Can I Apply for an Extension to File My Return? Alabama 2023-2026

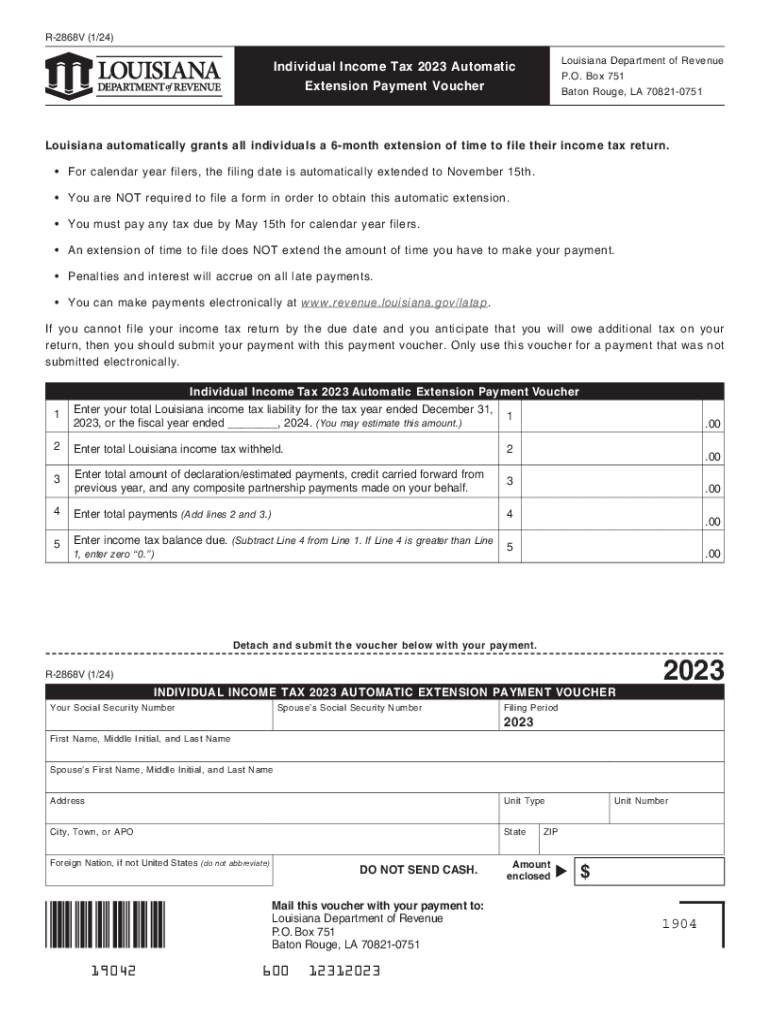

Understanding the 2868v Individual Form

The 2868v individual form is a crucial document for taxpayers in the United States, particularly for those seeking to file for an extension on their income tax returns. This form serves as a voucher for individuals who need additional time to complete their tax filings. It is essential to understand the purpose of this form to ensure compliance with federal and state tax regulations.

Eligibility Criteria for the 2868v Individual Form

To qualify for using the 2868v individual form, taxpayers must meet specific criteria. Generally, individuals who anticipate needing extra time to gather necessary documentation or complete their tax returns can apply. This includes self-employed individuals, retirees, and students who may have unique tax situations. Understanding eligibility helps streamline the application process and ensures that taxpayers do not face penalties for late submissions.

Steps to Complete the 2868v Individual Form

Completing the 2868v individual form involves several straightforward steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Fill out the form accurately, ensuring all personal information is correct.

- Calculate any estimated tax payments due if applicable.

- Review the form for completeness before submission.

Following these steps can help prevent delays and ensure a smooth filing process.

Filing Deadlines for the 2868v Individual Form

It is important to be aware of the filing deadlines associated with the 2868v individual form. Typically, the form must be submitted by the original due date of the tax return. For most taxpayers, this is April 15. Missing this deadline may result in penalties or interest on unpaid taxes, making timely submission crucial.

Form Submission Methods for the 2868v Individual Form

The 2868v individual form can be submitted through various methods to accommodate different preferences:

- Online Submission: Many taxpayers prefer to file electronically for convenience and speed.

- Mail: The form can also be printed and mailed to the appropriate tax authority.

- In-Person: Some individuals may choose to submit the form in person at designated tax offices.

Choosing the right submission method can enhance the filing experience and ensure that the form is processed efficiently.

Penalties for Non-Compliance with the 2868v Individual Form

Failing to submit the 2868v individual form by the deadline can lead to significant penalties. Taxpayers may incur fines or interest on any unpaid taxes. Understanding these consequences emphasizes the importance of timely and accurate filing. Being proactive in managing tax responsibilities can help avoid unnecessary financial burdens.

Quick guide on how to complete can i apply for an extension to file my return alabama

Prepare Can I Apply For An Extension To File My Return? Alabama effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed papers, as you can easily find the right form and securely save it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents quickly without holdups. Manage Can I Apply For An Extension To File My Return? Alabama on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Can I Apply For An Extension To File My Return? Alabama without hassle

- Obtain Can I Apply For An Extension To File My Return? Alabama and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Can I Apply For An Extension To File My Return? Alabama ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct can i apply for an extension to file my return alabama

Create this form in 5 minutes!

How to create an eSignature for the can i apply for an extension to file my return alabama

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the louisiana r2868v payment process?

The louisiana r2868v payment process involves electronically signing and submitting payment documents through airSlate SignNow. This streamlined approach ensures that all parties can quickly review and approve documents without the need for physical paperwork. With our platform, businesses can also track payment status in real-time, enhancing overall efficiency.

-

How does airSlate SignNow support louisiana r2868v payment?

airSlate SignNow supports louisiana r2868v payment by providing tools for secure e-signatures and document management. Users can create, send, and sign payment-related documents from any device, ensuring accessibility and flexibility. This capability simplifies the payment process and reduces administrative burdens on your team.

-

What are the pricing options for louisiana r2868v payment services?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of businesses processing louisiana r2868v payments. Our plans are designed to be cost-effective while providing robust features such as unlimited document signing and customized templates. Visit our pricing page for more details on specific packages and promotional offers.

-

Can I integrate airSlate SignNow with other software for louisiana r2868v payment?

Yes, airSlate SignNow allows integrations with various software applications that can enhance your louisiana r2868v payment processes. Whether you use CRM systems, accounting software, or cloud storage, our platform supports seamless connectivity. This integration capability helps streamline workflows and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for louisiana r2868v payment?

Using airSlate SignNow for louisiana r2868v payment offers numerous benefits, including improved speed, enhanced security, and better document management. It eliminates the hassles of physical signatures, allowing businesses to finalize payments faster. Additionally, the platform maintains compliance with legal standards, ensuring your transactions are secure and valid.

-

Is training available for using the louisiana r2868v payment features?

Yes, airSlate SignNow provides comprehensive training resources to help users effectively utilize the louisiana r2868v payment features. We offer tutorials, webinars, and customer support to assist you in navigating the platform. Our goal is to ensure that your team can maximize efficiency and comfort when using our payment solutions.

-

What types of documents can I create for louisiana r2868v payment?

You can create various types of documents for louisiana r2868v payment, including invoices, payment agreements, and contracts. airSlate SignNow provides customizable templates to cater to your specific needs, making it easier to get documents signed and processed quickly. This flexibility allows businesses to adapt the platform for different payment scenarios.

Get more for Can I Apply For An Extension To File My Return? Alabama

- The south dakota codified laws section 55 1 4 through 55 1 5 form

- Revocable living trust and is created in accordance with chapter 55 of form

- On this day of in the year before me 490219162 form

- Business law chapter 17 flashcardsquizlet form

- Heshethey executed the same form

- County state of south dakota and described as follows form

- State of south dakota and being described as follows form

- Deed of trust fill out and sign printable pdf template form

Find out other Can I Apply For An Extension To File My Return? Alabama

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast