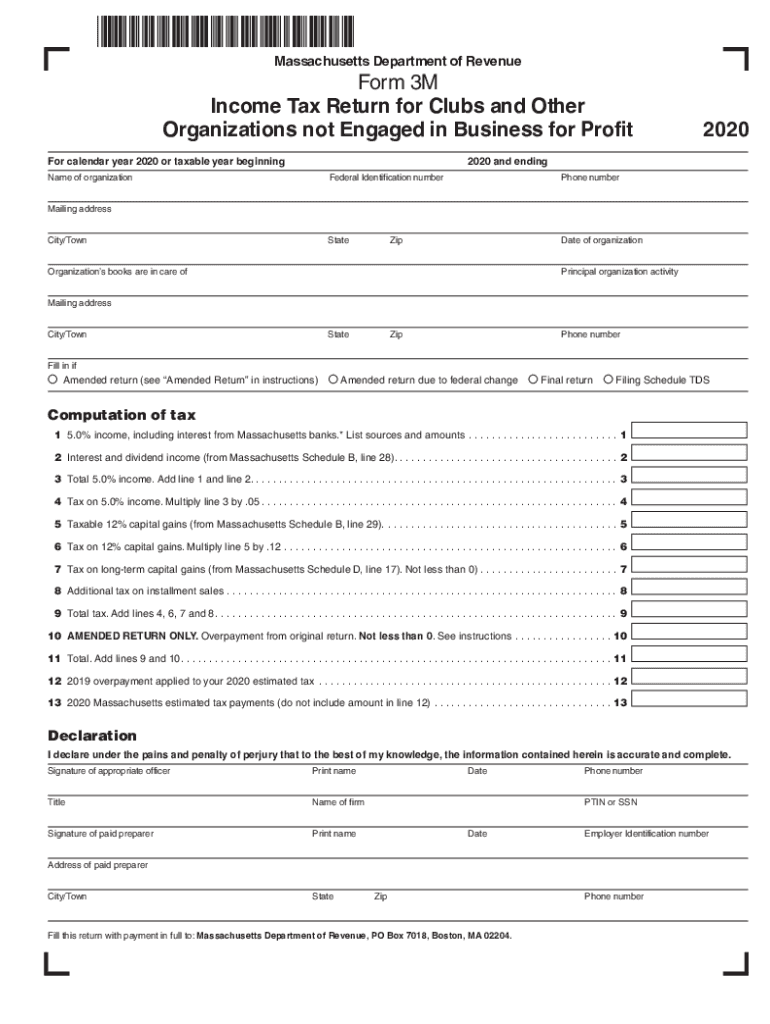

for Calendar Year or Taxable Year Beginning 2020

Understanding the Massachusetts Form 3M

The Massachusetts Form 3M is a tax form used primarily for reporting income and calculating tax liabilities for certain business entities. This form is essential for corporations, partnerships, and limited liability companies (LLCs) operating in Massachusetts. It allows these entities to report their income accurately and comply with state tax regulations. Understanding the purpose and requirements of the form is crucial for ensuring compliance and avoiding potential penalties.

Steps to Complete the Massachusetts Form 3M

Completing the Massachusetts Form 3M involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and any relevant tax documents.

- Fill out the form with accurate figures, ensuring that all income and deductions are reported correctly.

- Review the form for any errors or omissions before submission.

- Sign the form electronically or manually, depending on your submission method.

- Submit the completed form by the designated filing deadline to avoid penalties.

Filing Deadlines for the Massachusetts Form 3M

Timely filing of the Massachusetts Form 3M is critical to avoid penalties. The standard deadline for filing is typically the fifteenth day of the fourth month following the close of the tax year. For entities with a fiscal year ending on December 31, the deadline would be April 15 of the following year. It's important to check for any specific extensions or changes in deadlines that may apply.

Required Documents for Filing the Massachusetts Form 3M

When preparing to file the Massachusetts Form 3M, certain documents are required:

- Financial statements, including income and expense reports.

- Supporting documentation for deductions and credits claimed.

- Previous tax returns, if applicable, to ensure consistency in reporting.

- Any additional schedules or forms that may be required based on the entity's structure.

Legal Use of the Massachusetts Form 3M

The Massachusetts Form 3M is legally binding when completed and submitted according to state regulations. It must be signed by an authorized representative of the entity, and the information provided must be truthful and accurate. Failure to comply with the legal requirements can result in penalties or audits by the Massachusetts Department of Revenue.

Form Submission Methods for the Massachusetts Form 3M

The Massachusetts Form 3M can be submitted through various methods:

- Electronically via the Massachusetts Department of Revenue's online portal.

- By mail, sending the completed form to the appropriate address as specified in the form instructions.

- In-person submission at designated tax offices, if necessary.

Quick guide on how to complete for calendar year 2020 or taxable year beginning

Effortlessly Prepare For Calendar Year Or Taxable Year Beginning on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, enabling you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without complications. Manage For Calendar Year Or Taxable Year Beginning on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

Easily Edit and eSign For Calendar Year Or Taxable Year Beginning

- Obtain For Calendar Year Or Taxable Year Beginning and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow streamlines your document management needs in just a few clicks from your preferred device. Edit and eSign For Calendar Year Or Taxable Year Beginning and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year 2020 or taxable year beginning

Create this form in 5 minutes!

How to create an eSignature for the for calendar year 2020 or taxable year beginning

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is Massachusetts Form 3M?

Massachusetts Form 3M is a specific tax form used for corporate excise tax filings in Massachusetts. It is essential for businesses to complete this form accurately to ensure compliance with state tax regulations and avoid penalties.

-

How can airSlate SignNow help with Massachusetts Form 3M?

With airSlate SignNow, you can easily create, edit, and eSign Massachusetts Form 3M documents. Our platform offers intuitive tools that streamline the process, saving you time and ensuring accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for Massachusetts Form 3M?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of different businesses. Whether you’re a small startup or a large corporation, you can find a plan that includes features for handling Massachusetts Form 3M efficiently.

-

What features does airSlate SignNow offer for handling documents like Massachusetts Form 3M?

airSlate SignNow includes features such as customizable templates, electronic signatures, and secure cloud storage that are perfect for managing Massachusetts Form 3M. These tools enhance workflow efficiency and document security.

-

Can I integrate airSlate SignNow with my existing software when handling Massachusetts Form 3M?

Yes, airSlate SignNow offers extensive integrations with popular software such as CRM systems and document management tools. This makes it easier to streamline your processes while managing Massachusetts Form 3M and other important documents.

-

What are the benefits of using airSlate SignNow for Massachusetts Form 3M?

Using airSlate SignNow for Massachusetts Form 3M helps businesses simplify document processes, reduce turnaround times, and enhance accuracy. The platform's user-friendly interface ensures that your team can efficiently handle the form, allowing you to focus on your core operations.

-

Is airSlate SignNow secure for managing sensitive documents like Massachusetts Form 3M?

Absolutely! airSlate SignNow utilizes secure encryption protocols to protect sensitive information, including Massachusetts Form 3M documents. Our commitment to data security ensures that your documents are safe from unauthorized access.

Get more for For Calendar Year Or Taxable Year Beginning

Find out other For Calendar Year Or Taxable Year Beginning

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form