Maryland First Time Home Buyer Addendum Form

What is the Maryland First Time Home Buyer Addendum

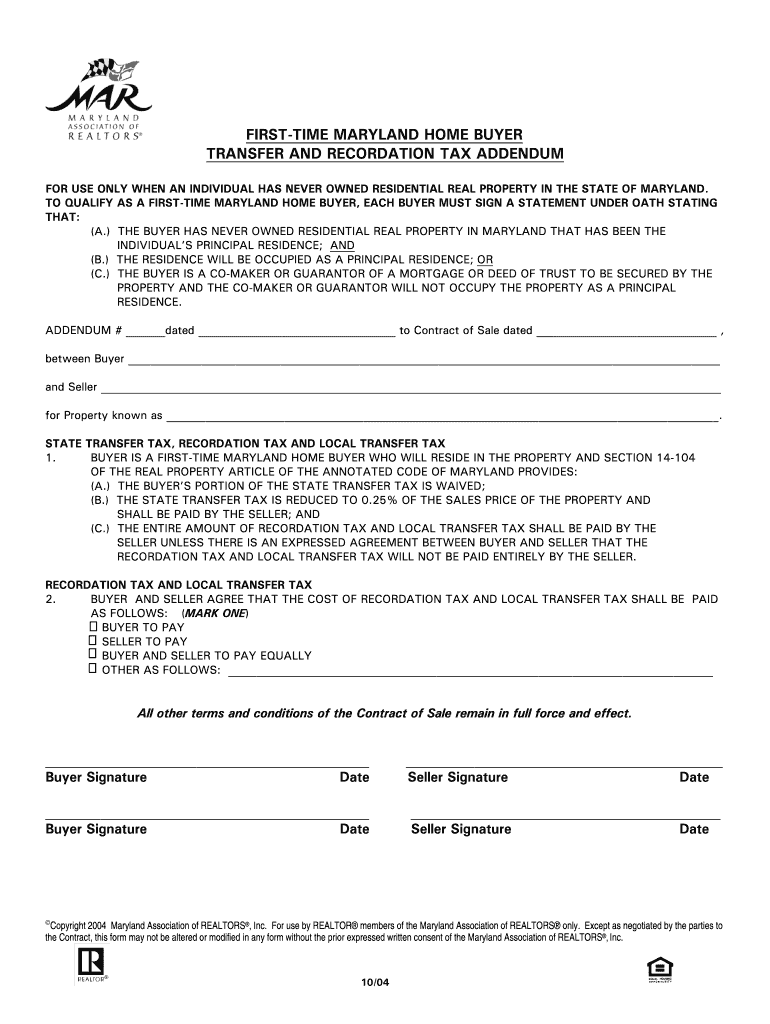

The Maryland First Time Home Buyer Addendum is a legal document designed to facilitate the transfer and recordation tax process for individuals purchasing their first home in Maryland. This addendum outlines the specific tax credits available to eligible first-time homebuyers, helping to reduce the financial burden associated with home purchases. By utilizing this addendum, buyers can ensure compliance with state regulations while benefiting from available tax incentives.

How to use the Maryland First Time Home Buyer Addendum

To effectively use the Maryland First Time Home Buyer Addendum, buyers must first determine their eligibility for the transfer tax credit. Once eligibility is established, the addendum should be completed accurately, detailing the necessary information about the buyer and the property. It is essential to submit this addendum alongside other required documents during the closing process to ensure that the tax benefits are applied correctly. Utilizing digital tools for this process can streamline the completion and submission of the addendum.

Steps to complete the Maryland First Time Home Buyer Addendum

Completing the Maryland First Time Home Buyer Addendum involves several key steps:

- Gather necessary information, including buyer details and property specifics.

- Fill out the addendum accurately, ensuring all required fields are completed.

- Review the document for any errors or omissions.

- Obtain the required signatures from all parties involved.

- Submit the addendum along with other closing documents to the appropriate authorities.

Key elements of the Maryland First Time Home Buyer Addendum

Several key elements must be included in the Maryland First Time Home Buyer Addendum to ensure its validity:

- Buyer’s full name and contact information.

- Property address and details.

- Statement of eligibility for the transfer tax credit.

- Signatures of all parties involved in the transaction.

- Date of completion and submission.

Eligibility Criteria

To qualify for the Maryland First Time Home Buyer Addendum, buyers must meet specific eligibility criteria. Generally, this includes being a first-time homebuyer, which is defined as someone who has not owned a home in the past three years. Additionally, buyers must provide proof of residency and meet income limits set by the state. Understanding these criteria is crucial for successfully utilizing the addendum and accessing the associated tax benefits.

Legal use of the Maryland First Time Home Buyer Addendum

The Maryland First Time Home Buyer Addendum is legally binding when executed correctly. To ensure its legal standing, all required signatures must be obtained, and the document must be submitted in accordance with Maryland state laws. Utilizing a reputable digital signing platform can enhance the legal validity of the addendum by providing a secure method for obtaining signatures and maintaining compliance with electronic signature regulations.

Quick guide on how to complete maryland first time home buyer addendum

Effortlessly Prepare Maryland First Time Home Buyer Addendum on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your files without any delays. Manage Maryland First Time Home Buyer Addendum on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign Maryland First Time Home Buyer Addendum Seamlessly

- Find Maryland First Time Home Buyer Addendum and click Get Form to commence.

- Utilize the tools available to complete your document.

- Highlight essential sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Alter and eSign Maryland First Time Home Buyer Addendum while ensuring excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland first time home buyer addendum

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the first time Maryland homebuyer transfer and recordation tax addendum?

The first time Maryland homebuyer transfer and recordation tax addendum is a document that allows eligible first-time homebuyers in Maryland to benefit from reduced transfer and recordation taxes. This addendum is essential for ensuring that first-time buyers can save money during their home purchase process, making homeownership more affordable.

-

How do I qualify for the first time Maryland homebuyer transfer and recordation tax addendum?

To qualify for the first time Maryland homebuyer transfer and recordation tax addendum, you must be a first-time homebuyer and meet certain income and purchase price limits set by the Maryland state government. It's important to review these criteria prior to submitting your addendum to ensure compliance and maximize your savings.

-

How can airSlate SignNow help with the first time Maryland homebuyer transfer and recordation tax addendum?

airSlate SignNow streamlines the process of filling out and e-signing the first time Maryland homebuyer transfer and recordation tax addendum. Our easy-to-use platform allows you to quickly prepare, send, and store necessary documents securely, helping you focus on your home purchase.

-

What are the benefits of using airSlate SignNow for my homebuyer documents?

Using airSlate SignNow for your homebuyer documents, including the first time Maryland homebuyer transfer and recordation tax addendum, provides convenience, security, and compliance. You can complete documents electronically, which saves time and reduces the likelihood of errors that could delay your home purchase.

-

Is there a cost associated with the first time Maryland homebuyer transfer and recordation tax addendum?

While the first time Maryland homebuyer transfer and recordation tax addendum itself is a template provided by the state, there may be costs associated with the transfer and recordation taxes based on your property's value. Utilizing airSlate SignNow may have a nominal fee, but it can ultimately save you time and hassle in document management.

-

Can airSlate SignNow integrate with other real estate tools for first-time homebuyers?

Yes, airSlate SignNow offers integrations with various real estate tools and platforms, enhancing your experience while preparing documents like the first time Maryland homebuyer transfer and recordation tax addendum. These integrations allow for a seamless workflow, enabling you to manage all aspects of your home buying process effectively.

-

What features does airSlate SignNow offer for e-signing my homebuyer documents?

airSlate SignNow provides a robust set of features for e-signing homebuyer documents, including the first time Maryland homebuyer transfer and recordation tax addendum. Features such as templates, in-app notifications, mobile compatibility, and document tracking make it easy to handle all your signing needs securely and efficiently.

Get more for Maryland First Time Home Buyer Addendum

Find out other Maryland First Time Home Buyer Addendum

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter