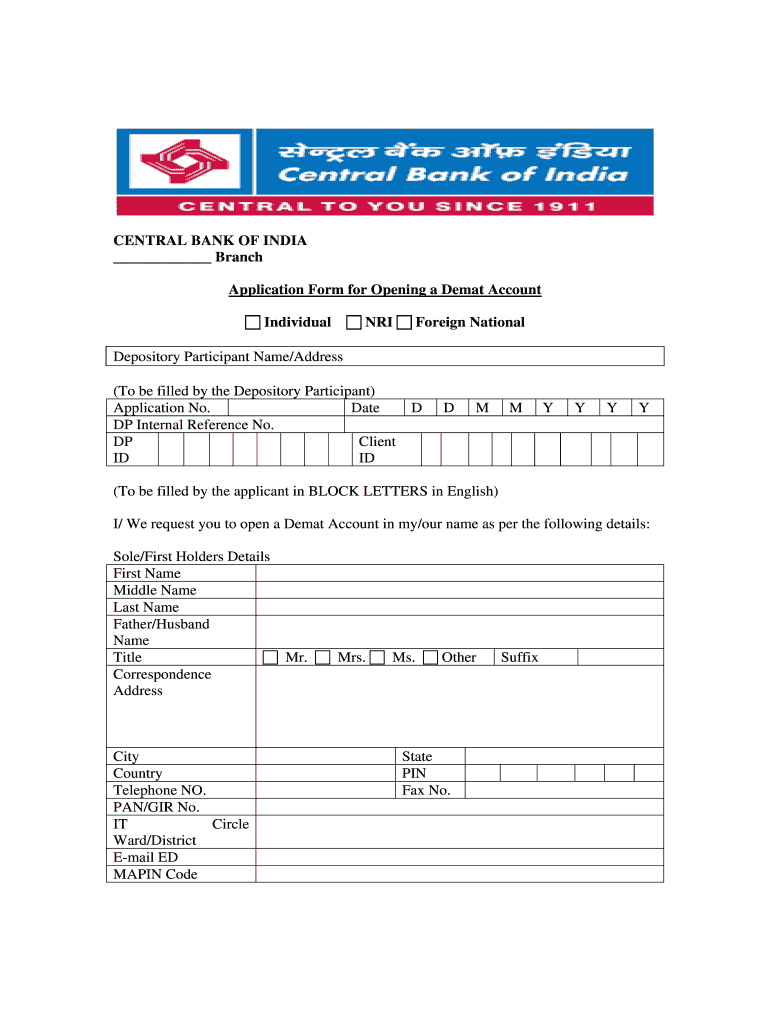

Central Bank of India Cif Form

What is the Central Bank of India CIF Form

The Central Bank of India CIF form, or Customer Information Form, is a crucial document used by individuals to establish their identity and provide necessary information to the bank. This form is specifically designed for new personal individual customers. It collects essential details such as name, address, date of birth, and identification numbers, which help the bank create a comprehensive customer profile. This profile is vital for compliance with regulatory requirements and for ensuring secure banking transactions.

How to Use the Central Bank of India CIF Form

Using the Central Bank of India CIF form involves several straightforward steps. First, obtain the form from the bank's official website or a local branch. Next, carefully fill out the required fields with accurate information. It is important to ensure that all details are correct to avoid any delays in processing. After completing the form, it can be submitted either online or in person at a branch, depending on the bank's submission policies. Always keep a copy of the completed form for your records.

Steps to Complete the Central Bank of India CIF Form

Completing the CIF form requires attention to detail. Here are the steps to follow:

- Obtain the form from the Central Bank of India’s website or a local branch.

- Fill in personal details accurately, including your full name, address, and contact information.

- Provide identification details, such as your Social Security number or any other relevant ID.

- Review the information for accuracy to prevent any errors.

- Sign the form to validate the information provided.

- Submit the form as per the bank’s guidelines, either online or at a branch.

Legal Use of the Central Bank of India CIF Form

The Central Bank of India CIF form is legally binding once it is completed and submitted. It serves as a formal declaration of your identity and banking intentions. Compliance with local and federal regulations is essential when using this form, as it helps prevent fraud and ensures that the bank adheres to Know Your Customer (KYC) guidelines. Electronic submissions must meet specific legal standards to be considered valid, which includes proper eSignature protocols.

Key Elements of the Central Bank of India CIF Form

Several key elements are essential in the Central Bank of India CIF form. These include:

- Personal Information: Full name, address, and contact details.

- Identification: Government-issued ID numbers, such as a driver's license or Social Security number.

- Account Preferences: Types of accounts you wish to open and any additional services required.

- Signature: A signature is required to authenticate the information provided.

Form Submission Methods

Submitting the Central Bank of India CIF form can be done through various methods. Customers can choose to submit the form online via the bank's digital platform or physically at a branch. Each method has its own advantages. Online submission offers convenience and quicker processing times, while in-person submission allows for immediate assistance from bank staff. It is advisable to check the specific requirements for each submission method to ensure compliance with bank policies.

Quick guide on how to complete central bank of india cif form

Complete Central Bank Of India Cif Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Central Bank Of India Cif Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Central Bank Of India Cif Form with ease

- Locate Central Bank Of India Cif Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from your chosen device. Modify and eSign Central Bank Of India Cif Form and ensure clear communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the central bank of india cif form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indian Bank CIF form, and why is it important?

The Indian Bank CIF form is a unique identifier for your bank account that links all your accounts to a single Customer Information File. It is crucial for easy access to banking services and for the maintenance of your account details. By using the Indian Bank CIF form, you can streamline your banking transactions and ensure a cohesive experience across various services.

-

How can I obtain the Indian Bank CIF form?

You can obtain the Indian Bank CIF form by visiting your nearest Indian Bank branch or by downloading it from the official website. It's important to fill out the form accurately with all required details to avoid any delays. Once completed, submit it to your branch for processing.

-

What are the benefits of using the Indian Bank CIF form?

Using the Indian Bank CIF form allows for a seamless banking experience by consolidating all your account information under one identifier. This results in easier tracking of transactions and account activity. Additionally, it simplifies the process of updating your personal details with the bank.

-

Is there any cost associated with the Indian Bank CIF form?

No, there is typically no cost associated with obtaining or submitting the Indian Bank CIF form. It is provided as a part of banking services to help customers manage their accounts more effectively. However, it's always a good idea to check with your local branch for any specific fees related to account services.

-

Can the Indian Bank CIF form be filled out online?

Currently, the Indian Bank CIF form is primarily available in a physical format that must be filled out and submitted at your branch. However, some services may allow for online pre-filling of information. Make sure to check the Indian Bank website for any updates regarding online submissions.

-

What information do I need to provide in the Indian Bank CIF form?

When filling out the Indian Bank CIF form, you will need to provide personal information such as your name, address, date of birth, and occupation. You may also need to include details of your existing accounts with the bank. Accurate and complete information ensures efficient processing of your form.

-

How does the Indian Bank CIF form improve customer service?

The Indian Bank CIF form enhances customer service by enabling the bank to maintain a comprehensive and organized record of all customer accounts. This ensures accurate and prompt service, as all relevant customer information is readily available to bank staff. Customers benefit from faster service and fewer errors in their banking transactions.

Get more for Central Bank Of India Cif Form

Find out other Central Bank Of India Cif Form

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document