NJ Form 2210 Underpayment of Estimated Tax by Individuals 2020

What is the NJ Form 2210 Underpayment Of Estimated Tax By Individuals

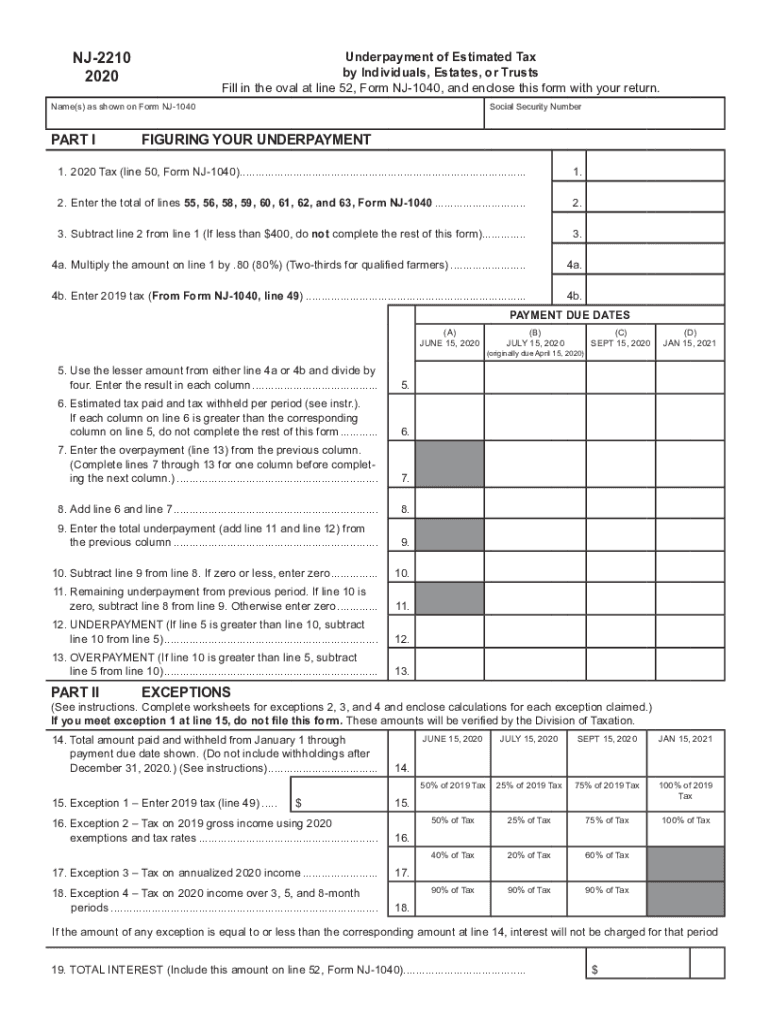

The NJ Form 2210 is designed for individuals who may not have paid enough estimated tax throughout the year. This form calculates any potential underpayment of estimated taxes due to insufficient tax payments made during the year. It is essential for taxpayers in New Jersey to understand their obligations regarding estimated tax payments, especially if they expect to owe more than a certain amount when filing their state income tax return.

How to use the NJ Form 2210 Underpayment Of Estimated Tax By Individuals

To use the NJ Form 2210, individuals must first determine if they have underpaid their estimated taxes. This involves calculating the total tax owed for the year and comparing it to the amount already paid through withholding or estimated payments. If the total payments are less than the required amount, the taxpayer should complete the form to determine any penalties or interest due. The form guides users through the necessary calculations and provides instructions for reporting any underpayment.

Steps to complete the NJ Form 2210 Underpayment Of Estimated Tax By Individuals

Completing the NJ Form 2210 involves several key steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Calculate the total tax owed for the year based on income and applicable deductions.

- Determine the total estimated tax payments made during the year.

- Complete the form by following the provided instructions, filling out all necessary sections accurately.

- Review the form for accuracy and ensure all calculations are correct before submission.

Key elements of the NJ Form 2210 Underpayment Of Estimated Tax By Individuals

The NJ Form 2210 includes several important components that taxpayers must understand:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Estimated Tax Payments: Taxpayers must report their total estimated tax payments made during the year.

- Calculation of Underpayment: The form includes specific lines for calculating any underpayment based on the taxpayer's total tax liability.

- Penalties and Interest: If applicable, the form outlines any penalties for underpayment and how they are calculated.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the NJ Form 2210. Generally, the form must be submitted along with the New Jersey income tax return by the state’s tax deadline. For most individuals, this is April fifteenth of each year. If taxpayers expect to owe taxes, they should ensure that estimated payments are made quarterly to avoid penalties.

Penalties for Non-Compliance

Failing to file the NJ Form 2210 when required can result in significant penalties. If a taxpayer underpays their estimated taxes, they may face interest charges on the unpaid amount. Additionally, the state may impose a penalty for failing to file the form, which can accumulate over time. It is essential for individuals to stay informed about their tax obligations to avoid these financial repercussions.

Quick guide on how to complete nj form 2210 underpayment of estimated tax by individuals

Complete NJ Form 2210 Underpayment Of Estimated Tax By Individuals effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly option to traditional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents swiftly without delays. Manage NJ Form 2210 Underpayment Of Estimated Tax By Individuals on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and electronically sign NJ Form 2210 Underpayment Of Estimated Tax By Individuals without hassle

- Obtain NJ Form 2210 Underpayment Of Estimated Tax By Individuals and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Adapt and electronically sign NJ Form 2210 Underpayment Of Estimated Tax By Individuals while ensuring exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj form 2210 underpayment of estimated tax by individuals

Create this form in 5 minutes!

How to create an eSignature for the nj form 2210 underpayment of estimated tax by individuals

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is nj 2210 and how does it relate to airSlate SignNow?

The nj 2210 is a tax form used in New Jersey, and airSlate SignNow offers solutions for businesses needing to send and eSign such documents efficiently. Our platform streamlines the eSignature process, ensuring you can complete your nj 2210 forms quickly and accurately. By utilizing airSlate SignNow, you can also track the status of your documents.

-

How does airSlate SignNow simplify the eSigning of nj 2210 forms?

airSlate SignNow provides a user-friendly interface that makes it easy to upload, sign, and send your nj 2210 forms. With just a few clicks, you can obtain legally binding signatures from multiple parties. This efficiency is especially beneficial for businesses looking to accelerate their workflow when dealing with tax documents.

-

What are the pricing options for using airSlate SignNow for nj 2210 documents?

airSlate SignNow offers various pricing plans tailored to fit the needs of businesses of all sizes that handle documents like the nj 2210. Our pricing is competitive and includes features that streamline eSigning processes. Customers can choose a plan that best suits their volume of document transactions.

-

Can airSlate SignNow integrate with other software I use for managing nj 2210 forms?

Yes, airSlate SignNow can integrate with numerous applications, allowing seamless management of your nj 2210 forms. This includes popular platforms like Google Drive, Dropbox, and various CRM systems. Our integrations help ensure that your document workflow remains uninterrupted.

-

What are the key features of airSlate SignNow for handling nj 2210 documents?

The key features of airSlate SignNow include customizable templates, advanced eSignature options, and secure cloud storage for your nj 2210 documents. Moreover, our platform allows you to set reminders and notifications, ensuring that you never miss a deadline for your tax submissions.

-

Is airSlate SignNow secure for signing nj 2210 documents?

Absolutely! airSlate SignNow employs industry-standard security measures to protect your nj 2210 documents. This includes encryption and robust authentication processes, ensuring that your sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for nj 2210 eSignatures?

Using airSlate SignNow for your nj 2210 eSignatures greatly enhances productivity by reducing the time taken to complete documents. The platform's convenience and accessibility mean that you can sign documents anytime, anywhere, leading to a smoother and more efficient documentation process.

Get more for NJ Form 2210 Underpayment Of Estimated Tax By Individuals

Find out other NJ Form 2210 Underpayment Of Estimated Tax By Individuals

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online