New Jersey Form NJ 1040NR V NJ Gross Income Tax 2022

What is the New Jersey Form NJ 1040NR V NJ Gross Income Tax

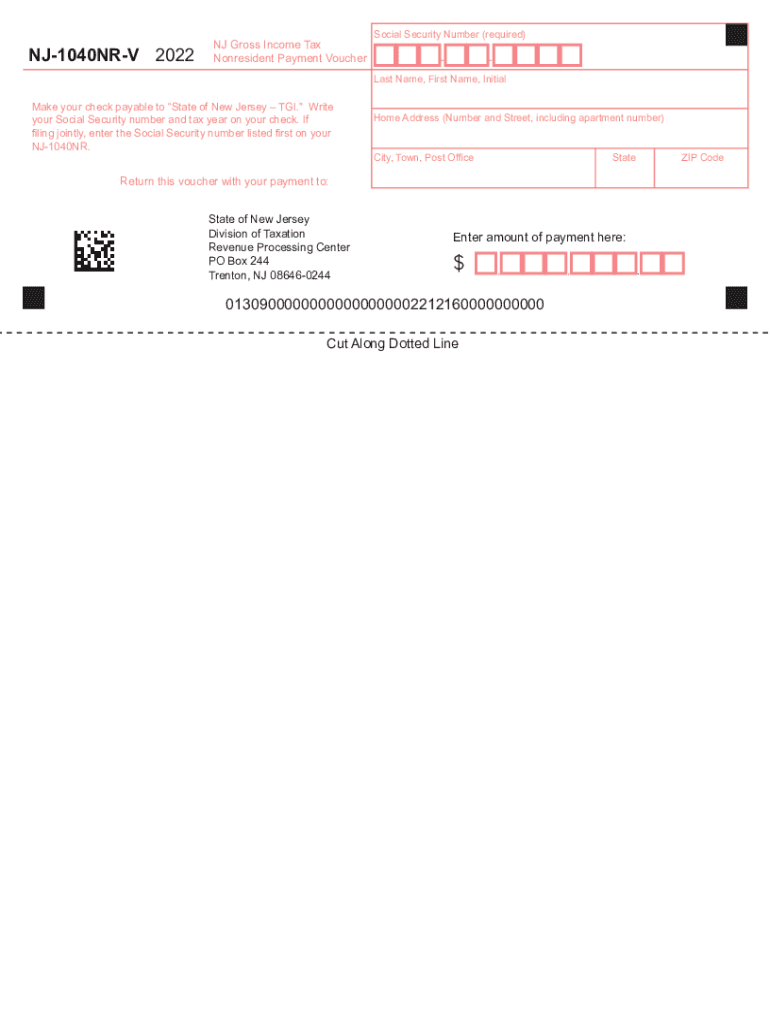

The New Jersey Form NJ 1040NR V is a tax document specifically designed for nonresidents of New Jersey who are required to report their income to the state. This form is part of the state's gross income tax system and is used to calculate the tax liability for individuals who earned income from New Jersey sources but do not reside in the state. Understanding this form is crucial for nonresidents to ensure compliance with New Jersey tax laws and to avoid potential penalties.

How to use the New Jersey Form NJ 1040NR V NJ Gross Income Tax

To effectively use the NJ 1040NR V form, nonresidents must first gather all necessary financial documents, including W-2s, 1099s, and any other income statements related to New Jersey earnings. The form requires detailed reporting of income, deductions, and credits. After completing the form, it should be submitted to the New Jersey Division of Taxation, either electronically or via mail, depending on the taxpayer's preference. Ensuring accuracy in reporting is vital to avoid delays in processing or issues with tax liability.

Steps to complete the New Jersey Form NJ 1040NR V NJ Gross Income Tax

Completing the NJ 1040NR V form involves several key steps:

- Gather all relevant income documentation, such as W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report all income earned from New Jersey sources in the designated sections.

- Claim any applicable deductions and credits available to nonresidents.

- Calculate the total tax owed based on the provided instructions.

- Review the completed form for accuracy before submission.

- Submit the form electronically or mail it to the appropriate tax office.

Legal use of the New Jersey Form NJ 1040NR V NJ Gross Income Tax

The NJ 1040NR V form is legally binding when completed accurately and submitted in accordance with New Jersey tax regulations. It is essential for nonresidents to understand their obligations under state law, as failure to file or inaccuracies can lead to penalties. The form must be signed and dated to validate the information provided. Utilizing secure electronic signature solutions can enhance the legitimacy of the submission process.

Filing Deadlines / Important Dates

Nonresidents must be aware of the filing deadlines for the NJ 1040NR V form to avoid late fees. Typically, the deadline coincides with the federal tax filing deadline, which is usually April fifteenth. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable to check the New Jersey Division of Taxation website for any updates or changes to the filing schedule.

Form Submission Methods (Online / Mail / In-Person)

The NJ 1040NR V form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file electronically using approved e-filing software, which often provides a streamlined process and faster processing times. Alternatively, the form can be printed and mailed to the New Jersey Division of Taxation. In-person submissions may be available at designated tax offices, but it is recommended to verify availability ahead of time.

Quick guide on how to complete new jersey form nj 1040nr v nj gross income tax

Complete New Jersey Form NJ 1040NR V NJ Gross Income Tax effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents quickly and without delays. Manage New Jersey Form NJ 1040NR V NJ Gross Income Tax on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The simplest method to modify and electronically sign New Jersey Form NJ 1040NR V NJ Gross Income Tax without effort

- Obtain New Jersey Form NJ 1040NR V NJ Gross Income Tax and click Get Form to begin.

- Use the resources we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing out new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign New Jersey Form NJ 1040NR V NJ Gross Income Tax and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jersey form nj 1040nr v nj gross income tax

Create this form in 5 minutes!

How to create an eSignature for the new jersey form nj 1040nr v nj gross income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 nj1040nrv tax form?

The 2023 nj1040nrv tax form is a non-resident income tax return specifically for individuals who earned income in New Jersey but are residents of another state. This form allows non-residents to report their NJ income and calculate the appropriate tax owed. It is crucial for anyone earning NJ-source income to properly file this form to avoid penalties.

-

How can airSlate SignNow assist with the 2023 nj1040nrv tax filing process?

airSlate SignNow provides an easy-to-use platform for eSigning and sending documents, including the 2023 nj1040nrv tax form. Our service simplifies the tax filing process, allowing you to securely collect electronic signatures and share required documents with ease. This streamlines the submission of your tax return, ensuring you meet deadlines efficiently.

-

What are the pricing options for airSlate SignNow when filing the 2023 nj1040nrv tax form?

Our pricing options for airSlate SignNow are competitive and designed to cater to businesses of all sizes. For those filing the 2023 nj1040nrv tax form, we offer flexible monthly and annual plans, allowing you to choose the best fit for your needs. We also provide a free trial, enabling users to explore our features without commitment.

-

What features does airSlate SignNow offer that are beneficial for managing the 2023 nj1040nrv tax process?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking of document status, which are essential for managing the 2023 nj1040nrv tax process. Additionally, our platform supports bulk sending, making it easy to send multiple tax forms to various parties simultaneously. These tools enhance efficiency and accuracy during tax season.

-

Can I integrate airSlate SignNow with other applications to assist in reporting the 2023 nj1040nrv tax?

Yes, airSlate SignNow integrates seamlessly with various applications including CRMs and document management systems that can help with your 2023 nj1040nrv tax reporting. This integration provides greater flexibility and allows for a more streamlined workflow when preparing and submitting your taxes. You can connect it with popular platforms, enhancing your overall productivity.

-

Is airSlate SignNow secure for handling sensitive 2023 nj1040nrv tax documents?

Absolutely, airSlate SignNow prioritizes security, implementing advanced encryption and authentication measures to protect sensitive documents like the 2023 nj1040nrv tax form. Our platform is designed to safeguard your data throughout the eSigning process, ensuring compliance with regulations and preventing unauthorized access. You can trust us to handle your tax documents safely.

-

What benefits does airSlate SignNow provide in the context of the 2023 nj1040nrv tax?

Using airSlate SignNow for your 2023 nj1040nrv tax preparations provides numerous benefits, such as time savings and increased accuracy in document handling. Our platform simplifies the process of document review and approval, allowing for quicker turnaround times. It also helps avoid mistakes, ultimately contributing to a smoother tax filing experience.

Get more for New Jersey Form NJ 1040NR V NJ Gross Income Tax

Find out other New Jersey Form NJ 1040NR V NJ Gross Income Tax

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now