for the automatic extension of time for filing louisiana income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow 2868v?

The airSlate SignNow 2868v offers powerful eSignature capabilities, document templates, and automated workflows. With user-friendly navigation, businesses can streamline their document processes, ensuring quick and secure transactions. This makes it an ideal solution for organizations looking to enhance efficiency and decrease turnaround times.

-

How does pricing for airSlate SignNow 2868v compare to competitors?

airSlate SignNow 2868v provides competitive pricing with various plans to fit businesses of all sizes. Its cost-effective solution allows users to access vital features without breaking the bank. This makes it an attractive option compared to other electronic signature providers in the market.

-

Can airSlate SignNow 2868v integrate with other applications?

Yes, airSlate SignNow 2868v seamlessly integrates with a variety of popular applications, including Google Drive, Salesforce, and Microsoft Office. This allows users to manage their document workflows more efficiently by combining tools they already use. The integrations enhance the overall functionality and convenience of the platform.

-

What benefits does airSlate SignNow 2868v provide for businesses?

By implementing airSlate SignNow 2868v, businesses can reduce paperwork, speed up contract processing, and improve compliance. This not only saves time but also enhances productivity within organizations. Users appreciate the ease of tracking document status and managing electronic signatures in one centralized location.

-

Is airSlate SignNow 2868v secure for sensitive documents?

Absolutely! airSlate SignNow 2868v employs industry-leading security measures, including encryption and secure cloud storage, to safeguard your documents. Compliance with regulations such as GDPR ensures that all transactions are conducted safely. You can trust that your sensitive information remains protected while using the platform.

-

What types of documents can be signed using airSlate SignNow 2868v?

airSlate SignNow 2868v allows users to sign a variety of document types, including contracts, agreements, and forms. This versatility makes it suitable for different industries, from legal to real estate, making document signing easier for everyone involved. Users can upload files in multiple formats to streamline the signing process.

-

Is there customer support available for airSlate SignNow 2868v users?

Yes, airSlate SignNow 2868v provides robust customer support through various channels, including live chat, email, and phone support. Users can access help when they encounter issues or have questions about features. The commitment to customer service ensures that users can maximize their usage of the platform.

Get more for Automatic Extension Of Time For Filing Louisiana Income Tax

- Wedding planning or consultant package texas form

- Texas hunting 497327841 form

- Identity theft recovery package texas form

- Statutory general power of attorney for health care texas form

- Revocation of statutory power of attorney for health care texas form

- Aging parent package texas form

- Sale of a business package texas form

- Guardianship of a minor in texas form

Find out other Automatic Extension Of Time For Filing Louisiana Income Tax

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple