Nj State Tax Forms Printable the Commons Law Center 2021

Understanding the 1040NR V Form

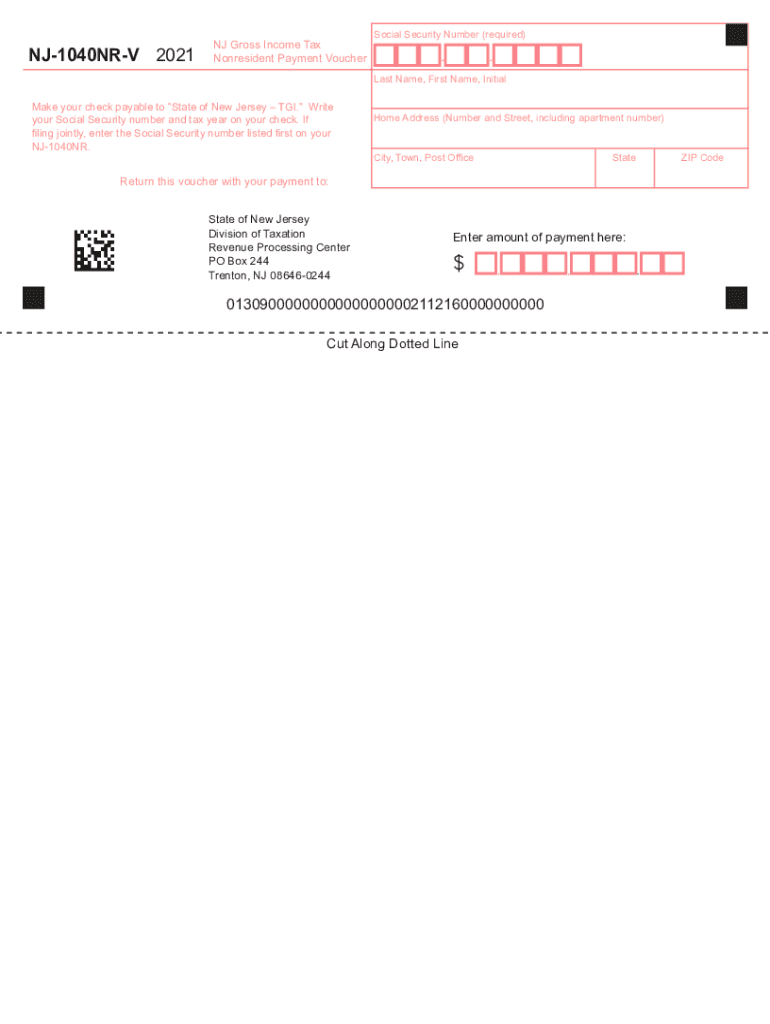

The 1040NR V form, also known as the Nonresident Income Tax Payment Voucher, is a crucial document for nonresident taxpayers in the United States. It is specifically designed for individuals who earn income in the U.S. but do not reside there. This form allows nonresidents to report their income and ensure compliance with U.S. tax laws. Understanding the purpose and requirements of the 1040NR V form is essential for accurate tax reporting and avoiding potential penalties.

Steps to Complete the 1040NR V Form

Completing the 1040NR V form involves several key steps:

- Gather necessary documents: Collect all relevant income statements, such as W-2s or 1099s, and any other documentation that supports your income claims.

- Fill out personal information: Provide your name, address, and taxpayer identification number (TIN) accurately.

- Report income: Enter your total income earned in the U.S. and any deductions you may qualify for.

- Calculate your tax liability: Use the appropriate tax rates to determine the amount owed based on your reported income.

- Complete the payment section: Indicate how much you are paying with the voucher and ensure that it aligns with your calculated tax liability.

- Review and sign: Double-check all entries for accuracy before signing the form to validate your submission.

Filing Deadlines for the 1040NR V Form

Timely filing of the 1040NR V form is essential to avoid penalties. Generally, the deadline for submitting this form aligns with the federal tax return deadline. For most nonresidents, this is typically April 15 of the year following the tax year. However, if you are a nonresident who does not receive wages subject to U.S. withholding, your deadline may differ. Always verify the specific deadline for your tax situation to ensure compliance.

Required Documents for the 1040NR V Form

When preparing to fill out the 1040NR V form, certain documents are necessary to support your claims:

- Income statements: W-2 forms, 1099 forms, or other records of income earned in the U.S.

- Identification: A valid taxpayer identification number (TIN) or Social Security number (SSN).

- Deductions and credits documentation: Any receipts or records that substantiate deductions you plan to claim.

Legal Use of the 1040NR V Form

The 1040NR V form serves a legal purpose in the U.S. tax system. It is a formal declaration of income and tax liability for nonresidents, ensuring compliance with federal tax laws. Properly completing and submitting this form is critical for maintaining legal standing and avoiding issues with the IRS. Nonresidents must understand the legal implications of their tax obligations and ensure that all information provided is accurate and truthful.

Penalties for Non-Compliance with the 1040NR V Form

Failing to file the 1040NR V form or submitting inaccurate information can lead to significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, incorrect reporting may result in audits or further scrutiny of your financial activities in the United States. It is essential to adhere to all filing requirements and deadlines to mitigate these risks.

Quick guide on how to complete nj state tax forms printable the commons law center

Prepare Nj State Tax Forms Printable The Commons Law Center effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Nj State Tax Forms Printable The Commons Law Center on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Nj State Tax Forms Printable The Commons Law Center with ease

- Find Nj State Tax Forms Printable The Commons Law Center and then click Get Form to commence.

- Make use of the tools we provide to fill out your form.

- Mark important parts of the documents or obscure sensitive information using tools designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, monotonous form navigation, or errors that demand printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Modify and eSign Nj State Tax Forms Printable The Commons Law Center and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj state tax forms printable the commons law center

Create this form in 5 minutes!

How to create an eSignature for the nj state tax forms printable the commons law center

How to create an e-signature for your PDF document online

How to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an e-signature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is the 1040nr v form?

The 1040nr v form is a U.S. tax form used by non-resident aliens to report their income and calculate taxes owed. It is specifically designed for individuals who have income that falls under the jurisdiction of the IRS but do not qualify as U.S. residents for tax purposes. This form helps in ensuring compliance with tax regulations for non-residents.

-

How can airSlate SignNow help with the 1040nr v form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the 1040nr v form. With our solution, users can streamline the document signing process, making it more efficient and secure. This is especially beneficial for non-residents who need to ensure timely submission of their tax documents.

-

What are the features of airSlate SignNow for managing the 1040nr v form?

airSlate SignNow offers robust features such as customizable templates, secure eSigning, and document tracking, all of which can be utilized for the 1040nr v form. Additionally, the platform allows for easy collaboration among users, making it simpler to gather necessary signatures and approvals. These features enhance the overall efficiency of handling tax documents.

-

Is there a cost associated with using airSlate SignNow for the 1040nr v form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses and individuals alike. Various pricing plans are available that cater to different needs, ensuring users can choose the one that best fits their requirements for managing the 1040nr v form. Investing in this solution can save time and reduce frustration during tax season.

-

How secure is airSlate SignNow when handling sensitive documents like the 1040nr v form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents such as the 1040nr v form. The platform employs advanced encryption methods and complies with industry standards to protect user data. This means you can confidently eSign and send your forms without worrying about unauthorized access.

-

Can airSlate SignNow integrate with other tools for managing the 1040nr v form?

Yes, airSlate SignNow integrates seamlessly with a variety of business tools, allowing you to manage the 1040nr v form alongside other important documents and workflows. This integration helps streamline your operations by connecting various platforms, making document management more efficient. Users can enhance their productivity by optimizing their existing tools with our solution.

-

What benefits does airSlate SignNow offer for non-residents using the 1040nr v form?

For non-residents, airSlate SignNow offers many benefits when dealing with the 1040nr v form, including time-saving efficiency and improved accuracy. The ability to electronically sign and share documents expedites the filing process, reducing delays. Additionally, the tracking feature ensures you are kept informed of the progress of your documents.

Get more for Nj State Tax Forms Printable The Commons Law Center

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497313332 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497313333 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497313334 form

- Mo marital property form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497313336 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497313337 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497313338 form

- Corporation dissolve form

Find out other Nj State Tax Forms Printable The Commons Law Center

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now