Net Operating Loss NOL Provisions Alabama Department 2022

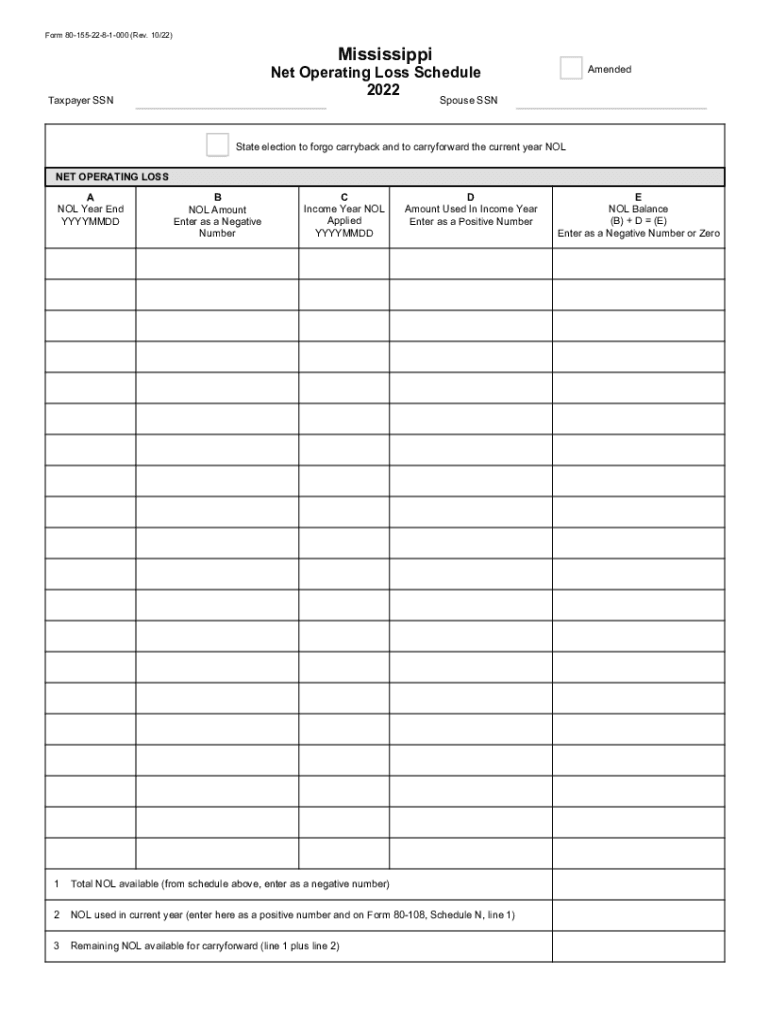

Understanding the Mississippi Form 80 155

The Mississippi Form 80 155 is primarily used for reporting net operating losses (NOL) for tax purposes. This form allows businesses to claim a deduction for losses incurred in previous years, which can offset taxable income in future years. Understanding the purpose and requirements of this form is crucial for ensuring compliance with state tax regulations.

Steps to Complete the Mississippi Form 80 155

Filling out the Mississippi Form 80 155 involves several key steps:

- Gather necessary financial documents, including profit and loss statements and prior tax returns.

- Complete the identification section with your business name, address, and tax identification number.

- Calculate the net operating loss for the applicable tax year, ensuring accuracy in figures.

- Transfer the calculated NOL to the appropriate section of the form.

- Review the form for completeness and accuracy before submission.

Eligibility Criteria for Using Form 80 155

To be eligible to use the Mississippi Form 80 155, a business must meet specific criteria:

- The business must have incurred a net operating loss in a prior year.

- Losses must be properly documented and substantiated with financial records.

- The business must be registered and in good standing with the Mississippi Department of Revenue.

Legal Use of the Mississippi Form 80 155

The legal validity of the Mississippi Form 80 155 hinges on adherence to state tax laws. Properly completing and submitting this form allows businesses to claim tax benefits legally. It is essential to ensure that all information provided is accurate and that the form is submitted within the designated filing deadlines to avoid potential penalties.

Filing Deadlines for Form 80 155

Timely filing of the Mississippi Form 80 155 is critical. The form must be submitted by the due date of the tax return for the year in which the NOL occurred. Extensions may be available, but it is crucial to check with the Mississippi Department of Revenue for specific deadlines and any changes that may occur annually.

Form Submission Methods for Mississippi Form 80 155

Businesses can submit the Mississippi Form 80 155 through various methods:

- Online submission via the Mississippi Department of Revenue's e-filing system.

- Mailing a paper version of the form to the appropriate state tax office.

- In-person submission at designated tax offices, if preferred.

Penalties for Non-Compliance with Form 80 155

Failure to comply with the requirements for the Mississippi Form 80 155 can result in penalties. These may include fines, interest on unpaid taxes, and potential audits. It is essential for businesses to ensure that they meet all filing requirements and deadlines to avoid these consequences.

Quick guide on how to complete net operating loss nol provisions alabama department

Complete Net Operating Loss NOL Provisions Alabama Department effortlessly on any device

Online document handling has gained prominence among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, amend, and eSign your documents promptly without interruptions. Manage Net Operating Loss NOL Provisions Alabama Department on any device with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Net Operating Loss NOL Provisions Alabama Department easily

- Obtain Net Operating Loss NOL Provisions Alabama Department and then click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors necessitating new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device of your choice. Modify and eSign Net Operating Loss NOL Provisions Alabama Department and ensure clear communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct net operating loss nol provisions alabama department

Create this form in 5 minutes!

How to create an eSignature for the net operating loss nol provisions alabama department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mississippi Form 80 155?

The Mississippi Form 80 155 is a crucial document used for specific legal and administrative purposes within the state. It plays an important role in ensuring compliance with state regulations. Understanding how to complete and submit this form can help streamline your business operations.

-

How can airSlate SignNow help with the Mississippi Form 80 155?

airSlate SignNow simplifies the process of creating, sending, and eSigning the Mississippi Form 80 155. Our platform allows you to easily manage document workflows, ensuring that you can submit forms accurately and promptly. This reduces delays and ensures compliance with state regulations.

-

What features does airSlate SignNow offer for the Mississippi Form 80 155?

Key features of airSlate SignNow for handling the Mississippi Form 80 155 include electronic signatures, document templates, and automated workflows. These features enhance efficiency and accuracy, allowing you to focus on more important business matters. Additionally, our solution is user-friendly and easy to navigate.

-

What pricing options are available for airSlate SignNow users?

airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for those focusing on the Mississippi Form 80 155. Each plan includes a range of features to facilitate efficient document management and eSigning. You can choose the plan that best meets your budget and requirements.

-

Is airSlate SignNow secure for managing the Mississippi Form 80 155?

Yes, airSlate SignNow prioritizes the security of all documents, including the Mississippi Form 80 155. Our platform employs advanced encryption and compliance measures to protect sensitive information. You can eSign and store your documents with confidence, knowing they are secure.

-

Can I integrate airSlate SignNow with other software for the Mississippi Form 80 155?

Absolutely! airSlate SignNow supports integrations with various applications and software, allowing you to manage the Mississippi Form 80 155 seamlessly. This allows you to streamline operations further, whether you are using CRM systems or cloud storage services.

-

What benefits does airSlate SignNow offer when using the Mississippi Form 80 155?

Using airSlate SignNow for the Mississippi Form 80 155 offers numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times. The platform's electronic signing feature allows you to complete forms quickly, avoiding the hassles of printing and mailing. It's a cost-effective solution that enhances productivity.

Get more for Net Operating Loss NOL Provisions Alabama Department

- Texas organized 497327912 form

- Postnuptial agreement template 497327913 form

- Letters of recommendation package texas form

- Texas construction or mechanics lien package individual texas form

- Texas mechanics lien file form

- Storage business package texas form

- Child care services package texas form

- Texas poa form

Find out other Net Operating Loss NOL Provisions Alabama Department

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure