NJ 2210 Underpayment of Estimated Tax by Individuals, Estates, or Trusts 2024-2026

Understanding the NJ 2210 Underpayment of Estimated Tax

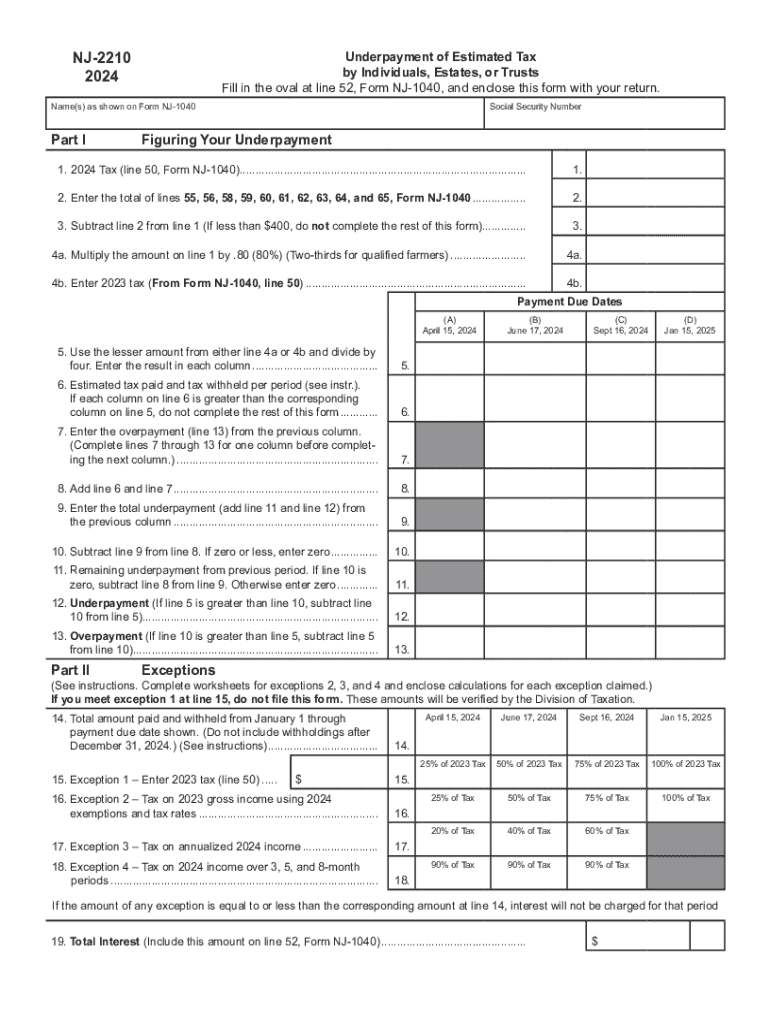

The NJ 2210 form is specifically designed for individuals, estates, and trusts in New Jersey to report underpayment of estimated tax. This form helps taxpayers determine if they owe any penalties due to insufficient estimated tax payments throughout the year. The underpayment occurs when the total estimated tax payments made are less than the required amount based on the taxpayer's income. Understanding this form is crucial for ensuring compliance with New Jersey tax laws and avoiding unnecessary penalties.

Steps to Complete the NJ 2210 Form

Filling out the NJ 2210 form involves several key steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year based on your income.

- Determine the amount of estimated tax you have already paid.

- Use the NJ 2210 form to compare your total tax liability with your estimated payments.

- Complete the form by following the instructions provided, ensuring all calculations are accurate.

- Submit the completed form by the specified deadline to avoid penalties.

Key Elements of the NJ 2210 Form

The NJ 2210 form includes several important sections that taxpayers must complete:

- Taxpayer Information: Basic details about the individual or entity filing the form.

- Tax Liability Calculation: A breakdown of total tax owed for the year.

- Estimated Payments: Documentation of all estimated tax payments made throughout the year.

- Penalty Calculation: If applicable, a calculation of any penalties for underpayment.

Filing Deadlines for the NJ 2210 Form

Timely filing of the NJ 2210 form is essential to avoid penalties. The form must be submitted by the due date of the New Jersey income tax return, typically April fifteenth for most taxpayers. For those who file extensions, the NJ 2210 should be submitted along with the extended return. It is advisable to keep track of any changes in tax laws that may affect filing deadlines.

Penalties for Non-Compliance

Failing to file the NJ 2210 form or underpaying estimated taxes can result in penalties. The state of New Jersey imposes penalties based on the amount of underpayment and the duration of the underpayment period. Taxpayers may face interest charges on unpaid amounts, which can accumulate over time. Understanding these penalties is crucial for maintaining compliance and avoiding financial repercussions.

Eligibility Criteria for Using the NJ 2210 Form

Not all taxpayers need to file the NJ 2210 form. Eligibility typically includes individuals, estates, and trusts who have a tax liability and have made estimated payments. Taxpayers should assess their income level and payment history to determine if they meet the criteria for filing this form. Those who expect to owe less than a specified amount may be exempt from filing.

Obtaining the NJ 2210 Form

The NJ 2210 form can be obtained from the New Jersey Division of Taxation's website or through various tax preparation software. It is important to ensure that you are using the most current version of the form to comply with state regulations. Taxpayers may also consult with tax professionals for assistance in obtaining and completing the form accurately.

Create this form in 5 minutes or less

Find and fill out the correct nj 2210 underpayment of estimated tax by individuals estates or trusts 771948032

Create this form in 5 minutes!

How to create an eSignature for the nj 2210 underpayment of estimated tax by individuals estates or trusts 771948032

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new jersey underpayment estimated tax?

The new jersey underpayment estimated tax refers to the tax owed by individuals or businesses that did not pay enough tax throughout the year. This can occur if you underestimate your income or fail to make timely payments. Understanding this concept is crucial for avoiding penalties and ensuring compliance with state tax laws.

-

How can airSlate SignNow help with new jersey underpayment estimated tax documents?

airSlate SignNow provides a seamless platform for creating, sending, and eSigning documents related to new jersey underpayment estimated tax. With our user-friendly interface, you can easily manage tax forms and ensure they are signed and submitted on time. This helps streamline your tax preparation process and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing new jersey underpayment estimated tax?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for new jersey underpayment estimated tax documents. These features enhance efficiency and ensure that all necessary paperwork is completed accurately. Additionally, our platform allows for easy collaboration with tax professionals.

-

Is airSlate SignNow cost-effective for handling new jersey underpayment estimated tax?

Yes, airSlate SignNow is a cost-effective solution for managing new jersey underpayment estimated tax documents. Our pricing plans are designed to fit various budgets, making it accessible for both individuals and businesses. By reducing the time spent on paperwork, you can save money and focus on more important tasks.

-

Can I integrate airSlate SignNow with other tax software for new jersey underpayment estimated tax?

Absolutely! airSlate SignNow integrates seamlessly with various tax software solutions, allowing you to manage new jersey underpayment estimated tax documents efficiently. This integration ensures that your tax data is synchronized, reducing the chances of errors and improving your overall workflow.

-

What are the benefits of using airSlate SignNow for new jersey underpayment estimated tax?

Using airSlate SignNow for new jersey underpayment estimated tax offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete tax documents quickly and securely, ensuring compliance with state regulations. Additionally, the ability to track document status provides peace of mind.

-

How does airSlate SignNow ensure the security of my new jersey underpayment estimated tax documents?

airSlate SignNow prioritizes the security of your new jersey underpayment estimated tax documents by employing advanced encryption and secure storage solutions. We adhere to industry standards to protect sensitive information, ensuring that your tax documents remain confidential and secure throughout the signing process.

Get more for NJ 2210 Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts

- Control number or p011 pkg form

- Control number or p012 pkg form

- Control number or p013 pkg form

- State of ohio declaration for mental health treatment nrc form

- Control number or p018 pkg form

- Sc advance directive jervey eye group form

- Control number or p019 pkg form

- Declarant executed an advance directive for health care on the day of form

Find out other NJ 2210 Underpayment Of Estimated Tax By Individuals, Estates, Or Trusts

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free