TIR 99 10 Filing Requirements for Qualified S Corporation Mass Gov 2013

What is the TIR 99 10 Filing Requirements for Qualified S Corporation

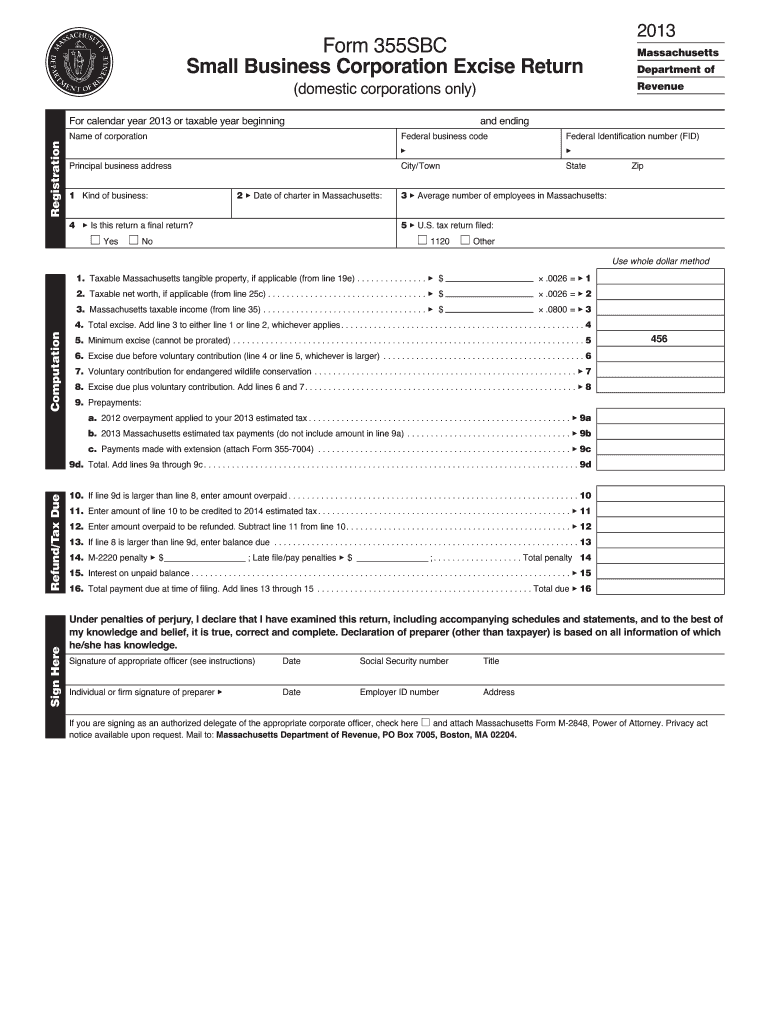

The TIR 99 10 filing requirements for qualified S Corporations in Massachusetts outline the necessary steps and documentation for S Corporations to comply with state tax regulations. This form is essential for ensuring that S Corporations meet their tax obligations and maintain their qualified status under Massachusetts law. It includes specific guidelines on income reporting, deductions, and credits that are unique to S Corporations, making it crucial for accurate tax filing.

Steps to Complete the TIR 99 10 Filing Requirements for Qualified S Corporation

Completing the TIR 99 10 form involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Accurately fill out the form, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online or via mail, as per the guidelines provided by the Massachusetts Department of Revenue.

Required Documents

To successfully file the TIR 99 10 form, certain documents are required. These typically include:

- Federal tax return for the S Corporation.

- State income statements and any relevant schedules.

- Documentation supporting any deductions or credits claimed.

- Any additional forms as specified by the Massachusetts Department of Revenue.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the TIR 99 10 form. Generally, the form must be submitted by the due date of the S Corporation's annual tax return. Late submissions may incur penalties, so timely filing is essential to avoid unnecessary fees.

Penalties for Non-Compliance

Failure to comply with the TIR 99 10 filing requirements can result in significant penalties. These may include:

- Monetary fines for late submissions.

- Interest on unpaid taxes.

- Potential loss of S Corporation status if requirements are not met consistently.

Digital vs. Paper Version

Filing the TIR 99 10 form can be done digitally or via paper submission. The digital version offers several advantages, such as faster processing times and reduced risk of errors. However, some taxpayers may prefer the traditional paper method. It is essential to choose the method that best suits your needs while ensuring compliance with state regulations.

Quick guide on how to complete tir 99 10 filing requirements for qualified s corporation massgov

Your assistance manual on how to prepare your TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov

If you're interested in learning how to finalize and submit your TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov, here are a few concise tips on how to streamline tax processing.

To begin, simply register your airSlate SignNow account to transform your document management online. airSlate SignNow is a highly intuitive and powerful document solution that enables you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and go back to adjust answers as necessary. Simplify your tax handling with advanced PDF editing, eSigning, and user-friendly sharing options.

Follow the steps below to complete your TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our catalog to access any IRS tax form; browse through various versions and schedules.

- Hit Get form to open your TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper filing can lead to return errors and delay refunds. Additionally, before e-filing your taxes, consult the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct tir 99 10 filing requirements for qualified s corporation massgov

Create this form in 5 minutes!

How to create an eSignature for the tir 99 10 filing requirements for qualified s corporation massgov

How to make an electronic signature for the Tir 99 10 Filing Requirements For Qualified S Corporation Massgov online

How to generate an eSignature for the Tir 99 10 Filing Requirements For Qualified S Corporation Massgov in Google Chrome

How to generate an electronic signature for signing the Tir 99 10 Filing Requirements For Qualified S Corporation Massgov in Gmail

How to make an eSignature for the Tir 99 10 Filing Requirements For Qualified S Corporation Massgov from your mobile device

How to make an eSignature for the Tir 99 10 Filing Requirements For Qualified S Corporation Massgov on iOS

How to create an electronic signature for the Tir 99 10 Filing Requirements For Qualified S Corporation Massgov on Android OS

People also ask

-

What are the TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov?

The TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov outlines the necessary standards and documentation required for qualified S corporations to comply with state tax regulations. Understanding these requirements is crucial for maintaining compliance and avoiding penalties. airSlate SignNow can help streamline the e-signing and filing process related to these requirements.

-

How can airSlate SignNow assist with TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov?

airSlate SignNow simplifies the process of preparing and signing the necessary documents for TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov. With user-friendly features, you can easily obtain signatures, ensuring timely submission of your filings. This solution saves time and mitigates the risk of errors.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting from cost-effective options for small businesses to comprehensive packages for larger enterprises. With features tailored to meet the TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov, the pricing ensures that you receive value for essential compliance solutions. Check our website for current pricing and promotional offers.

-

Are there specific features that assist in maintaining compliance with TIR 99 10 requirements?

Yes, airSlate SignNow includes features designed to help businesses comply with TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov. These features include template creation for common tax forms, audit trails for document histories, and secure storage options for sensitive files. This ensures you have all necessary documentation organized and readily available.

-

Can airSlate SignNow integrate with accounting software for filing compliance?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier for businesses to maintain compliance with TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov. By automating document transfers and signatures, you can reduce redundancy and enhance efficiency in your filing processes.

-

What benefits does airSlate SignNow provide for qualified S corporations?

Using airSlate SignNow, qualified S corporations can enjoy expedited documentation processes, reduced paperwork, and improved security features. This platform allows easy access to electronic signatures, ensuring all documents meet the TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov efficiently. The end result is a more streamlined experience that enhances operational effectiveness.

-

How does the e-signature process align with TIR 99 10 Filing Requirements?

The e-signature process offered by airSlate SignNow meets the legal standards required for compliance with TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov. Each e-signature is secure and legally binding, providing assurance that your filings are compliant and valid. This feature helps expedite the process of submitting necessary tax documents.

Get more for TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov

Find out other TIR 99 10 Filing Requirements For Qualified S Corporation Mass gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors