Corporate Excise Tax Forms and InstructionsMass Gov 2014

What is the Corporate Excise Tax Forms And InstructionsMass gov

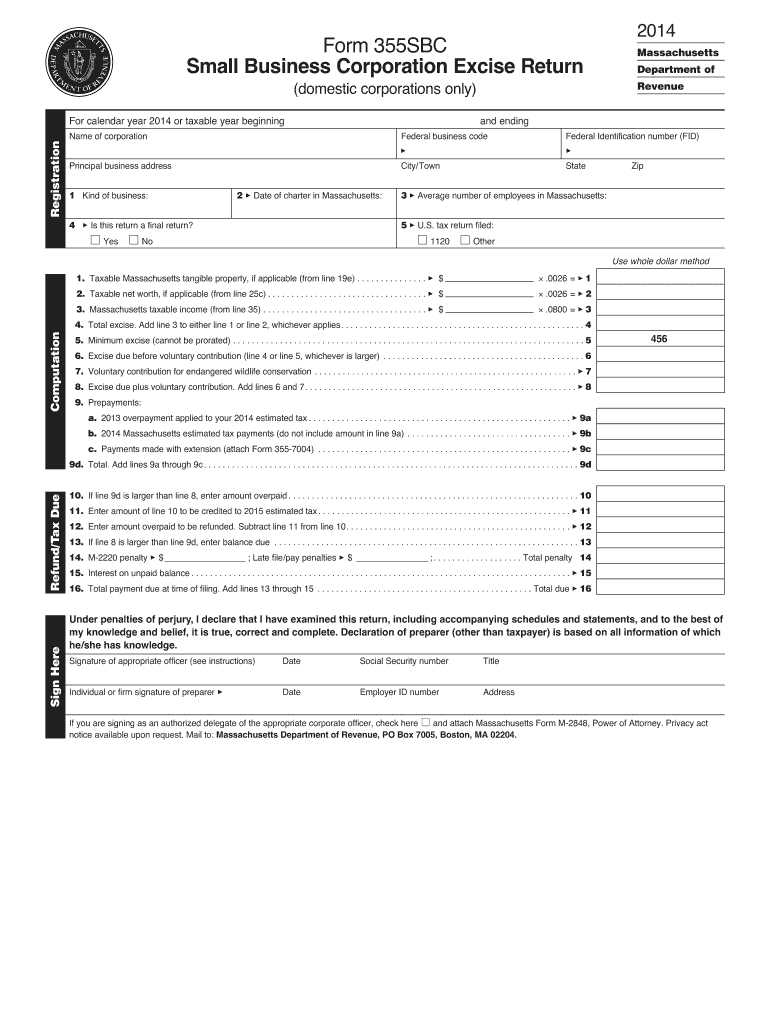

The Corporate Excise Tax Forms and Instructions from Mass.gov are essential documents required for corporations operating in Massachusetts to report their income and calculate their tax obligations. These forms provide a structured way for businesses to disclose their financial information to the state government and ensure compliance with tax laws. The forms typically include various schedules and worksheets that guide users through the process of reporting income, deductions, and credits applicable to their specific business structure.

How to use the Corporate Excise Tax Forms And InstructionsMass gov

Using the Corporate Excise Tax Forms and Instructions from Mass.gov involves several steps. First, businesses need to download the appropriate forms from the official website. Once downloaded, users should carefully read the accompanying instructions to understand the requirements for completion. The forms can be filled out digitally or printed for manual completion. After filling out the forms, businesses must review them for accuracy before submission to ensure that all information is correct and complete.

Steps to complete the Corporate Excise Tax Forms And InstructionsMass gov

Completing the Corporate Excise Tax Forms involves a systematic approach:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Select the correct form based on your business structure, such as a corporation or limited liability company.

- Fill out the form with accurate financial data, following the instructions provided for each section.

- Calculate the excise tax owed based on the guidelines outlined in the instructions.

- Review the completed form for any errors or omissions.

- Sign and date the form, ensuring that all required signatures are included.

- Submit the form electronically or via mail, depending on your preference and the submission options available.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Corporate Excise Tax Forms. Typically, the deadline for filing is the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year basis, this means the forms are due by March fifteenth. Late submissions may incur penalties, so it is essential to adhere to these deadlines to avoid additional fees.

Required Documents

To complete the Corporate Excise Tax Forms, businesses need several supporting documents, including:

- Financial statements, such as income statements and balance sheets.

- Prior year tax returns for reference.

- Documentation of any deductions or credits claimed.

- Records of any adjustments made throughout the fiscal year.

Having these documents readily available will streamline the process and ensure accurate reporting.

Penalties for Non-Compliance

Failing to comply with the filing requirements for the Corporate Excise Tax can result in significant penalties. Businesses may face fines for late submissions, which can accumulate over time. Additionally, non-compliance may lead to interest charges on unpaid taxes. It is important for corporations to understand these consequences and take timely action to fulfill their tax obligations.

Quick guide on how to complete 2018 corporate excise tax forms and instructionsmassgov

Your assistance manual on how to prepare your Corporate Excise Tax Forms And InstructionsMass gov

If you’re curious about how to finalize and submit your Corporate Excise Tax Forms And InstructionsMass gov, here are a few brief guidelines on how to simplify tax processing.

First, you only need to register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that allows you to modify, create, and finalize your tax documents with ease. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to adjust information where necessary. Optimize your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to finalize your Corporate Excise Tax Forms And InstructionsMass gov in just a few minutes:

- Establish your account and begin working on PDFs in no time.

- Utilize our catalog to obtain any IRS tax form; explore different versions and schedules.

- Click Obtain form to access your Corporate Excise Tax Forms And InstructionsMass gov in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Signature Tool to insert your legally-recognized eSignature (if required).

- Review your document and rectify any errors.

- Save modifications, print out your copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting in paper format can lead to increased return errors and delays in refunds. Naturally, before e-filing your taxes, visit the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2018 corporate excise tax forms and instructionsmassgov

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

As an employer, what legal and tax forms am I required to have a new employee to fill out?

I-9, W-4, state W-4, and some sort of state new hire form. The New hire form is for dead beat parents. Don’t inform the state in time and guess what? You become personally liable for what should have been garnished from their wages.From the sound of your question I infer that you are trying to make this a DIY project. DO NOT. There are just too many things that you can F up. Seek yea a CPA or at least a payroll service YESTERDAY.

Create this form in 5 minutes!

How to create an eSignature for the 2018 corporate excise tax forms and instructionsmassgov

How to generate an electronic signature for your 2018 Corporate Excise Tax Forms And Instructionsmassgov online

How to make an electronic signature for the 2018 Corporate Excise Tax Forms And Instructionsmassgov in Google Chrome

How to make an electronic signature for signing the 2018 Corporate Excise Tax Forms And Instructionsmassgov in Gmail

How to generate an eSignature for the 2018 Corporate Excise Tax Forms And Instructionsmassgov from your smartphone

How to generate an electronic signature for the 2018 Corporate Excise Tax Forms And Instructionsmassgov on iOS

How to make an electronic signature for the 2018 Corporate Excise Tax Forms And Instructionsmassgov on Android

People also ask

-

What are Corporate Excise Tax Forms And InstructionsMass gov?

Corporate Excise Tax Forms And InstructionsMass gov are the official documents required for businesses to report their excise taxes in the state of Massachusetts. These forms provide the necessary guidelines for compliance and detail how to accurately calculate and submit taxes owed. Understanding these forms is crucial for maintaining tax compliance and avoiding penalties.

-

How can airSlate SignNow help with Corporate Excise Tax Forms And InstructionsMass gov?

airSlate SignNow streamlines the process of signing and submitting Corporate Excise Tax Forms And InstructionsMass gov by providing a user-friendly digital platform. Businesses can easily send and eSign these important documents, ensuring compliance and efficiency. This saves time and reduces the risk of errors associated with traditional paper methods.

-

Is there a cost associated with using airSlate SignNow for Corporate Excise Tax Forms And InstructionsMass gov?

Yes, using airSlate SignNow involves a subscription fee, but it is known for being a cost-effective solution for managing Corporate Excise Tax Forms And InstructionsMass gov. The pricing is structured to provide value, with various plans catering to different business sizes and needs. This investment can ultimately save you money by reducing the time and resources spent on paperwork.

-

What features does airSlate SignNow offer for Corporate Excise Tax Forms And InstructionsMass gov?

AirSlate SignNow offers several features to aid in managing Corporate Excise Tax Forms And InstructionsMass gov, including eSigning, document templates, secure cloud storage, and tracking capabilities. These tools ensure documents are easily accessible and can be signed quickly, enhancing workflow efficiency. The platform also improves team collaboration, which is vital during tax season.

-

Does airSlate SignNow integrate with other software for Corporate Excise Tax Forms And InstructionsMass gov?

Yes, airSlate SignNow seamlessly integrates with popular business applications, making it easy to manage Corporate Excise Tax Forms And InstructionsMass gov alongside your existing tools. This integration facilitates smoother workflows, as data can be shared effortlessly between platforms. The compatibility with accounting software is particularly beneficial for tax reporting.

-

Are Corporate Excise Tax Forms And InstructionsMass gov easy to access through airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that makes accessing Corporate Excise Tax Forms And InstructionsMass gov straightforward. Users can quickly find and manage their documents, whether in the cloud or on their devices. This ease of access is crucial for timely submissions and ensuring compliance.

-

Can I customize Corporate Excise Tax Forms And InstructionsMass gov templates in airSlate SignNow?

Yes, airSlate SignNow allows users to customize templates for Corporate Excise Tax Forms And InstructionsMass gov according to their specific needs. This flexibility ensures that all necessary information is included and formatted correctly. Customizable templates save time and help maintain consistency across submissions.

Get more for Corporate Excise Tax Forms And InstructionsMass gov

- Subjects and predicates worksheet library form

- Training and competency assessment record hemocue hb 201dm hemoglobin massgeneral form

- Mgcb millionaire party form

- Sglv 8286a july form

- Learn english teens 299506995 form

- Travel expense claim california department of corrections and form

- Confidential information form ujs home ujs sd

Find out other Corporate Excise Tax Forms And InstructionsMass gov

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast