Underpayment of Estimated Tax by Individuals, Estates, or Trusts, Form NJ 2210 2022

What is the Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts, Form NJ 2210

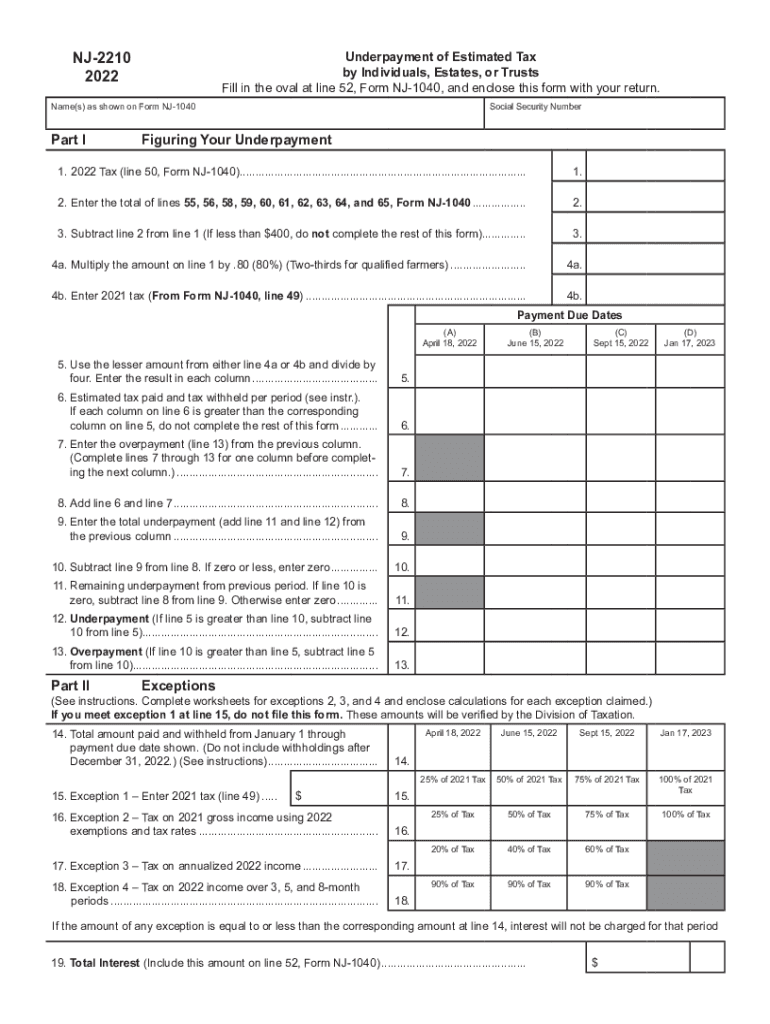

The Underpayment of Estimated Tax By Individuals, Estates, or Trusts, Form NJ 2210, is a tax form used by New Jersey taxpayers to determine if they have underpaid their estimated taxes. This form is essential for individuals, estates, or trusts that do not meet the required payment thresholds throughout the tax year. It helps calculate any penalties for underpayment and ensures compliance with state tax laws. Understanding this form is crucial for avoiding unexpected tax liabilities and penalties.

Steps to complete the Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts, Form NJ 2210

Completing Form NJ 2210 involves several key steps to ensure accuracy and compliance. Start by gathering your financial information, including income, deductions, and previous tax payments. Next, follow these steps:

- Determine your total tax liability for the year.

- Calculate your total estimated tax payments made throughout the year.

- Use the form to compare your total tax liability with your estimated payments.

- If your payments are less than the required amount, calculate the penalty using the form's instructions.

- Complete the form by filling in all required fields accurately.

- Review the form for any errors before submission.

Key elements of the Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts, Form NJ 2210

Form NJ 2210 includes several key elements that taxpayers must understand. These include:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Estimated Tax Payments: A summary of all payments made during the tax year.

- Tax Liability Calculation: A section to calculate the total tax owed based on income and deductions.

- Penalty Calculation: Instructions for determining if a penalty applies due to underpayment.

How to obtain the Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts, Form NJ 2210

To obtain Form NJ 2210, taxpayers can visit the New Jersey Division of Taxation's official website, where the form is available for download. It can also be accessed through various tax preparation software that supports New Jersey tax forms. Additionally, physical copies may be available at local tax offices or public libraries. Ensure you have the most current version of the form to comply with the latest tax regulations.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form NJ 2210 is essential for compliance. Typically, the form must be submitted along with your annual tax return by April fifteenth of the following year. If you are filing for an extension, ensure that you still meet the estimated tax payment deadlines to avoid penalties. Staying aware of these dates helps maintain good standing with the New Jersey Division of Taxation.

Penalties for Non-Compliance

Failing to file Form NJ 2210 when required can result in penalties. The New Jersey Division of Taxation imposes penalties for underpayment of estimated taxes, which can accumulate over time. The penalty is generally calculated based on the amount of underpayment and the duration of the underpayment period. To avoid these penalties, it is crucial to accurately assess your estimated tax payments and file the form as required.

Quick guide on how to complete 2022 underpayment of estimated tax by individuals estates or trusts form nj 2210

Complete Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts, Form NJ 2210 effortlessly on any device

Web-based document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts, Form NJ 2210 on any device using airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

The easiest way to modify and electronically sign Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts, Form NJ 2210 with ease

- Obtain Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts, Form NJ 2210 and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight key sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to misplaced or lost documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts, Form NJ 2210 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 underpayment of estimated tax by individuals estates or trusts form nj 2210

Create this form in 5 minutes!

How to create an eSignature for the 2022 underpayment of estimated tax by individuals estates or trusts form nj 2210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the nj 2210 instructions for filing my taxes?

The nj 2210 instructions provide guidelines for taxpayers in New Jersey who need to file their income taxes. This form helps determine if you owe additional taxes due to underpayment of estimated taxes. It's crucial for anyone who has fluctuating income or has not paid sufficient estimated taxes during the year.

-

How can airSlate SignNow help with submitting nj 2210 instructions?

airSlate SignNow streamlines the process of sending and eSigning your nj 2210 instructions and other tax documents. Its user-friendly platform allows you to quickly upload your forms and share them securely with your accountant or tax professional for review. This saves you time and ensures accuracy in your tax filings.

-

Is there a cost associated with using airSlate SignNow for nj 2210 instructions?

Yes, airSlate SignNow offers a range of pricing plans to suit different needs, including individual users and large businesses. The cost is competitive compared to traditional methods of signing and submitting documents. There is also a free trial available, allowing you to evaluate its features for handling nj 2210 instructions without upfront investment.

-

What features does airSlate SignNow offer for managing nj 2210 instructions?

airSlate SignNow includes features such as document templates, automated eSigning, and real-time tracking of document status. These features enhance your ability to manage and submit your nj 2210 instructions efficiently. Furthermore, the platform offers integrations with various applications to streamline your workflow.

-

Can I integrate airSlate SignNow with accounting software for nj 2210 instructions?

Absolutely! airSlate SignNow supports integration with popular accounting and tax software, making it easier to manage your nj 2210 instructions. This ensures that your documents flow seamlessly between systems, reducing the risk of errors and improving productivity.

-

What benefits does airSlate SignNow provide for eSigning nj 2210 instructions?

Using airSlate SignNow for eSigning your nj 2210 instructions adds convenience and security. The platform enables you to sign documents from anywhere, at any time, which is particularly useful during tax season. Additionally, it offers secure storage, so you can access your signed documents whenever needed.

-

Are there any limitations when using airSlate SignNow for nj 2210 instructions?

While airSlate SignNow is a powerful tool, users should be aware of certain limitations, such as varying compatibility with specific file formats. Ensure your nj 2210 instructions are in supported formats to avoid issues. Also, while the platform offers robust features, some complex tax situations may still require professional assistance.

Get more for Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts, Form NJ 2210

Find out other Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts, Form NJ 2210

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple