Credit for Taxes Paid to Another State Virginia Tax 2022-2026

Understanding the Vermont 117 Tax Credit

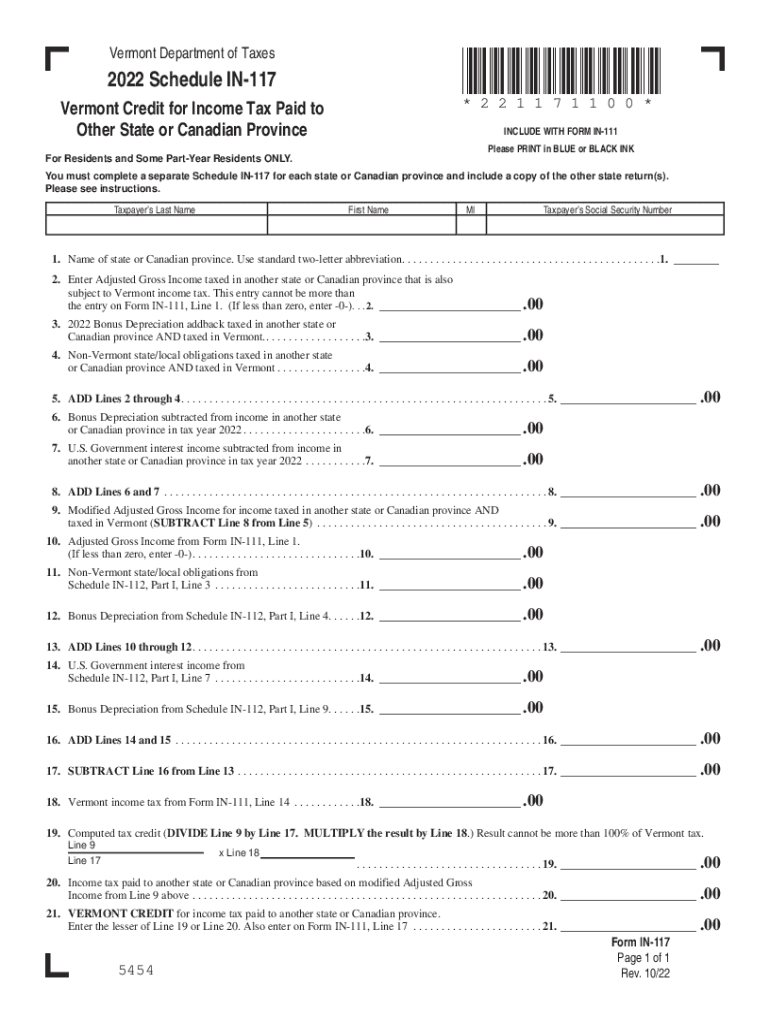

The Vermont 117 tax credit, also known as the Vermont credit for taxes paid to another state, is designed to alleviate the tax burden for residents who earn income in multiple states. This credit allows taxpayers to claim a portion of the taxes paid to another state against their Vermont tax liability. This is particularly beneficial for individuals who work in neighboring states while maintaining residency in Vermont.

To qualify for this credit, taxpayers must have paid income taxes to another state on income that is also subject to Vermont tax. The credit is limited to the amount of tax that would have been due to Vermont on that income, ensuring that taxpayers do not receive a double benefit.

Steps to Claim the Vermont 117 Tax Credit

Claiming the Vermont 117 tax credit involves several key steps:

- Gather documentation of taxes paid to the other state, including W-2s or 1099s.

- Complete the Vermont 117 form, ensuring all relevant income and tax information is accurately reported.

- Calculate the credit amount based on the taxes paid to the other state and Vermont's tax rates.

- Attach any necessary documentation to your Vermont tax return to substantiate your claim.

- Submit your completed Vermont tax return, including the 117 form, by the filing deadline.

Eligibility Criteria for the Vermont 117 Tax Credit

To be eligible for the Vermont 117 tax credit, taxpayers must meet specific criteria:

- Must be a resident of Vermont for the tax year in question.

- Must have earned income in another state that is subject to taxation.

- Must have paid income tax to that other state on the income earned.

- Must file a Vermont income tax return, including the Vermont 117 form.

Required Documents for Filing the Vermont 117 Tax Credit

When filing for the Vermont 117 tax credit, it is essential to have the following documents ready:

- W-2 forms or 1099s showing income earned in another state.

- Proof of taxes paid to the other state, such as tax returns or payment receipts.

- A completed Vermont 117 form, accurately filled out with all relevant details.

Filing Deadlines for the Vermont 117 Tax Credit

Taxpayers should be aware of the important deadlines for filing the Vermont 117 tax credit:

- The Vermont income tax return is typically due on April 15 each year.

- If you are unable to meet the deadline, you may request an extension, but the credit must still be claimed within the original filing period.

Penalties for Non-Compliance with Vermont Tax Regulations

Failure to comply with Vermont tax regulations regarding the 117 tax credit can result in penalties. These may include:

- Interest on unpaid taxes, which accrues from the original due date.

- Fines for late filing or underreporting income.

- Loss of eligibility for the credit in future tax years if discrepancies are found.

Quick guide on how to complete credit for taxes paid to another state virginia tax

Finalize Credit For Taxes Paid To Another State Virginia Tax seamlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hassle. Manage Credit For Taxes Paid To Another State Virginia Tax on any gadget using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to amend and eSign Credit For Taxes Paid To Another State Virginia Tax effortlessly

- Obtain Credit For Taxes Paid To Another State Virginia Tax and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes moments and holds the same legal validity as a traditional signed document.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Credit For Taxes Paid To Another State Virginia Tax to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct credit for taxes paid to another state virginia tax

Create this form in 5 minutes!

How to create an eSignature for the credit for taxes paid to another state virginia tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Vermont 117 Tax?

The Vermont 117 Tax refers to a particular state tax form that residents and businesses in Vermont must complete for tax filing purposes. Understanding the Vermont 117 Tax is crucial for accurate tax reporting and compliance. airSlate SignNow can help streamline the document signing process associated with this tax form.

-

How can airSlate SignNow help with the Vermont 117 Tax?

AirSlate SignNow provides a straightforward platform to eSign and send necessary documents related to the Vermont 117 Tax. By using our features, you can ensure quick and secure signatures, allowing you to focus on other important tax-related tasks. This efficiency can enhance your overall tax preparation experience.

-

What are the pricing options for using airSlate SignNow for Vermont 117 Tax filings?

AirSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes for tasks including Vermont 117 Tax document management. Pricing is structured based on your volume of use and specific features you need. Visit our pricing page for detailed information and find the plan that meets your Vermont 117 Tax filing needs.

-

Does airSlate SignNow support integrations with tax software for Vermont 117 Tax?

Yes, airSlate SignNow integrates seamlessly with popular tax software that can assist in filing Vermont 117 Tax. This integration allows for the importation and exportation of documents, creating a smooth workflow for tax professionals and business owners. Enhance your productivity by connecting your tools effectively.

-

What features does airSlate SignNow offer to assist with Vermont 117 Tax documents?

AirSlate SignNow offers various features like customizable templates, automated reminders, and secure cloud storage, all designed to simplify the handling of Vermont 117 Tax documents. These tools help ensure that you never miss a deadline and that all your documents are well-organized. Effortless document management makes tax season less stressful.

-

Is airSlate SignNow secure for handling sensitive Vermont 117 Tax documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, including those related to the Vermont 117 Tax. With bank-grade encryption and secure data storage, your sensitive tax information is protected. This ensures you can eSign and send documents confidently, knowing they are safe.

-

Can airSlate SignNow streamline the eSigning process for Vermont 117 Tax forms?

Yes, airSlate SignNow is designed to streamline the eSigning process, signNowly reducing the time needed to get Vermont 117 Tax forms signed. Our intuitive platform allows multiple parties to sign documents quickly, ensuring timely submission. This speed can be invaluable when meeting tax deadlines.

Get more for Credit For Taxes Paid To Another State Virginia Tax

Find out other Credit For Taxes Paid To Another State Virginia Tax

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure