CITY of TOLEDO EZ INDIVIDUAL RESIDENT TAX RET 2024-2026

What is the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET

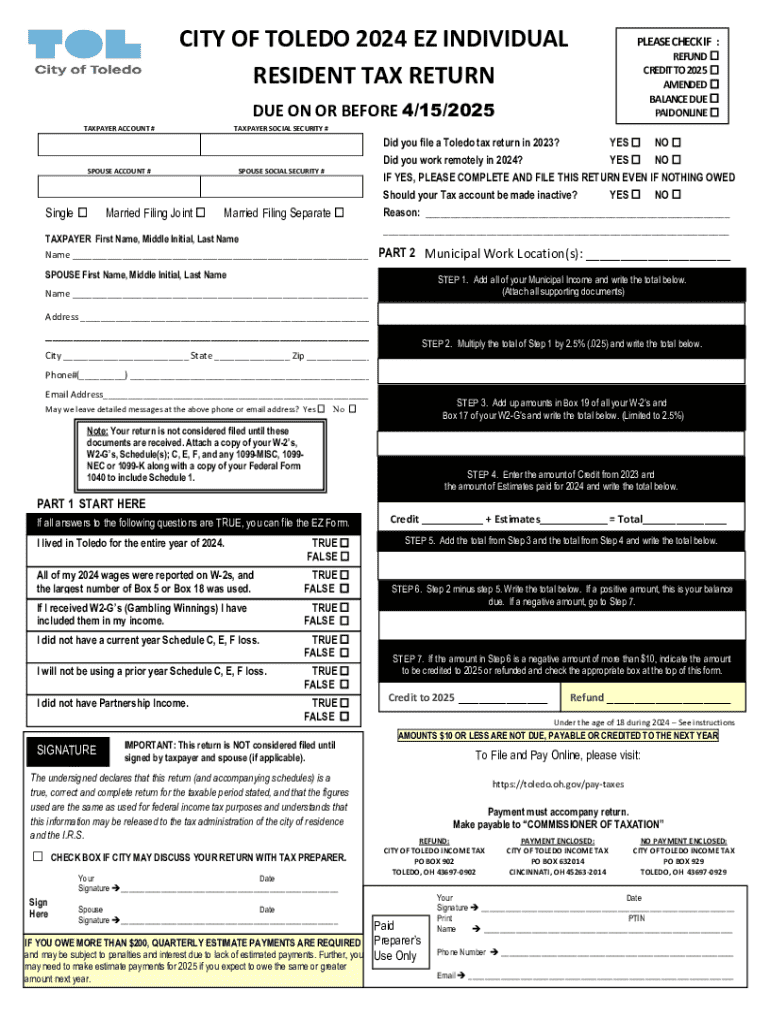

The CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET is a simplified tax form designed for individual residents of Toledo, Ohio, who are required to file local income taxes. This form streamlines the tax filing process, allowing residents to report their income and calculate their tax liability efficiently. It is specifically tailored for individuals with straightforward tax situations, making it easier for them to comply with local tax regulations.

How to use the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET

Using the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET involves several straightforward steps. First, gather all necessary financial documents, including W-2s and any other income statements. Next, complete the form by entering your personal information, income details, and deductions if applicable. After filling out the form, review it carefully to ensure accuracy. Finally, submit the completed form to the appropriate Toledo tax authority, either electronically or by mail.

Steps to complete the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET

Completing the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET requires a methodical approach. Follow these steps:

- Gather all relevant documents, such as W-2 forms and any additional income records.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income accurately, ensuring all sources are included.

- Calculate your tax liability based on the provided tax rates and guidelines.

- Review the form for any errors or omissions before submission.

- Submit the form to the Toledo tax office through your preferred method.

Required Documents

When preparing to file the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET, certain documents are essential. These typically include:

- W-2 forms from your employer(s) detailing your earnings.

- Any 1099 forms if you have additional income sources.

- Records of any deductions you plan to claim, such as charitable contributions.

- Identification documents, including your Social Security number.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET. Typically, the deadline for filing local income taxes in Toledo aligns with the federal tax deadline, which is April fifteenth. However, it is advisable to check for any updates or changes that may affect the filing schedule.

Eligibility Criteria

To be eligible to use the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET, individuals must meet specific criteria. Generally, this form is intended for residents of Toledo who have a straightforward tax situation, such as those with single sources of income and minimal deductions. Individuals with more complex financial situations may need to use a different form to ensure compliance with local tax laws.

Create this form in 5 minutes or less

Find and fill out the correct city of toledo ez individual resident tax ret

Create this form in 5 minutes!

How to create an eSignature for the city of toledo ez individual resident tax ret

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET?

The CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET is a simplified tax return form designed for individual residents of Toledo. It streamlines the filing process, making it easier for taxpayers to report their income and claim deductions. This form is ideal for those with straightforward tax situations.

-

How can airSlate SignNow help with the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET?

airSlate SignNow provides an efficient platform for electronically signing and sending the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET. With its user-friendly interface, you can easily manage your tax documents, ensuring they are securely signed and submitted on time. This saves you time and reduces the hassle of traditional paper filing.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The plans are cost-effective, allowing you to choose one that fits your budget while providing access to features that streamline the filing of the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET. You can start with a free trial to explore the platform.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools enhance your experience when handling the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET, ensuring that you can easily create, sign, and manage your tax documents. The platform also allows for collaboration with tax professionals if needed.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for managing sensitive tax information like the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET. The platform uses advanced encryption and security protocols to protect your data. You can confidently eSign and send your tax documents without worrying about unauthorized access.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software. This allows you to seamlessly incorporate the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET into your existing workflow, enhancing efficiency and ensuring that all your documents are in one place for easy access and management.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing, including the CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET, offers numerous benefits such as time savings, increased accuracy, and enhanced convenience. The platform simplifies the signing process and allows for quick document turnaround. Additionally, you can access your documents anytime, anywhere, making tax season less stressful.

Get more for CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET

- Final authorizing resolution thnk dutchess alliance for form

- Rapport 20052 vittneskonfrontation polisen polisen form

- Self assessment questionnaire b ip pci security standards council form

- Kwit wypaty wynagrodzenia bedrukibbplb form

- Certificate of motor insurance form b beltelb bukb eltel uk

- Idaho department of correction sex offender idoc idaho form

- Jdf 1405 order re modification of child us state forms

- Expense approval form sample forms sampleforms

Find out other CITY OF TOLEDO EZ INDIVIDUAL RESIDENT TAX RET

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure