Filing Season Tips Ohio Department of Taxation 2022

What is the Filing Season Tips Ohio Department of Taxation?

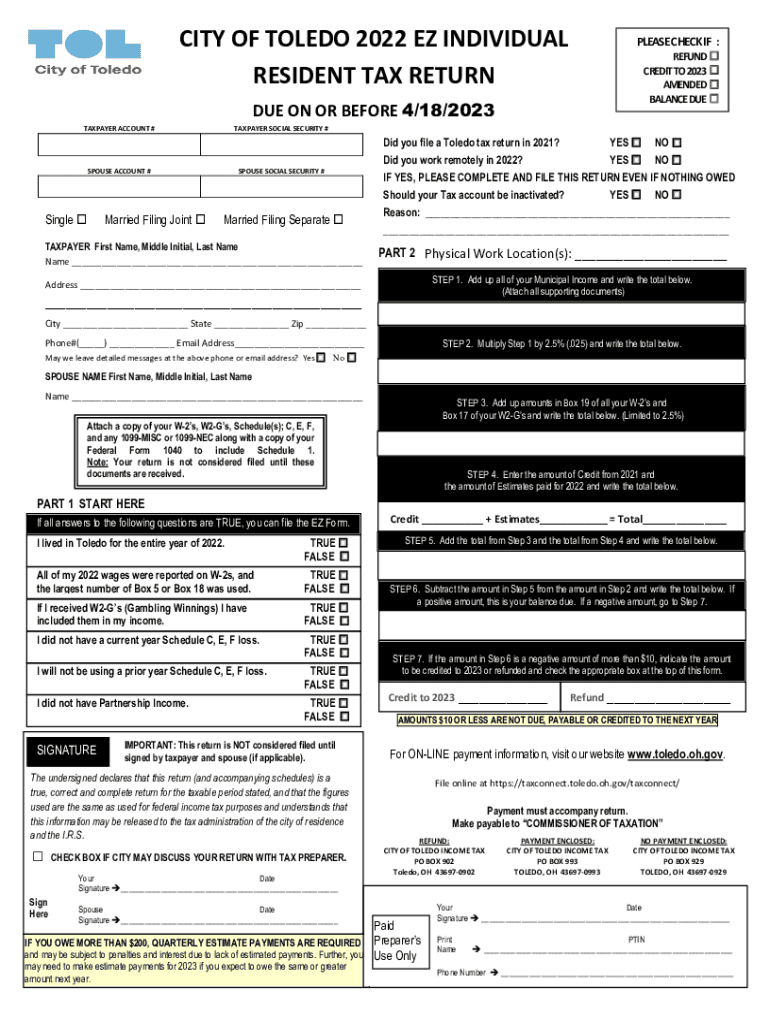

The Filing Season Tips Ohio Department of Taxation is a document designed to assist taxpayers in navigating the complexities of tax filing during the annual tax season. This form provides essential guidance on various aspects of tax preparation, including deductions, credits, and compliance with state tax laws. It is particularly useful for individuals and businesses looking to ensure they meet all necessary requirements while maximizing their tax benefits.

Steps to Complete the Filing Season Tips Ohio Department of Taxation

Completing the Filing Season Tips Ohio Department of Taxation involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and other income statements.

- Review the tips provided in the document to identify applicable deductions and credits.

- Fill out the required forms accurately, ensuring that all information is complete and correct.

- Double-check all entries for errors before submission.

- Submit the completed forms either electronically or via mail, following the guidelines specified in the document.

Legal Use of the Filing Season Tips Ohio Department of Taxation

The Filing Season Tips Ohio Department of Taxation serves as a legally recognized guide that outlines the responsibilities of taxpayers in Ohio. Utilizing this document helps ensure compliance with state tax laws, which can protect individuals and businesses from potential penalties. It is important to follow the guidelines closely to maintain legal standing and avoid issues with tax authorities.

Required Documents for Filing Season Tips Ohio Department of Taxation

To effectively use the Filing Season Tips Ohio Department of Taxation, certain documents are required. These typically include:

- Proof of income, such as W-2 forms and 1099 forms.

- Receipts for deductible expenses, including medical, educational, and business-related costs.

- Previous tax returns for reference and accuracy.

- Any relevant documentation for tax credits and exemptions.

Filing Deadlines / Important Dates

Adhering to filing deadlines is crucial for compliance with the Ohio Department of Taxation. Key dates include:

- January 31: Deadline for employers to issue W-2 forms.

- April 15: Standard deadline for filing individual income tax returns.

- October 15: Extended deadline for those who filed for an extension.

Examples of Using the Filing Season Tips Ohio Department of Taxation

Taxpayers can utilize the Filing Season Tips Ohio Department of Taxation in various scenarios, such as:

- Individuals preparing their annual tax returns to ensure they claim all eligible deductions.

- Small business owners seeking to understand tax obligations and available credits.

- Self-employed individuals needing guidance on estimated tax payments and record-keeping.

Quick guide on how to complete filing season tips ohio department of taxation

Complete Filing Season Tips Ohio Department Of Taxation effortlessly on any device

Web-based document management has become favored by companies and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and digitally sign your documents swiftly without interruptions. Manage Filing Season Tips Ohio Department Of Taxation on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to alter and digitally sign Filing Season Tips Ohio Department Of Taxation with ease

- Locate Filing Season Tips Ohio Department Of Taxation and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and bears the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Select your preferred method for submitting your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and digitally sign Filing Season Tips Ohio Department Of Taxation to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct filing season tips ohio department of taxation

Create this form in 5 minutes!

How to create an eSignature for the filing season tips ohio department of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can I contact support at 8776076400?

airSlate SignNow is a powerful eSignature platform designed for businesses to easily send and sign documents online. If you have any questions or require assistance, you can signNow our customer support at 8776076400, where our team is ready to help you with all your needs.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs. By calling us at 8776076400, you can receive detailed information on pricing tiers and find the plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer?

airSlate SignNow provides a comprehensive suite of features that includes document templates, in-person signing, and automated workflows. For a complete overview of our features, feel free to call us at 8776076400, and our team will guide you through the benefits.

-

How can airSlate SignNow improve my business efficiency?

With airSlate SignNow, businesses can streamline their document management processes, reducing turnaround time and enhancing productivity. To learn more about how our solution can benefit your specific needs, give us a call at 8776076400.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with a variety of applications including Google Drive, Salesforce, and many more. For a full list of available integrations, contact our team at 8776076400 for assistance.

-

Is airSlate SignNow secure for sending sensitive documents?

Absolutely! airSlate SignNow uses advanced encryption protocols to ensure the security and confidentiality of your documents. For any security-related inquiries or concerns, feel free to signNow us at 8776076400.

-

Can I use airSlate SignNow for international transactions?

Yes, airSlate SignNow is designed to support international transactions and users worldwide. If you have specific questions about international use, don’t hesitate to call us at 8776076400 for further information.

Get more for Filing Season Tips Ohio Department Of Taxation

- Agreement to sell business by sole proprietorship including right to tradename and business franchise with assignment of 497328928 form

- Theft minor form

- Lease of alarm system to residential customer form

- Letter to creditors notifying them of identity theft of minor for new accounts form

- Agreement farm contract form

- Letter enforcement form

- Lease taxicab form

- Postal theft form

Find out other Filing Season Tips Ohio Department Of Taxation

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online