Individual Resident Tax Return 2021

What is the Individual Resident Tax Return

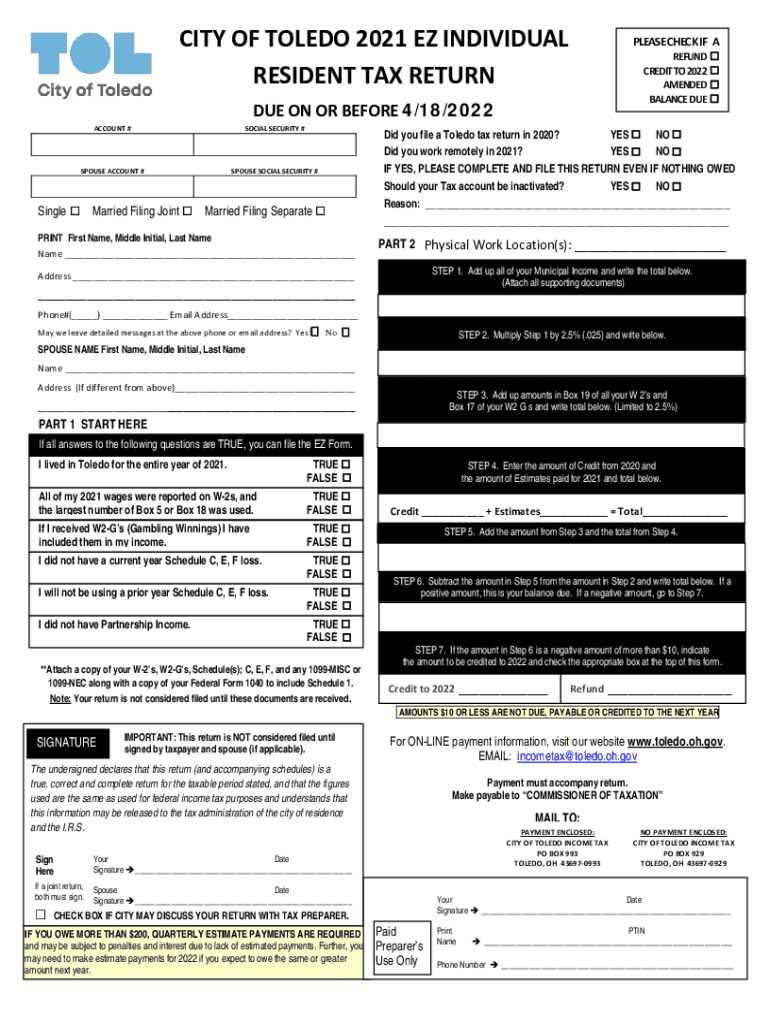

The individual resident tax return is a crucial document for U.S. taxpayers, specifically designed for residents of a particular state to report their income, deductions, and credits. This form allows individuals to calculate their tax liability based on their earnings and ensure compliance with state tax laws. Each state may have its own version of this form, tailored to its tax regulations, which must be accurately completed and submitted by the designated deadlines.

Steps to Complete the Individual Resident Tax Return

Completing the individual resident tax return involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, identify applicable deductions and credits that may reduce your taxable income. After that, fill out the individual resident tax return form carefully, ensuring all information is correct. Finally, review the completed form for any errors before submitting it electronically or via mail.

Required Documents

To successfully complete the individual resident tax return, several documents are essential. These typically include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Receipts for deductible expenses

- Records of any tax credits claimed

- Previous year’s tax return for reference

Having these documents organized will streamline the filing process and help ensure that all income and deductions are accurately reported.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for avoiding penalties. Generally, the deadline for submitting the individual resident tax return is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, some states may have different deadlines, so it's important to verify specific dates based on your state of residence.

Legal Use of the Individual Resident Tax Return

The individual resident tax return serves as a legally binding document that must be completed truthfully and accurately. Filing this form is not only a requirement for tax compliance but also a means of ensuring that taxpayers fulfill their civic duties. Misrepresentation or omission of information can lead to legal consequences, including fines or audits by tax authorities.

Form Submission Methods (Online / Mail / In-Person)

There are various methods for submitting the individual resident tax return. Taxpayers can file online through state tax websites or approved software, which often simplifies the process and provides instant confirmation. Alternatively, individuals may choose to mail their completed forms to the appropriate state tax office. In-person submissions may also be available at designated tax offices, offering assistance for those who require additional help.

Quick guide on how to complete individual resident tax return

Complete Individual Resident Tax Return effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It presents an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Individual Resident Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven procedure today.

How to alter and eSign Individual Resident Tax Return with ease

- Obtain Individual Resident Tax Return and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools offered by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign option, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any chosen device. Modify and eSign Individual Resident Tax Return to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual resident tax return

Create this form in 5 minutes!

How to create an eSignature for the individual resident tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an individual resident tax return?

An individual resident tax return is a tax return filed by residents to report their income, deductions, and credits for the year. It is essential for accurately calculating tax obligations and ensuring compliance with tax laws. airSlate SignNow can help you efficiently sign and send your individual resident tax return documents electronically.

-

How does airSlate SignNow simplify the individual resident tax return process?

airSlate SignNow streamlines the individual resident tax return process by providing a user-friendly platform for sending and eSigning documents. This eliminates the need for physical paperwork and speeds up the filing process. You can easily manage and track your individual resident tax return documents within the application.

-

What features does airSlate SignNow offer for managing individual resident tax returns?

airSlate SignNow offers features like templates for tax documents, real-time collaboration, and automated reminders to enhance your experience while handling individual resident tax returns. These tools help ensure that you don’t miss deadlines and can efficiently gather necessary signatures. With our platform, your individual resident tax return process is optimized for efficiency.

-

Is airSlate SignNow cost-effective for filing individual resident tax returns?

Yes, airSlate SignNow is a cost-effective solution for filing individual resident tax returns. We offer various pricing plans to fit different budgets, ensuring that you have access to our powerful eSigning and document management features without breaking the bank. Investing in airSlate SignNow can save you both time and money in the long run.

-

Can I integrate airSlate SignNow with other tax preparation software?

Absolutely! airSlate SignNow can be easily integrated with popular tax preparation software, enhancing the efficiency of your individual resident tax return filing process. These integrations allow for seamless data transfer, ensuring that your tax documents are always up-to-date and accessible. This simplifies the way you manage your individual resident tax return.

-

What benefits does using airSlate SignNow provide for individual resident tax returns?

Using airSlate SignNow for individual resident tax returns offers several benefits, including reduced paperwork, enhanced security, and faster turnaround times for eSignatures. This digital approach ensures that your documents are securely stored and easily retrievable. By simplifying the process, airSlate SignNow helps you focus on what matters—getting your individual resident tax return filed accurately and efficiently.

-

How secure is my data when using airSlate SignNow for my individual resident tax return?

Security is a top priority at airSlate SignNow. We use bank-level encryption to protect your sensitive information while you manage your individual resident tax return. This ensures that your personal and financial data remains confidential and secure throughout the entire eSigning process.

Get more for Individual Resident Tax Return

Find out other Individual Resident Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors