NJ 1040NR V Nonresident Payment Voucher 2024-2026

Understanding the NJ 1040NR V Nonresident Payment Voucher

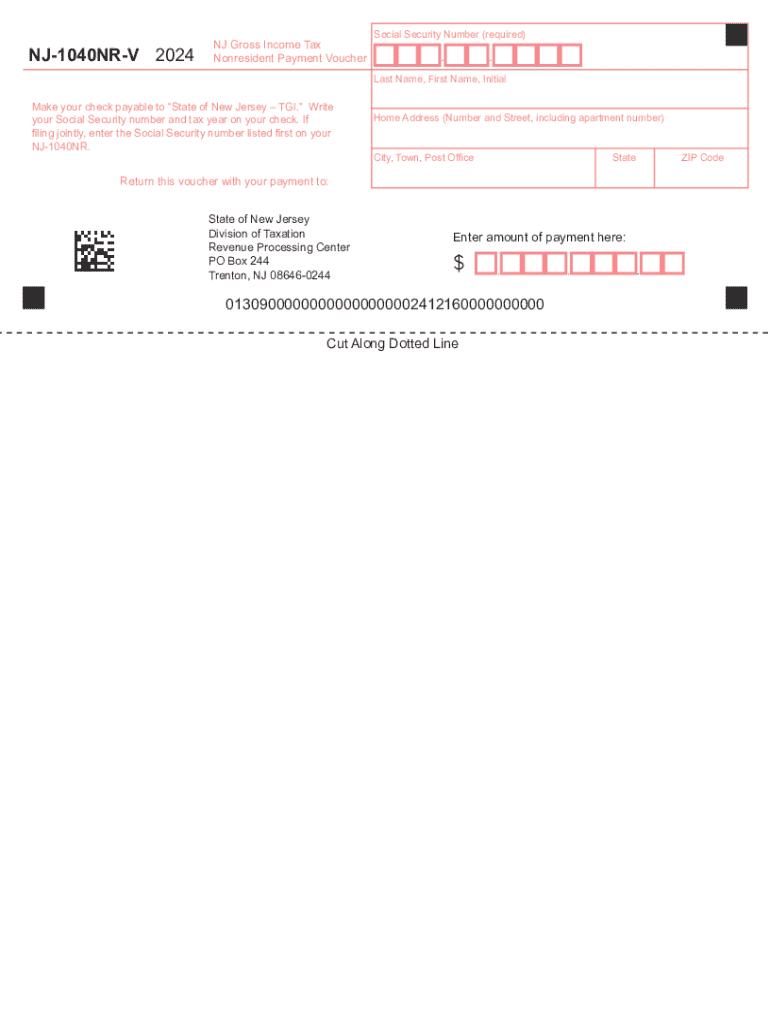

The NJ 1040NR V Nonresident Payment Voucher is a crucial document for nonresident taxpayers in New Jersey. This form is used to report and pay taxes owed on income earned within the state. Nonresidents are individuals who do not reside in New Jersey but earn income from New Jersey sources. The voucher facilitates the payment of state taxes, ensuring compliance with state tax laws.

Steps to Complete the NJ 1040NR V Nonresident Payment Voucher

Completing the NJ 1040NR V Nonresident Payment Voucher involves several key steps:

- Gather necessary information, including your Social Security number, income details, and any applicable deductions.

- Fill out the form accurately, ensuring all income from New Jersey sources is reported.

- Calculate the total tax owed based on the income reported.

- Include any payments made throughout the year to avoid double payment.

- Sign and date the voucher to validate your submission.

How to Obtain the NJ 1040NR V Nonresident Payment Voucher

The NJ 1040NR V Nonresident Payment Voucher can be obtained from the New Jersey Division of Taxation's official website. It is available for download in a printable format. Additionally, taxpayers may request a physical copy by contacting the Division of Taxation directly. Ensure you have the most current version of the form to avoid any discrepancies during filing.

Key Elements of the NJ 1040NR V Nonresident Payment Voucher

Important components of the NJ 1040NR V Nonresident Payment Voucher include:

- Taxpayer Information: This section requires your name, address, and Social Security number.

- Income Details: Report all income earned from New Jersey sources.

- Tax Calculation: This part shows how to calculate the total tax owed based on your reported income.

- Payment Information: Indicate the amount you are paying with the voucher.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the NJ 1040NR V Nonresident Payment Voucher. Typically, the voucher must be submitted by the same deadline as the New Jersey income tax return, which is usually April fifteenth. However, if the deadline falls on a weekend or holiday, it may be extended. Always verify the specific dates each tax year, as they can change.

Legal Use of the NJ 1040NR V Nonresident Payment Voucher

The NJ 1040NR V Nonresident Payment Voucher serves a legal purpose in tax compliance for nonresidents. By submitting this voucher, taxpayers fulfill their obligation to report and pay taxes on income earned in New Jersey. Failure to file or pay using this form can result in penalties or interest charges, emphasizing the importance of timely and accurate submission.

Create this form in 5 minutes or less

Find and fill out the correct nj 1040nr v nonresident payment voucher

Create this form in 5 minutes!

How to create an eSignature for the nj 1040nr v nonresident payment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nj 1040nrv nonresident form?

The nj 1040nrv nonresident form is used by nonresidents of New Jersey to report income earned in the state. This form helps ensure compliance with state tax regulations while allowing nonresidents to claim any applicable deductions or credits. Understanding this form is crucial for accurate tax filing.

-

How can airSlate SignNow help with the nj 1040nrv nonresident form?

airSlate SignNow simplifies the process of completing and eSigning the nj 1040nrv nonresident form. Our platform provides an easy-to-use interface that allows users to fill out the form digitally, ensuring accuracy and efficiency. This streamlines the tax filing process for nonresidents.

-

What are the pricing options for using airSlate SignNow for nj 1040nrv nonresident forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those needing to manage nj 1040nrv nonresident forms. Our plans are designed to be cost-effective, ensuring that you get the best value for your document management and eSigning needs. You can choose a plan that fits your budget and requirements.

-

Are there any features specifically beneficial for nj 1040nrv nonresident users?

Yes, airSlate SignNow includes features that are particularly beneficial for users dealing with the nj 1040nrv nonresident form. These features include customizable templates, secure eSigning, and real-time tracking of document status. This ensures that your tax documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for nj 1040nrv nonresident processing?

Absolutely! airSlate SignNow offers integrations with various software applications that can enhance your experience when processing the nj 1040nrv nonresident form. This allows for seamless data transfer and improved workflow, making it easier to manage your tax documents alongside other business processes.

-

What benefits does airSlate SignNow provide for nonresidents filing the nj 1040nrv?

Using airSlate SignNow for filing the nj 1040nrv nonresident form provides numerous benefits, including time savings and increased accuracy. Our platform reduces the risk of errors and ensures that your documents are securely stored and easily accessible. This can lead to a smoother tax filing experience for nonresidents.

-

Is airSlate SignNow secure for handling sensitive nj 1040nrv nonresident information?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling sensitive nj 1040nrv nonresident information. We utilize advanced encryption and security protocols to protect your data throughout the signing process. You can trust that your personal and financial information is secure with us.

Get more for NJ 1040NR V Nonresident Payment Voucher

- Providence equity home form

- Isle of capri casinos inc secgov form

- Isle of capri casinos inc 10 k405 for 43000 sec info form

- License agreement by and between the broad institute inc form

- This agreement is entered into as of april 11 1985 by and between form

- Whitestone reit edgar online form

- Supergen inc media corporate ir net form

- Settlement agreement and mutual general release secgov form

Find out other NJ 1040NR V Nonresident Payment Voucher

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF