Form 3M Income Tax Return for Clubs and Other Mass Gov 2022

What is the Massachusetts Form 3M Income Tax Return?

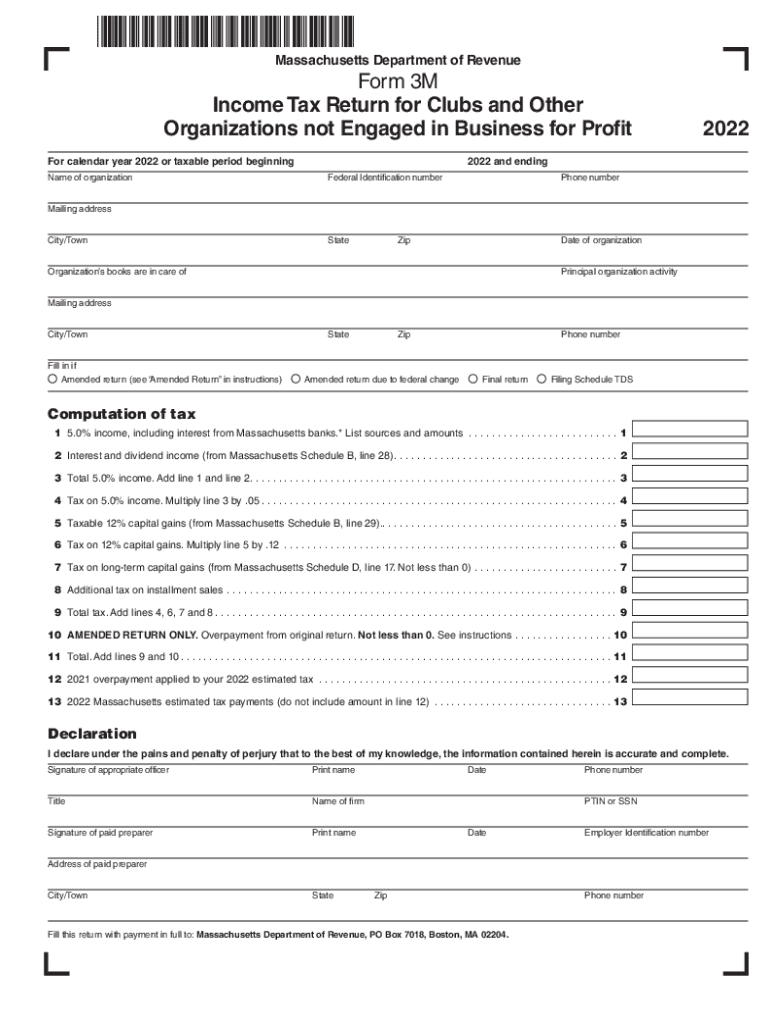

The Massachusetts Form 3M is an income tax return specifically designed for clubs and other organizations that are not classified as traditional corporations. This form is essential for entities that derive income from various activities but do not operate with the same structure as typical businesses. The form allows these organizations to report their income and calculate any tax obligations they may have to the state of Massachusetts. Understanding the purpose of Form 3M is crucial for compliance with state tax laws and for maintaining the organization's tax-exempt status, if applicable.

Steps to Complete the Massachusetts Form 3M

Completing the Massachusetts Form 3M involves several key steps that ensure accurate reporting of income and expenses. Here’s a straightforward approach to filling out the form:

- Gather all necessary financial documents, including income statements and expense records.

- Begin by entering the organization’s identifying information, such as name, address, and federal employer identification number (EIN).

- Report total income from all sources, ensuring to include any contributions or grants received.

- Detail allowable deductions, which may include operational expenses and other relevant costs.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the applicable tax rate and calculate the total tax due.

- Review the completed form for accuracy before submission.

Legal Use of the Massachusetts Form 3M

The Massachusetts Form 3M is legally binding when filled out correctly and submitted to the Department of Revenue. To ensure that the form is recognized as valid, it must adhere to specific legal requirements. This includes accurate reporting of income and expenses, proper signatures from authorized individuals within the organization, and compliance with all applicable state tax laws. Using a reliable electronic signature tool can enhance the legal standing of the submission by providing an audit trail and ensuring compliance with eSignature regulations.

Filing Deadlines for the Massachusetts Form 3M

Filing deadlines for the Massachusetts Form 3M are critical for compliance and avoiding penalties. Generally, the form is due on the fifteenth day of the fifth month following the close of the organization's fiscal year. For organizations operating on a calendar year, this means the form is typically due by May fifteenth. It is important for organizations to mark their calendars and prepare their financial documentation in advance to meet this deadline.

Required Documents for the Massachusetts Form 3M

To complete the Massachusetts Form 3M, organizations need to gather specific documents that support the information reported on the form. Essential documents include:

- Income statements detailing all sources of revenue.

- Expense reports outlining all operational costs incurred during the fiscal year.

- Previous tax returns, if applicable, to provide context and assist with accurate reporting.

- Any relevant correspondence from the Massachusetts Department of Revenue.

Key Elements of the Massachusetts Form 3M

The Massachusetts Form 3M consists of several key elements that organizations must understand to ensure proper completion. These include:

- Identification section for the organization.

- Income section where total revenue is reported.

- Deductions section for allowable expenses.

- Tax calculation section to determine the amount owed.

- Signature section for authorized representatives.

Quick guide on how to complete form 3m income tax return for clubs and other massgov

Complete Form 3M Income Tax Return For Clubs And Other Mass gov effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environment-friendly alternative to conventional printed and signed paperwork, allowing you to find the right template and securely archive it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and electronically sign your documents promptly without delays. Administer Form 3M Income Tax Return For Clubs And Other Mass gov across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form 3M Income Tax Return For Clubs And Other Mass gov effortlessly

- Find Form 3M Income Tax Return For Clubs And Other Mass gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure confidential information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management requirements with just a few clicks from your chosen device. Alter and eSign Form 3M Income Tax Return For Clubs And Other Mass gov and maintain exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3m income tax return for clubs and other massgov

Create this form in 5 minutes!

How to create an eSignature for the form 3m income tax return for clubs and other massgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts Form 3M?

The Massachusetts Form 3M is a document used for filing estate taxes in Massachusetts. It is essential for individuals managing estates exceeding the exemption threshold. Utilizing airSlate SignNow ensures you can complete and eSign the Massachusetts Form 3M quickly and accurately.

-

How does airSlate SignNow simplify the process of completing the Massachusetts Form 3M?

airSlate SignNow offers a user-friendly interface that streamlines the process of filling out the Massachusetts Form 3M. With easy document uploads and electronic signatures, you can complete your filing without any hassle. This allows users to focus on important details rather than cumbersome paperwork.

-

What are the pricing options for airSlate SignNow when using the Massachusetts Form 3M?

airSlate SignNow provides flexible pricing plans designed to cater to different business needs. Whether you're a solo practitioner or part of a larger firm, you can find a plan that fits your budget while efficiently managing documents like the Massachusetts Form 3M.

-

Can I integrate airSlate SignNow with other applications for managing the Massachusetts Form 3M?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when handling documents like the Massachusetts Form 3M. You can connect it with CRMs, cloud storage, and other productivity tools to create a more streamlined document management process.

-

What are the benefits of using airSlate SignNow for the Massachusetts Form 3M?

Using airSlate SignNow for the Massachusetts Form 3M provides several benefits, including reduced turnaround times, enhanced accuracy, and improved collaboration. The electronic signature feature ensures that your filings are timely and compliant, allowing you to manage estate-related tasks efficiently.

-

Is training available for using airSlate SignNow to complete the Massachusetts Form 3M?

Absolutely! airSlate SignNow offers comprehensive training resources, including tutorials and customer support, to guide you through the process of completing the Massachusetts Form 3M. No matter your level of experience, you can get the help you need to use the platform effectively.

-

How secure is the information when using airSlate SignNow for the Massachusetts Form 3M?

Security is a top priority for airSlate SignNow. When you complete the Massachusetts Form 3M through the platform, your information is protected with advanced encryption and secure data storage. You can trust that your sensitive documents and personal details are kept confidential.

Get more for Form 3M Income Tax Return For Clubs And Other Mass gov

Find out other Form 3M Income Tax Return For Clubs And Other Mass gov

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast