Ct Au 677 Form

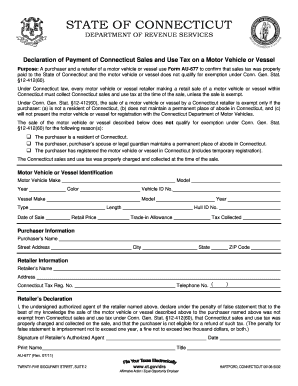

What is the Ct Au 677 Form

The Ct Au 677 form is an official document used in the state of Connecticut, primarily for tax-related purposes. This form is essential for individuals and businesses to report specific financial information to the state tax authorities. Understanding its purpose is crucial for ensuring compliance with state tax regulations.

How to use the Ct Au 677 Form

Using the Ct Au 677 form involves several steps to ensure accurate completion. First, gather all necessary financial documents that pertain to the reporting period. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. This attention to detail helps avoid potential issues with the tax authorities.

Steps to complete the Ct Au 677 Form

To complete the Ct Au 677 form effectively, follow these steps:

- Gather all relevant financial documents, including income statements and expense records.

- Fill in the required fields on the form, ensuring all information is accurate.

- Double-check for any missing information or errors.

- Sign and date the form where indicated.

- Submit the form according to the specified submission methods.

Legal use of the Ct Au 677 Form

The legal use of the Ct Au 677 form is governed by state tax laws. When completed and submitted correctly, this form serves as a legally binding document that reports financial information to the state. Compliance with all relevant regulations is essential to avoid penalties or issues with tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The Ct Au 677 form can be submitted through various methods, providing flexibility for users. Options include:

- Online submission through the official state tax website.

- Mailing the completed form to the designated tax office address.

- In-person submission at local tax offices, if applicable.

Who Issues the Form

The Ct Au 677 form is issued by the Connecticut Department of Revenue Services. This agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Users can find the form and additional information on the department's official website.

Quick guide on how to complete ct au 677 form

Effortlessly Prepare Ct Au 677 Form on Any Gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, amend, and eSign your documents swiftly and without complications. Manage Ct Au 677 Form on any gadget using airSlate SignNow's Android or iOS applications and simplify your document-based tasks today.

The easiest way to modify and eSign Ct Au 677 Form seamlessly

- Find Ct Au 677 Form and click on Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, annoying form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management within a few clicks from your preferred device. Modify and eSign Ct Au 677 Form and ensure exceptional communication throughout your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct au 677 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct dor au677?

The term ct dor au677 refers to a specific feature within airSlate SignNow that enhances document signing processes. This feature enables seamless eSigning and document management, streamlining workflows for businesses. Understanding ct dor au677 can help users leverage its capabilities for better efficiency.

-

How much does airSlate SignNow with ct dor au677 cost?

airSlate SignNow offers flexible pricing plans that accommodate different business needs. While the cost related to ct dor au677 may vary based on selected features, it generally provides a cost-effective solution for eSigning. For detailed pricing, you can visit our pricing page.

-

What features does ct dor au677 offer?

ct dor au677 includes features such as user-friendly document editing, advanced eSignature capabilities, and integration with various applications. These features allow businesses to create a smooth signing experience while managing documents efficiently. Utilizing ct dor au677 can signNowly enhance your workflow.

-

How can ct dor au677 benefit my business?

By implementing ct dor au677, your business can decrease turnaround time for document signing and increase overall productivity. It simplifies the signing process, allowing teams to collaborate easily and reduce paper-based transactions. The efficiency gained through ct dor au677 can lead to more successful business outcomes.

-

Is there a free trial available for ct dor au677?

Yes, airSlate SignNow offers a free trial that includes access to features like ct dor au677. This allows prospective customers to explore the tool and experience its benefits without any financial commitment. Signing up for the free trial is a great way to determine if ct dor au677 fits your business needs.

-

Can I integrate ct dor au677 with other tools?

Absolutely! airSlate SignNow with ct dor au677 supports integration with a variety of other software tools and platforms. This compatibility ensures you can streamline your workflows further, connecting the signing process with your existing business applications for enhanced productivity.

-

How secure is the ct dor au677 signing process?

The signing process with ct dor au677 is designed with top-tier security protocols to protect your documents and data. airSlate SignNow employs encryption and secure authentication methods, ensuring that all signed documents are safe and compliant with industry regulations. Trust us to safeguard your important information.

Get more for Ct Au 677 Form

- Identity theft by known imposter package nebraska form

- Nebraska assets form

- Essential documents for the organized traveler package nebraska form

- Essential documents for the organized traveler package with personal organizer nebraska form

- Postnuptial agreements package nebraska form

- Letters of recommendation package nebraska form

- Ne lien 497318399 form

- Nebraska mechanics form

Find out other Ct Au 677 Form

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form