Massachusetts Department of Revenue Form IFTA 1 International Fuel Tax 2023-2026

What is the Massachusetts Department Of Revenue Form IFTA 1 International Fuel Tax

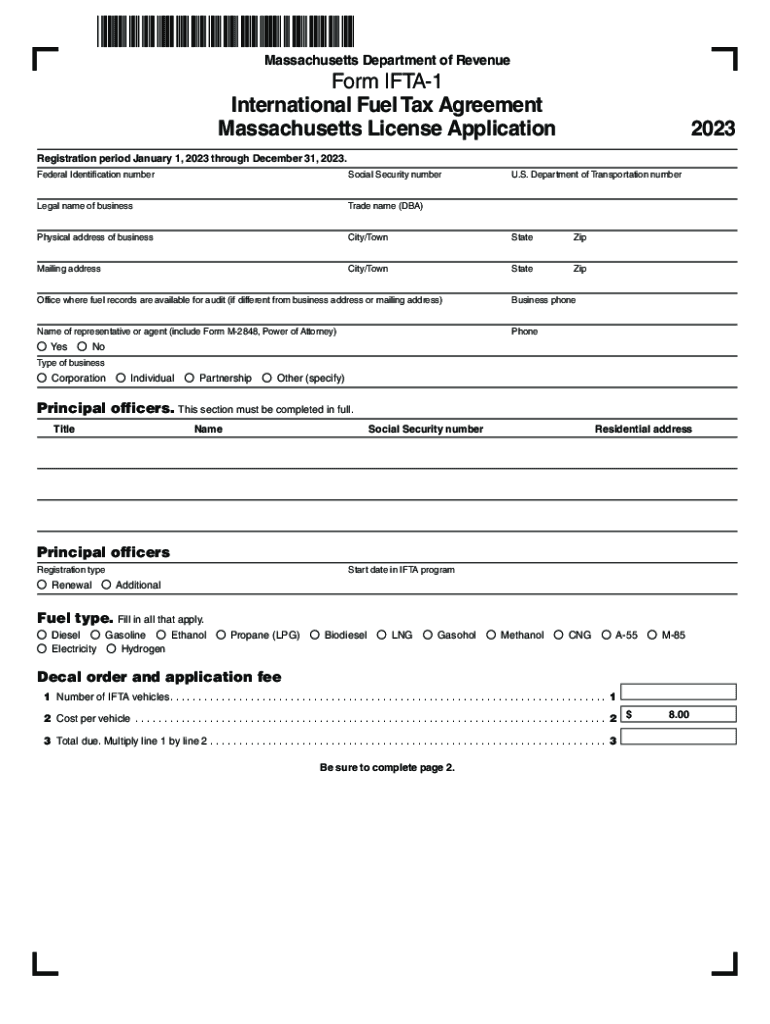

The Massachusetts Department of Revenue Form IFTA 1 is an essential document for businesses operating commercial vehicles that travel across state lines. This form is used to report and pay fuel taxes under the International Fuel Tax Agreement (IFTA). The IFTA aims to simplify the reporting of fuel taxes by allowing carriers to file a single return for multiple jurisdictions, making it easier for businesses to comply with tax regulations.

By completing the IFTA 1 form, businesses can accurately report their fuel usage and calculate the taxes owed to each state based on the miles traveled and fuel consumed. This form is crucial for maintaining compliance with state and federal tax laws, ensuring that businesses fulfill their tax obligations efficiently.

Steps to complete the Massachusetts Department Of Revenue Form IFTA 1 International Fuel Tax

Completing the Massachusetts IFTA 1 form involves several key steps to ensure accuracy and compliance. First, gather all necessary records, including fuel purchase receipts and mileage logs for each jurisdiction traveled. This information is vital for calculating the total fuel consumed and the miles driven in each state.

Next, fill out the form by entering the required information, such as the total miles traveled, fuel purchased, and the jurisdictions where the fuel was used. Ensure that all entries are accurate, as discrepancies can lead to penalties or audits. After completing the form, review it thoroughly for any errors before submission.

Finally, submit the IFTA 1 form along with any payment due to the Massachusetts Department of Revenue by the specified deadline. It is advisable to keep a copy of the submitted form and any supporting documents for your records.

Legal use of the Massachusetts Department Of Revenue Form IFTA 1 International Fuel Tax

The legal use of the Massachusetts IFTA 1 form is governed by state and federal regulations that outline the requirements for fuel tax reporting. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated filing period.

Electronic signatures are accepted for the IFTA 1 form, provided that the eSignature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Using a reliable eSignature platform can enhance the legal standing of the submitted form, ensuring that it meets all necessary legal criteria.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts IFTA 1 form are crucial for compliance. Typically, the form must be submitted quarterly, with specific due dates for each quarter. For instance, the deadlines often fall on the last day of the month following the end of each quarter: January 31, April 30, July 31, and October 31.

It is important to be aware of these deadlines to avoid late fees or penalties. Additionally, keeping track of any changes in regulations or deadlines announced by the Massachusetts Department of Revenue can help ensure timely compliance.

Required Documents

When completing the Massachusetts IFTA 1 form, several documents are required to support the information provided. Key documents include:

- Fuel purchase receipts that detail the amount of fuel bought and the jurisdictions where it was purchased.

- Mileage logs that record the number of miles driven in each state.

- Previous IFTA returns, if applicable, which can provide a reference for current filings.

Having these documents readily available will facilitate the completion of the IFTA 1 form and help ensure that all reported information is accurate and verifiable.

Form Submission Methods (Online / Mail / In-Person)

The Massachusetts IFTA 1 form can be submitted through various methods to accommodate different preferences. Businesses may choose to file online through the Massachusetts Department of Revenue's website, which often provides a streamlined process for electronic submissions.

Alternatively, the form can be mailed to the appropriate department, ensuring that it is postmarked by the filing deadline. For those who prefer in-person submissions, visiting a local Department of Revenue office may be an option, allowing for direct interaction with staff for any questions or clarifications needed during the filing process.

Quick guide on how to complete massachusetts department of revenue form ifta 1 international fuel tax

Effortlessly Manage Massachusetts Department Of Revenue Form IFTA 1 International Fuel Tax on Any Device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Massachusetts Department Of Revenue Form IFTA 1 International Fuel Tax seamlessly on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Massachusetts Department Of Revenue Form IFTA 1 International Fuel Tax Effortlessly

- Obtain Massachusetts Department Of Revenue Form IFTA 1 International Fuel Tax and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or conceal sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to retain your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign Massachusetts Department Of Revenue Form IFTA 1 International Fuel Tax while ensuring outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form ifta 1 international fuel tax

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form ifta 1 international fuel tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IFTA Massachusetts and how does it affect my business?

IFTA Massachusetts refers to the International Fuel Tax Agreement regulations that govern the reporting of fuel use by commercial vehicles operating in multiple states. Understanding these regulations is crucial for compliance and helps you avoid penalties. Utilizing a tool like airSlate SignNow can streamline your IFTA Massachusetts documentation process.

-

How can airSlate SignNow help with IFTA Massachusetts reporting?

airSlate SignNow facilitates easy electronic signatures and document management, which is essential for timely IFTA Massachusetts filings. By using our platform, you can quickly prepare, send, and eSign required IFTA forms, ensuring compliance with state regulations. This saves you time and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow services related to IFTA Massachusetts?

airSlate SignNow offers competitive pricing plans tailored for various business needs, including those focusing on IFTA Massachusetts reporting. Our pricing is designed to be cost-effective, making it accessible for small and large businesses alike. You can view our pricing page to find the plan that best fits your IFTA needs.

-

Is airSlate SignNow secure for handling IFTA Massachusetts documents?

Yes, airSlate SignNow is built with high-level security features to protect your sensitive IFTA Massachusetts documents. We use encryption and secure data storage to ensure your information is safe. Our compliance with regulatory standards means you can trust our platform for handling important documents.

-

Can airSlate SignNow integrate with other tools used for IFTA Massachusetts reporting?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and fleet management software that assist with IFTA Massachusetts reporting. This integration streamlines your workflow by allowing you to manage documents without switching between multiple applications. Boost your efficiency by utilizing our integrations!

-

What benefits can I expect by using airSlate SignNow for IFTA Massachusetts?

Using airSlate SignNow for IFTA Massachusetts offers numerous benefits, including faster processing times and reduced paperwork. The electronic signing feature allows for quick approvals, enhancing your operational efficiency. Moreover, our user-friendly interface makes it easy for anyone to manage their IFTA documentation effectively.

-

How can I track my IFTA Massachusetts filing status using airSlate SignNow?

airSlate SignNow provides a tracking feature that allows you to monitor the status of your IFTA Massachusetts filings. You’ll receive notifications regarding document views and completions, ensuring you stay updated. This transparency helps you manage your fleet's compliance effectively.

Get more for Massachusetts Department Of Revenue Form IFTA 1 International Fuel Tax

- Agreement vocalist form

- Agreement for purchase of business assets from a corporation form

- Letter discount form

- Accident report form

- Collateral source rule and property damage in illinois form

- Motion for private medical treatment 497329177 form

- Purchase money mortgage form

- Motion to withdraw 497329179 form

Find out other Massachusetts Department Of Revenue Form IFTA 1 International Fuel Tax

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure