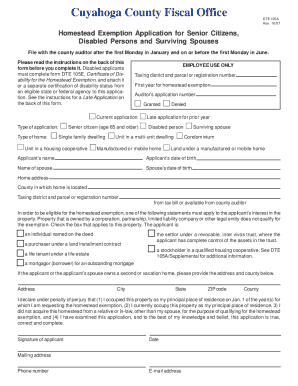

Cuyahoga Homestead Exemption Form

What is the Cuyahoga Homestead Exemption

The Cuyahoga Homestead Exemption is a property tax reduction program designed to assist homeowners in Cuyahoga County, Ohio. This exemption allows eligible homeowners to reduce the taxable value of their primary residence, thereby lowering their property tax bills. The program is particularly beneficial for seniors, disabled individuals, and low-income households, providing financial relief and promoting homeownership stability within the community.

Eligibility Criteria

To qualify for the Cuyahoga Homestead Exemption, applicants must meet specific eligibility requirements. Generally, applicants must be homeowners residing in Cuyahoga County and must occupy the property as their primary residence. Additional criteria may include:

- Age: Applicants must be at least sixty-five years old or permanently and totally disabled.

- Income Limit: Applicants must have an annual income below a certain threshold, which is subject to change.

- Ownership: The property must be owned solely by the applicant or jointly with a spouse.

Steps to complete the Cuyahoga Homestead Exemption

Completing the Cuyahoga Homestead Exemption involves several straightforward steps. Applicants should follow these guidelines to ensure their application is processed efficiently:

- Gather necessary documentation, including proof of age, disability, and income.

- Obtain the Cuyahoga County Homestead Exemption application form from the Cuyahoga County Auditor's office or their official website.

- Fill out the application form accurately, providing all required information.

- Submit the completed application along with any supporting documents to the appropriate office, either online, by mail, or in person.

Required Documents

When applying for the Cuyahoga Homestead Exemption, applicants must provide certain documents to verify their eligibility. Commonly required documents include:

- Proof of age (e.g., driver's license or birth certificate).

- Evidence of disability (if applicable, such as a Social Security award letter).

- Income verification, such as recent tax returns or pay stubs.

Form Submission Methods

Applicants can submit their Cuyahoga Homestead Exemption application through various methods, providing flexibility to accommodate different preferences:

- Online: Complete and submit the application via the Cuyahoga County Auditor's website.

- Mail: Send the completed application and documents to the Cuyahoga County Auditor's office address.

- In-Person: Visit the Cuyahoga County Auditor's office to submit the application directly.

Who Issues the Form

The Cuyahoga Homestead Exemption application form is issued by the Cuyahoga County Auditor's office. This office is responsible for managing property tax assessments and ensuring that all applications are processed according to state regulations. Homeowners can contact the Auditor's office for assistance or clarification regarding the application process.

Quick guide on how to complete cuyahoga homestead exemption

Effortlessly Prepare Cuyahoga Homestead Exemption on Any Device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Cuyahoga Homestead Exemption on any device with the airSlate SignNow applications available for Android and iOS, and streamline any document-oriented process today.

The Easiest Way to Edit and Electronically Sign Cuyahoga Homestead Exemption

- Locate Cuyahoga Homestead Exemption and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or a shared link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Cuyahoga Homestead Exemption to ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cuyahoga homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Cuyahoga County Auditor?

The Cuyahoga County Auditor oversees financial operations, property assessments, and taxation within the county. This role is essential for ensuring transparency and accuracy in financial reporting and property evaluations. Understanding the auditor's functions can help residents navigate property-related concerns more effectively.

-

How can airSlate SignNow assist with Cuyahoga County Auditor processes?

AirSlate SignNow streamlines the document signing and sending process, making it easier to handle the paperwork required by the Cuyahoga County Auditor. With our platform, users can eSign essential documents promptly and efficiently, saving time and reducing errors in submissions. This is especially beneficial for property owners and businesses interacting with the auditor's office.

-

What features does airSlate SignNow offer for businesses in Cuyahoga County?

AirSlate SignNow provides features such as customizable templates, automated workflows, and multi-party signing options tailored for businesses in Cuyahoga County. These features enhance efficiency when dealing with documents that may require approval from the Cuyahoga County Auditor. Additionally, our user-friendly interface makes navigation seamless for all users.

-

Is airSlate SignNow cost-effective for Cuyahoga County residents?

Yes, airSlate SignNow offers a variety of pricing plans designed to be cost-effective for Cuyahoga County residents and businesses. Our subscription models cater to different needs, ensuring that users only pay for the features they use. This affordability makes it an ideal choice for managing transactions with the Cuyahoga County Auditor.

-

What are the benefits of using airSlate SignNow for legal documents in Cuyahoga County?

Using airSlate SignNow for legal documents in Cuyahoga County provides signNow benefits, including compliance with state regulations and the ability to securely store documents. Our platform ensures that all signed documents are accessible and can be easily retrieved when needed, which is particularly advantageous for those needing to present documents to the Cuyahoga County Auditor.

-

Can airSlate SignNow integrate with other software used by Cuyahoga County businesses?

Yes, airSlate SignNow can seamlessly integrate with various software solutions that Cuyahoga County businesses may already be using. This compatibility allows for efficient handling of documents related to the Cuyahoga County Auditor and other agencies. Integrations help streamline workflows, making it easier to manage tasks and improve productivity.

-

How secure is airSlate SignNow for documents related to the Cuyahoga County Auditor?

AirSlate SignNow prioritizes the security of documents by employing advanced encryption methods and data protection measures. Users can rest assured that their documents, especially those involving the Cuyahoga County Auditor, are secure and protected from unauthorized access. Our commitment to security means that sensitive information remains confidential.

Get more for Cuyahoga Homestead Exemption

Find out other Cuyahoga Homestead Exemption

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement