Www Mass Gov DOC Form355sbcpdfForm 355SBC Small Business Corporation Excise Return 2021-2026

What is the Massachusetts Form 355SBC Small Business Corporation Excise Return

The Massachusetts Form 355SBC is a tax return specifically designed for small business corporations operating within the state. This corporate excise form is essential for reporting income, deductions, and credits for tax purposes. It is applicable to corporations that meet the criteria set by the Massachusetts Department of Revenue and is crucial for ensuring compliance with state tax laws.

Steps to Complete the Massachusetts Form 355SBC

Completing the Massachusetts Form 355SBC involves several steps to ensure accuracy and compliance. Start by gathering necessary financial documents, including income statements and expense reports. Next, follow these steps:

- Fill in the corporation's name, address, and federal identification number.

- Report total income and allowable deductions on the appropriate lines.

- Calculate the excise tax based on the corporation's taxable income.

- Review the form for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the Massachusetts Form 355SBC

The Massachusetts Form 355SBC is legally binding when completed and submitted according to state regulations. To ensure its legal validity, the form must be signed by an authorized officer of the corporation. Additionally, it is important to comply with all relevant tax laws and regulations, as failure to do so may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Timely filing of the Massachusetts Form 355SBC is critical to avoid penalties. The standard deadline for submission is typically the fifteenth day of the third month following the end of the corporation's fiscal year. Corporations should be aware of any changes to deadlines that may arise due to state regulations or specific circumstances.

Required Documents for Form 355SBC

To accurately complete the Massachusetts Form 355SBC, corporations must gather several key documents. These include:

- Financial statements, including profit and loss statements.

- Records of all income and expenses.

- Previous year’s tax returns for reference.

- Any applicable tax credits or deductions documentation.

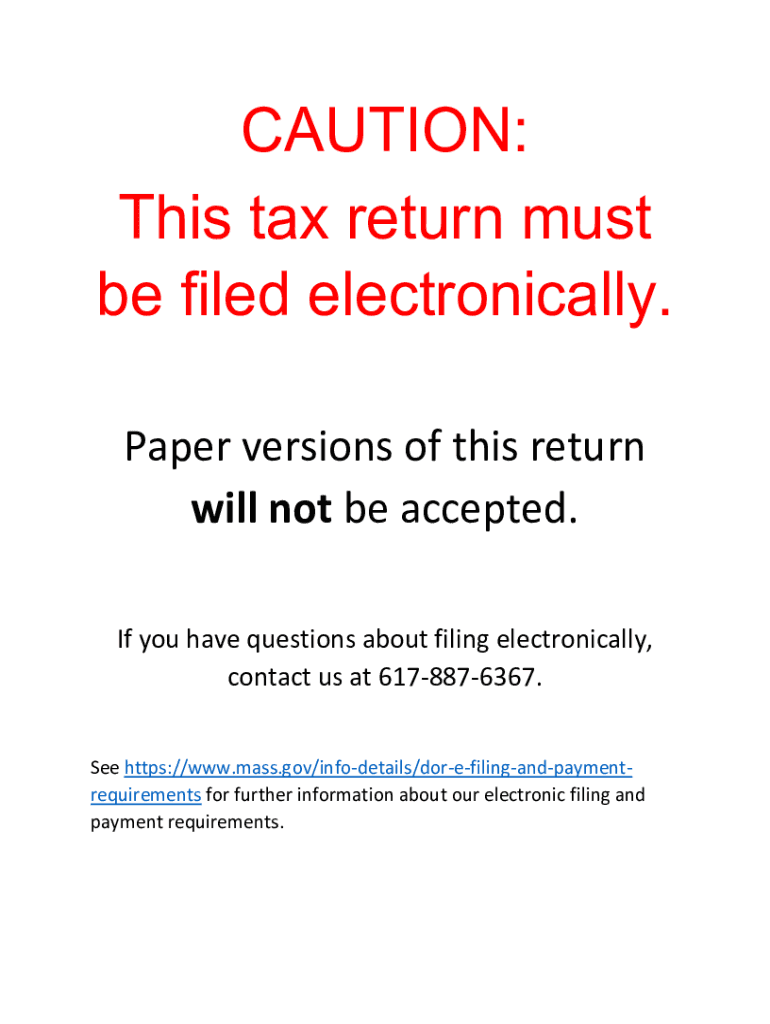

Form Submission Methods

The Massachusetts Form 355SBC can be submitted through various methods to accommodate different preferences. Corporations may choose to file online through the Massachusetts Department of Revenue's website, submit the form by mail, or deliver it in person at designated locations. Each method has its own requirements and processing times, so it is advisable to choose the one that best fits the corporation's needs.

Quick guide on how to complete wwwmassgov doc form355sbcpdfform 355sbc small business corporation excise return

Complete Www mass gov Doc Form355sbcpdfForm 355SBC Small Business Corporation Excise Return seamlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Www mass gov Doc Form355sbcpdfForm 355SBC Small Business Corporation Excise Return on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to update and eSign Www mass gov Doc Form355sbcpdfForm 355SBC Small Business Corporation Excise Return effortlessly

- Obtain Www mass gov Doc Form355sbcpdfForm 355SBC Small Business Corporation Excise Return and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Www mass gov Doc Form355sbcpdfForm 355SBC Small Business Corporation Excise Return and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwmassgov doc form355sbcpdfform 355sbc small business corporation excise return

Create this form in 5 minutes!

How to create an eSignature for the wwwmassgov doc form355sbcpdfform 355sbc small business corporation excise return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 355sbc and how does it benefit my business?

The 355sbc represents a high-performance engine option that can enhance your vehicle's capability. By using a 355sbc, you can expect improved power and efficiency, making it a perfect choice for businesses that require reliable performance. Investing in a 355sbc can signNowly minimize downtime and maintenance costs.

-

How much does a 355sbc engine typically cost?

The pricing for a 355sbc engine can vary depending on several factors, including customization and the vendor. On average, you can expect to pay between $3,500 and $6,000 for a quality 355sbc engine. It’s important to compare prices and features to ensure you're getting the best value for your investment.

-

What features should I look for in a 355sbc engine?

When considering a 355sbc engine, look for features such as horsepower ratings, torque specifications, and fuel efficiency. Additionally, a quality intake and exhaust system can signNowly impact performance. Ensure that the engine meets your specific needs, whether for street use or racing.

-

What are the benefits of using airSlate SignNow for 355sbc-related documentation?

Using airSlate SignNow offers a streamlined solution for managing documents related to your 355sbc engine. The platform allows you to send, sign, and store documents electronically, making the process quick and secure. This efficiency can save time and reduce administrative overhead for businesses handling multiple engine transactions.

-

Can I integrate airSlate SignNow with other platforms for 355sbc documentation?

Yes, airSlate SignNow can be easily integrated with various platforms to enhance your workflow related to 355sbc documentation. Whether you use CRM systems or project management tools, integration ensures a seamless experience. This capability allows for better tracking and management across your business processes.

-

Is airSlate SignNow user-friendly for managing 355sbc contracts?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple to manage 355sbc contracts. The intuitive interface allows users to create, send, and sign documents with minimal training, making it accessible for everyone in your organization.

-

How does e-signing work for 355sbc-related documents?

E-signing with airSlate SignNow for 355sbc-related documents is straightforward. Users can upload documents, add signers, and request signatures electronically. This process enhances speed, reduces paper usage, and allows for real-time tracking of document status.

Get more for Www mass gov Doc Form355sbcpdfForm 355SBC Small Business Corporation Excise Return

Find out other Www mass gov Doc Form355sbcpdfForm 355SBC Small Business Corporation Excise Return

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter