80155248 2024-2026

Understanding the Mississippi 155 Schedule

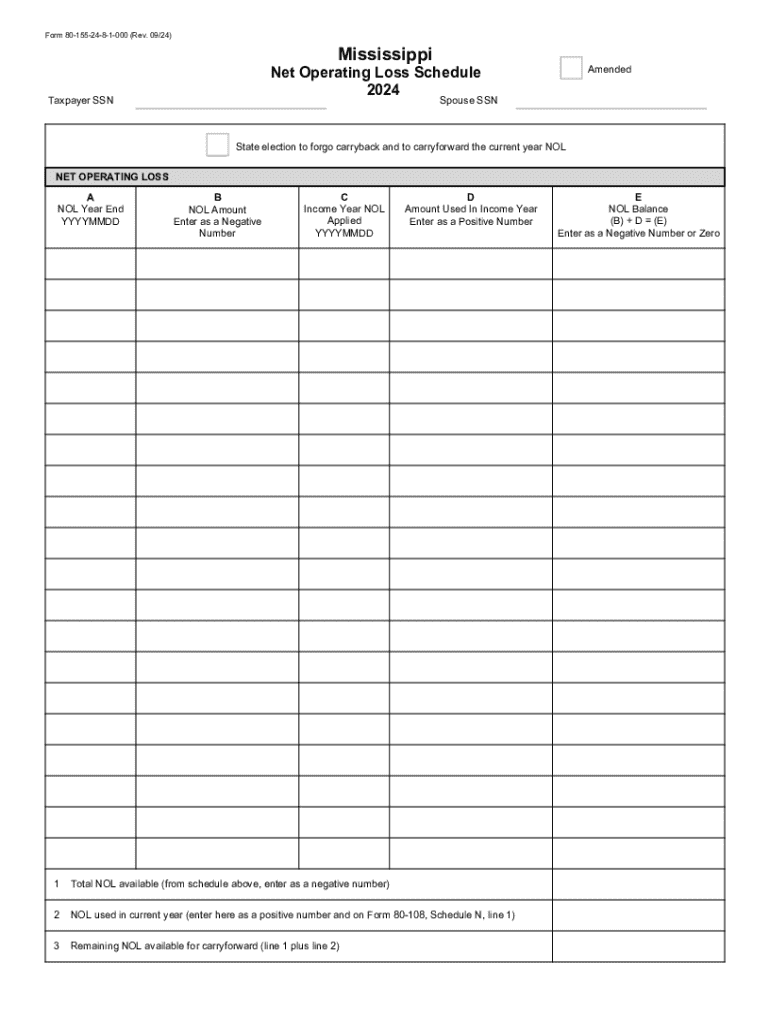

The Mississippi 155 Schedule, also known as the Mississippi Form 155, is a tax document used primarily for reporting various types of income and deductions. This form is essential for individuals and businesses in Mississippi to accurately report their financial activities to the state’s Department of Revenue. It ensures compliance with state tax laws and helps taxpayers avoid penalties associated with incorrect filings.

Steps to Complete the Mississippi 155 Schedule

Completing the Mississippi 155 Schedule involves several key steps:

- Gather necessary documentation, including income statements, receipts for deductions, and any previous tax returns.

- Fill out the form accurately, ensuring all income sources are reported and deductions are claimed appropriately.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid late fees or penalties.

Required Documents for the Mississippi 155 Schedule

To successfully complete the Mississippi 155 Schedule, taxpayers should prepare the following documents:

- W-2 forms from employers, detailing wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as business expenses or charitable contributions.

- Any prior year tax returns for reference.

Filing Deadlines for the Mississippi 155 Schedule

It is crucial to be aware of the filing deadlines for the Mississippi 155 Schedule. Typically, the form must be submitted by April 15 of the following tax year. However, if the deadline falls on a weekend or holiday, the due date may be extended. Taxpayers should check with the Mississippi Department of Revenue for any updates or changes to these deadlines.

Legal Use of the Mississippi 155 Schedule

The Mississippi 155 Schedule is legally required for residents and businesses earning income in the state. Filing this form accurately is essential to fulfill tax obligations and avoid legal repercussions. Failure to file or inaccuracies in the form can lead to audits, fines, or other penalties imposed by the state.

Who Issues the Mississippi 155 Schedule

The Mississippi 155 Schedule is issued by the Mississippi Department of Revenue. This state agency is responsible for administering tax laws, collecting taxes, and ensuring compliance among taxpayers. Individuals and businesses can obtain the form directly from the Department of Revenue’s official website or through authorized tax preparation services.

Create this form in 5 minutes or less

Find and fill out the correct 80155248

Create this form in 5 minutes!

How to create an eSignature for the 80155248

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mississippi 155 schedule for airSlate SignNow?

The Mississippi 155 schedule refers to the timeline and availability of airSlate SignNow's services tailored for users in Mississippi. This schedule ensures that businesses can efficiently send and eSign documents without delays. By adhering to the Mississippi 155 schedule, users can optimize their document workflows.

-

How does airSlate SignNow support the Mississippi 155 schedule?

airSlate SignNow is designed to align with the Mississippi 155 schedule by providing timely updates and features that cater to local businesses. This includes ensuring compliance with state regulations and offering tools that enhance document management. Users can rely on airSlate SignNow to streamline their processes according to the Mississippi 155 schedule.

-

What are the pricing options for airSlate SignNow in relation to the Mississippi 155 schedule?

airSlate SignNow offers competitive pricing plans that accommodate the needs of businesses following the Mississippi 155 schedule. These plans are designed to be cost-effective while providing essential features for document signing and management. Users can choose a plan that best fits their requirements and budget.

-

What features does airSlate SignNow offer that align with the Mississippi 155 schedule?

Key features of airSlate SignNow that align with the Mississippi 155 schedule include customizable templates, real-time tracking, and secure eSigning capabilities. These features help businesses manage their documents efficiently and ensure compliance with local regulations. By utilizing these tools, users can enhance their productivity.

-

How can airSlate SignNow benefit businesses following the Mississippi 155 schedule?

Businesses following the Mississippi 155 schedule can benefit from airSlate SignNow by streamlining their document workflows and reducing turnaround times. The platform's user-friendly interface allows for quick eSigning and document management. This efficiency can lead to improved customer satisfaction and operational effectiveness.

-

Are there integrations available for airSlate SignNow that support the Mississippi 155 schedule?

Yes, airSlate SignNow offers various integrations that support the Mississippi 155 schedule, allowing users to connect with popular applications and services. These integrations enhance the functionality of airSlate SignNow, making it easier to manage documents across different platforms. Users can seamlessly incorporate their existing tools into their workflows.

-

Is airSlate SignNow compliant with Mississippi regulations regarding the 155 schedule?

airSlate SignNow is designed to comply with Mississippi regulations, including those related to the 155 schedule. This compliance ensures that businesses can confidently use the platform for their document signing needs. By adhering to these regulations, airSlate SignNow helps users avoid potential legal issues.

Get more for 80155248

- Sss e6 form

- Laboratory address number and street form

- Eagle scout service project worksheet boy scouts of america form

- 2018 michigan individual income tax return mi 1040 2018 michigan individual income tax return mi 1040 form

- A small claims writ and notice of suit form

- Ems agency form

- Membership savings pagibigfund gov form

- P87 form

Find out other 80155248

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure