Credit Application Wajax Form

What is the Credit Application Wajax

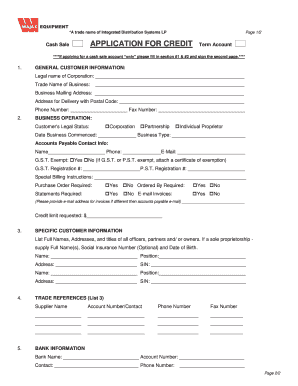

The Credit Application Wajax is a formal document used by individuals or businesses to request credit from Wajax, a leading provider of industrial equipment and services. This application allows potential customers to provide necessary financial information, enabling Wajax to assess creditworthiness and determine the terms of credit extended. The form typically includes sections for personal or business details, financial history, and references, ensuring a comprehensive overview of the applicant's financial situation.

How to use the Credit Application Wajax

Using the Credit Application Wajax involves several straightforward steps. First, access the form either online or in a physical format. Next, carefully fill out all required fields, ensuring that the information is accurate and complete. This may include your name, address, social security number, and financial information. After completing the form, review it for any errors before submitting it to Wajax for processing. If submitting electronically, follow the instructions for digital submission to ensure your application is received securely.

Steps to complete the Credit Application Wajax

Completing the Credit Application Wajax can be broken down into several key steps:

- Gather necessary documents, including identification and financial records.

- Fill out the application form with accurate personal and financial information.

- Review the application for completeness and correctness.

- Submit the application through the designated method, whether online or via mail.

- Await confirmation from Wajax regarding the status of your application.

Legal use of the Credit Application Wajax

The Credit Application Wajax is legally binding when completed correctly and submitted according to established guidelines. It is essential to provide truthful information, as any discrepancies can lead to denial of credit or legal repercussions. The application must comply with relevant laws, including consumer protection regulations that govern credit applications in the United States. By using a secure platform for submission, applicants can ensure their information is protected while maintaining compliance with legal standards.

Key elements of the Credit Application Wajax

Several key elements are critical to the Credit Application Wajax. These include:

- Personal Information: Name, address, and contact details.

- Financial Information: Income, assets, and liabilities.

- Business Information: For business applicants, details about the business structure and ownership.

- References: Contacts who can vouch for the applicant's creditworthiness.

Eligibility Criteria

Eligibility for the Credit Application Wajax typically includes factors such as age, residency, and financial stability. Applicants must be at least eighteen years old and legally able to enter into contracts. Additionally, Wajax may require a minimum credit score or specific income levels to qualify for credit. Understanding these criteria can help applicants prepare their information accordingly and increase their chances of approval.

Quick guide on how to complete credit application wajax

Effortlessly prepare Credit Application Wajax on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, enabling you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Credit Application Wajax on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to modify and eSign Credit Application Wajax with ease

- Locate Credit Application Wajax and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you prefer. Modify and eSign Credit Application Wajax to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit application wajax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Credit Application Wajax process?

The Credit Application Wajax process involves submitting a complete credit application to Wajax through a secure online platform. This digital solution streamlines the application procedure, allowing customers to fill out forms efficiently and track their application status. With airSlate SignNow, businesses can ensure the application is eSigned and securely stored for future reference.

-

How does airSlate SignNow enhance the Credit Application Wajax experience?

airSlate SignNow enhances the Credit Application Wajax experience by providing a seamless eSignature solution. Users can quickly sign documents online, reducing the turnaround time for approvals. This feature not only saves time but also improves customer satisfaction by simplifying the application process.

-

What are the pricing plans for using Credit Application Wajax with airSlate SignNow?

The pricing plans for using Credit Application Wajax with airSlate SignNow are designed to be flexible and cost-effective. Users can choose from various subscription options based on their business needs, ensuring they only pay for the features they require. This allows companies to utilize the Credit Application Wajax service without overspending.

-

What features does airSlate SignNow provide for the Credit Application Wajax?

airSlate SignNow offers multiple features for the Credit Application Wajax, including customizable templates and automated reminders. The platform also includes real-time tracking of document status, ensuring that both parties are updated on progress. These features signNowly enhance the efficiency of credit applications.

-

Can I integrate other tools with airSlate SignNow for Credit Application Wajax?

Yes, airSlate SignNow allows for seamless integration with various third-party applications to optimize the Credit Application Wajax process. Users can connect with tools like CRM systems, payment processors, and more. This integration ensures that all relevant data is synchronized, improving overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for Credit Application Wajax?

Using airSlate SignNow for Credit Application Wajax offers numerous benefits, including enhanced efficiency, improved accuracy, and secure record-keeping. The electronic signing process minimizes human error and speeds up the approval process. Additionally, businesses can access their documents anytime, anywhere, ensuring convenience.

-

Is it safe to submit my Credit Application Wajax through airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, implementing robust encryption and compliance measures to protect the Credit Application Wajax submissions. All documents are stored securely, and users can authenticate their identity through various security protocols. This makes the platform a safe choice for submitting sensitive information.

Get more for Credit Application Wajax

- Licensed motor car trader form 2 dealings book pdf 17 kb consumer vic gov

- Optumrx mail order form rnbenefits

- Edf form mauritius

- Used vehicle consignment agreement affordable auto form

- Visio family tree template download form

- Drivers statement of on duty hours pdf form

- Stop work notice form

- Therapist form

Find out other Credit Application Wajax

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe