Fast Easy Absolutely Louisiana Department of Revenue 2022

Understanding the Louisiana State Tax Form 2022

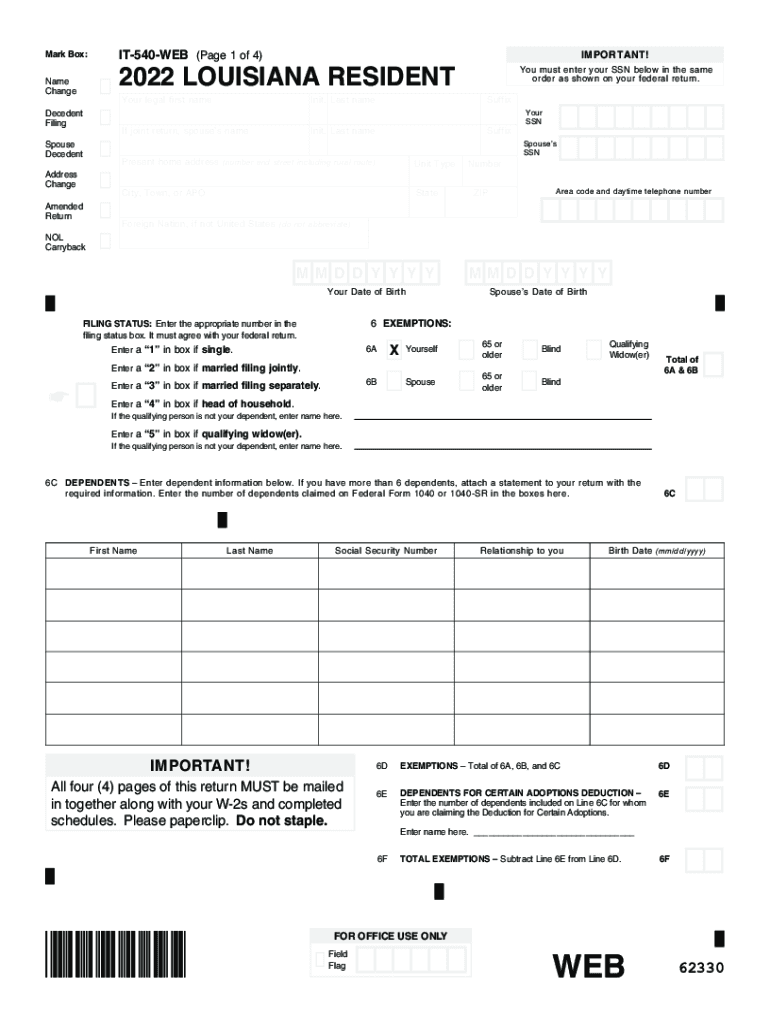

The Louisiana state tax form 2022, specifically the IT-540, is essential for residents who need to report their income and calculate their state tax obligations. This form is designed for individuals filing their annual income tax returns. It captures various income sources, deductions, and credits that may apply to taxpayers in Louisiana. Understanding the structure and requirements of this form can help ensure accurate and timely filing.

Steps to Complete the Louisiana State Tax Form 2022

Filling out the Louisiana state tax form 2022 involves several key steps:

- Gather Required Documents: Collect all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: List all sources of income, including wages, interest, and dividends.

- Claim Deductions and Credits: Identify any deductions or credits you qualify for, such as the standard deduction or specific tax credits.

- Calculate Tax Liability: Use the provided tables to determine your tax liability based on your taxable income.

- Review and Sign: Carefully review the completed form for accuracy before signing and dating it.

Filing Deadlines for the Louisiana State Tax Form 2022

It is important to be aware of the filing deadlines for the Louisiana state tax form 2022. The typical deadline for filing individual income tax returns is May 15, 2023, for the 2022 tax year. If you need additional time, you may request an extension, but this must be done before the original deadline. Keep in mind that any taxes owed must still be paid by the original due date to avoid penalties and interest.

Form Submission Methods for the Louisiana State Tax Form 2022

There are several methods to submit the Louisiana state tax form 2022:

- Online Filing: You can file your form electronically through the Louisiana Department of Revenue's website or using approved e-filing software.

- Mail: If you prefer to file by mail, send your completed form to the appropriate address provided by the Louisiana Department of Revenue.

- In-Person: You may also visit a local Department of Revenue office to submit your form in person.

Required Documents for the Louisiana State Tax Form 2022

When completing the Louisiana state tax form 2022, you will need to have several documents on hand:

- W-2 Forms: These are provided by your employer and detail your earnings and withheld taxes.

- 1099 Forms: If you have income from freelance work or other sources, these forms will be necessary.

- Receipts for Deductions: Keep records of any deductible expenses, such as medical bills or charitable contributions.

- Previous Year’s Tax Return: This can serve as a reference for completing your current return.

Penalties for Non-Compliance with the Louisiana State Tax Form 2022

Failing to file the Louisiana state tax form 2022 on time or not paying the taxes owed can lead to penalties. Common penalties include:

- Late Filing Penalty: A percentage of the unpaid tax may be charged for each month the return is late.

- Interest Charges: Interest accrues on any unpaid tax from the original due date until payment is made.

- Failure to Pay Penalty: Additional penalties may apply if taxes are not paid by the deadline.

Quick guide on how to complete fast easy absolutely free louisiana department of revenue

Easily Prepare Fast Easy Absolutely Louisiana Department Of Revenue on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the appropriate template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and effortlessly. Manage Fast Easy Absolutely Louisiana Department Of Revenue on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-focused workflow today.

The Easiest Way to Edit and eSign Fast Easy Absolutely Louisiana Department Of Revenue with Minimal Effort

- Obtain Fast Easy Absolutely Louisiana Department Of Revenue and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact confidential data using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Fast Easy Absolutely Louisiana Department Of Revenue to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fast easy absolutely free louisiana department of revenue

Create this form in 5 minutes!

How to create an eSignature for the fast easy absolutely free louisiana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the louisiana state tax form 2022 and why is it important?

The louisiana state tax form 2022 is a document required for filing state taxes in Louisiana. It is important for ensuring compliance with state tax laws and accurately reporting your income. Filing this form correctly can help you avoid penalties and ensure that you receive potential tax refunds.

-

How can airSlate SignNow help me with my louisiana state tax form 2022?

airSlate SignNow simplifies the process of completing and eSigning your louisiana state tax form 2022. With its user-friendly interface, you can easily upload, fill out, and send the form securely. This ensures that your tax documents are processed efficiently and accurately.

-

What features does airSlate SignNow offer for managing louisiana state tax form 2022?

airSlate SignNow offers features such as customizable templates, electronic signatures, and secure document storage to assist with your louisiana state tax form 2022. These tools streamline the filing process and enhance collaboration with your tax preparer or team members.

-

Is there a cost associated with using airSlate SignNow for louisiana state tax form 2022?

Yes, airSlate SignNow has a subscription pricing model. However, it is generally considered a cost-effective solution for managing your louisiana state tax form 2022, especially when compared to traditional paper methods which involve additional costs for printing and mailing.

-

Can I integrate airSlate SignNow with other tools for my louisiana state tax form 2022?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and various accounting software. This allows you to seamlessly manage your louisiana state tax form 2022 alongside your other business documents and workflows.

-

What are the benefits of using airSlate SignNow for my louisiana state tax form 2022?

Using airSlate SignNow for your louisiana state tax form 2022 provides numerous benefits such as increased efficiency, reduced paperwork, and secure document handling. It simplifies the eSignature process, ensuring quicker approvals and submissions while keeping your personal data safe.

-

How does airSlate SignNow ensure the security of my louisiana state tax form 2022?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your louisiana state tax form 2022. This commitment to security ensures that your sensitive information remains confidential and accessible only to authorized users.

Get more for Fast Easy Absolutely Louisiana Department Of Revenue

- Assignment of mortgage package texas form

- Assignment of lease package texas form

- Texas purchase 497327866 form

- Cancellation release 497327867 form

- Texas premarital agreement 497327868 form

- Painting contractor package texas form

- Framing contractor package texas form

- Foundation contractor package texas form

Find out other Fast Easy Absolutely Louisiana Department Of Revenue

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile