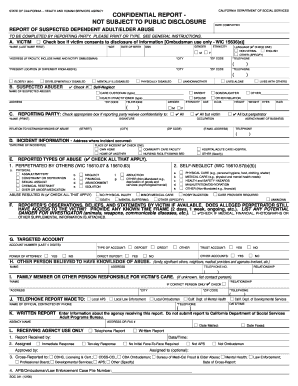

Soc 341 Form

What is the Soc 341

The Soc 341 is a specific form used primarily in the context of tax reporting and compliance. It is essential for individuals and businesses to understand its purpose and requirements. This form is often utilized to report certain information to the IRS, ensuring that taxpayers meet their obligations. The Soc 341 serves as a crucial document for maintaining transparency in financial reporting and compliance with U.S. tax laws.

How to use the Soc 341

Using the Soc 341 involves several steps that ensure accurate completion and submission. First, gather all necessary information, including personal identification details and financial data relevant to the form. Next, fill out the form carefully, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the Soc 341 through the appropriate channels, whether electronically or by mail, as per IRS guidelines.

Steps to complete the Soc 341

Completing the Soc 341 requires attention to detail. Follow these steps for successful completion:

- Gather personal and financial information needed for the form.

- Access the Soc 341 form, either as a printable document or an electronic version.

- Fill in the required fields, ensuring accuracy in all entries.

- Double-check the form for any mistakes or omissions.

- Submit the completed form as instructed, either online or via mail.

Legal use of the Soc 341

The legal use of the Soc 341 is governed by specific regulations and guidelines set forth by the IRS. To ensure that the form is legally binding, it must be completed accurately and submitted within the required timeframes. Compliance with these regulations is crucial for avoiding penalties and ensuring that the information reported is valid. Utilizing reliable electronic tools for submission can enhance the legal standing of the form.

Key elements of the Soc 341

Understanding the key elements of the Soc 341 is vital for effective use. Important components include:

- Identification information: Personal details of the taxpayer.

- Financial data: Relevant income and deduction information.

- Signature: Required for validation of the form.

- Submission details: Instructions for how and where to submit the form.

Filing Deadlines / Important Dates

Filing deadlines for the Soc 341 are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by specific dates, which can vary based on the taxpayer's situation. It is important to stay informed about these deadlines to avoid late filing penalties. Mark your calendar with the relevant dates to ensure timely submission.

Quick guide on how to complete soc 341

Complete Soc 341 seamlessly on any device

Online document management has gained traction with businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed papers, allowing you to locate the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Soc 341 on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Soc 341 effortlessly

- Locate Soc 341 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Soc 341 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the soc 341

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to soc341?

airSlate SignNow is a robust eSignature solution designed to streamline the process of sending and signing documents electronically. It offers features that cater specifically to the needs of businesses dealing with soc341, making it easier to comply with this regulatory requirement while ensuring document security.

-

How does pricing work for airSlate SignNow with a focus on soc341?

airSlate SignNow offers flexible pricing plans that cater to different business sizes needing to meet soc341 compliance. Each plan includes essential features like document tracking and templates, ensuring you get the best value while maintaining compliance with soc341 standards.

-

What features does airSlate SignNow include that are important for soc341 compliance?

airSlate SignNow includes features such as advanced security measures, audit trails, and customizable workflows that enhance document management for soc341 compliance. These features provide assurance that your documents are securely managed and compliant with relevant regulations.

-

Can airSlate SignNow help my business improve efficiency for soc341 processes?

Absolutely! airSlate SignNow streamlines document workflows for soc341 requirements, reducing turnaround time for obtaining eSignatures. This boost in efficiency helps your team focus on critical tasks rather than being bogged down by paper processes.

-

What integrations does airSlate SignNow offer that support soc341 operations?

airSlate SignNow seamlessly integrates with a variety of applications, enhancing your workflow for soc341 needs. Popular platforms like Salesforce, Google Drive, and Microsoft Office work perfectly with airSlate SignNow to ensure that your document processes remain efficient and compliant.

-

How does airSlate SignNow ensure the security needed for soc341 documentation?

Security is a priority for airSlate SignNow, especially for documents related to soc341. The platform utilizes AES-256 encryption, multi-factor authentication, and secure cloud storage to protect sensitive information and ensure compliance with industry standards.

-

What benefits does airSlate SignNow provide for businesses dealing with soc341 documents?

Using airSlate SignNow for soc341 documents provides numerous benefits, including reduced operational costs, enhanced compliance capabilities, and improved document turnaround times. This efficient solution allows businesses to manage their eSigning process with ease and confidence.

Get more for Soc 341

Find out other Soc 341

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online