File Tax and Wage Reports and Make Payments 2022-2026

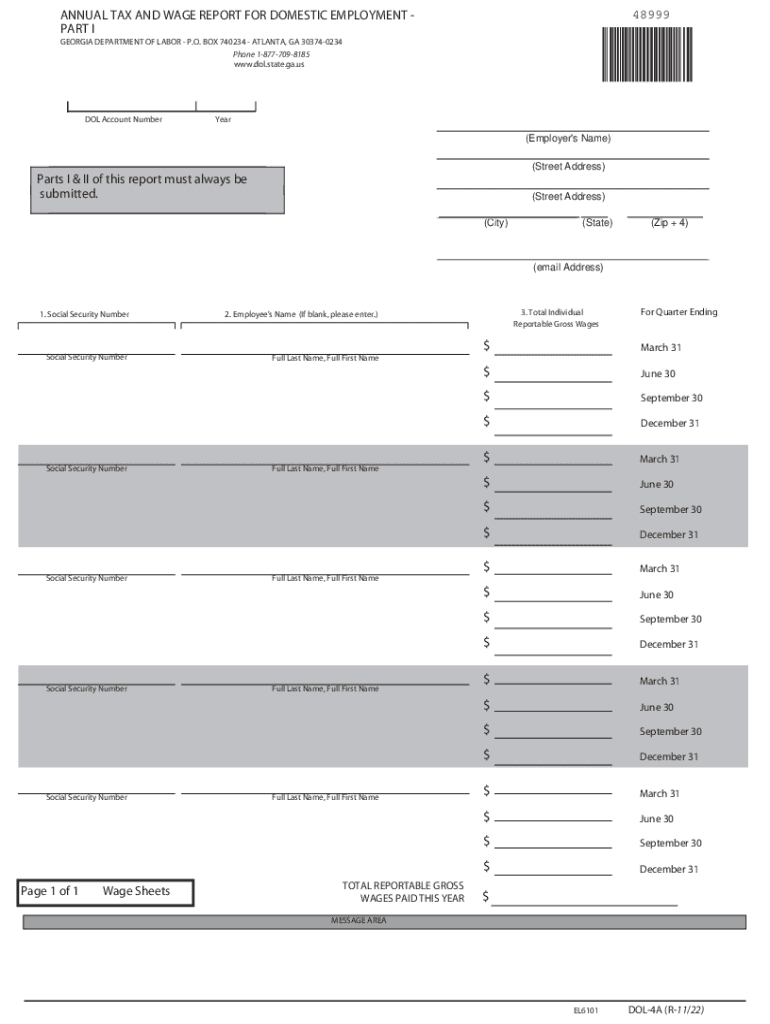

What is the dol 4 form?

The dol 4 form is a crucial document used in the context of filing tax and wage reports in the state of Georgia. It is specifically designed for employers to report wages paid to employees and to make necessary tax payments. This form ensures compliance with state regulations regarding domestic employment and helps maintain accurate records for tax purposes. The dol 4 form is essential for both employers and employees to ensure that all tax obligations are met and documented correctly.

How to complete the dol 4 form

Completing the dol 4 form involves several key steps that ensure accuracy and compliance. First, gather all necessary information, including employee details, wages paid, and any applicable deductions. Next, accurately fill in the required fields, ensuring that all data is correct and complete. After filling out the form, review it for any errors or omissions. Once verified, you can submit the dol 4 form electronically through a secure platform or by mailing it to the appropriate state agency. Utilizing a reliable eSignature solution can streamline this process, making it easier to manage and submit your documents securely.

Legal use of the dol 4 form

The dol 4 form is legally binding when completed and submitted in accordance with state regulations. To ensure its validity, it is essential to adhere to the guidelines set forth by the Georgia Department of Labor. This includes providing accurate information and ensuring that all signatures are obtained as required. Compliance with eSignature laws, such as the ESIGN and UETA acts, further solidifies the form's legal standing when submitted electronically. Employers must understand the legal implications of this form to avoid potential penalties for non-compliance.

Filing deadlines for the dol 4 form

Timely submission of the dol 4 form is critical to avoid penalties and ensure compliance with state tax regulations. Generally, the dol 4 form must be filed quarterly, with specific deadlines for each quarter. Employers should be aware of these deadlines to ensure that they submit their forms on time. Failure to meet these deadlines can result in fines and additional scrutiny from tax authorities. Keeping a calendar of important filing dates can help employers stay organized and compliant.

Required documents for the dol 4 form

To complete the dol 4 form accurately, employers must gather several key documents. These typically include employee wage records, tax identification numbers, and any relevant payroll documentation. Having this information readily available simplifies the process of filling out the form and ensures that all required data is included. Additionally, employers should maintain copies of submitted forms for their records, as this can be helpful in case of audits or inquiries from tax authorities.

Penalties for non-compliance with the dol 4 form

Non-compliance with the dol 4 form can lead to significant penalties for employers. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for employers to understand the importance of timely and accurate submissions to avoid these repercussions. Regular training and updates on compliance requirements can help organizations stay informed and mitigate risks associated with the dol 4 form.

Quick guide on how to complete file tax and wage reports and make payments

Complete File Tax And Wage Reports And Make Payments effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle File Tax And Wage Reports And Make Payments on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

The easiest way to modify and eSign File Tax And Wage Reports And Make Payments seamlessly

- Obtain File Tax And Wage Reports And Make Payments and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with features specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your edits.

- Select your preferred method to deliver your form, whether by email, SMS, or invite link, or download it directly to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign File Tax And Wage Reports And Make Payments to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct file tax and wage reports and make payments

Create this form in 5 minutes!

How to create an eSignature for the file tax and wage reports and make payments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dol 4, and how does it relate to airSlate SignNow?

Dol 4 refers to a specific document format that can be easily created, sent, and signed using airSlate SignNow's platform. This format simplifies the process for businesses by allowing secure electronic signatures and efficient document management.

-

How much does it cost to use airSlate SignNow for dol 4 documents?

airSlate SignNow offers flexible pricing plans that cater to varying business needs. When dealing with dol 4 documents, users can choose plans that best fit their budget and usage, making it a cost-effective solution.

-

What features does airSlate SignNow provide for dol 4 document management?

With airSlate SignNow, users can easily create, send, and manage dol 4 documents with features such as customizable templates, real-time tracking, and automated workflows. These features streamline the signing process and enhance productivity.

-

How can airSlate SignNow help businesses improve their dol 4 signing process?

AirSlate SignNow enhances the dol 4 signing process by providing a user-friendly interface that simplifies document signing for all parties. This accelerates transaction times and increases document compliance, ultimately improving customer satisfaction.

-

Is airSlate SignNow compliant with legal regulations for dol 4 documents?

Yes, airSlate SignNow complies with several legal regulations for electronic signatures, making it suitable for dol 4 documents. This compliance ensures that all signed documents are legally binding and recognized, providing peace of mind for businesses.

-

Can airSlate SignNow integrate with other applications for managing dol 4 documents?

Absolutely! airSlate SignNow offers integrations with numerous applications, allowing users to seamlessly manage dol 4 documents within their existing workflows. This integration capability enhances efficiency and ensures better management of business processes.

-

What benefits do businesses gain by using airSlate SignNow for dol 4?

Businesses using airSlate SignNow for dol 4 documents benefit from enhanced efficiency, reduced turnaround times, and increased security in the signing process. Additionally, organizations can lower operational costs associated with paper document management.

Get more for File Tax And Wage Reports And Make Payments

- Policy use business form

- Policy company template form

- Agreement business assets purchase form

- Letter sales form

- Full final form

- Renew contract form

- Waiver and release by parent of minor child from liability and personal injury for soccer training in favor of soccer 497328869 form

- Name with service form

Find out other File Tax And Wage Reports And Make Payments

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF