Form 40A TY 2022

What is the Form 40A TY?

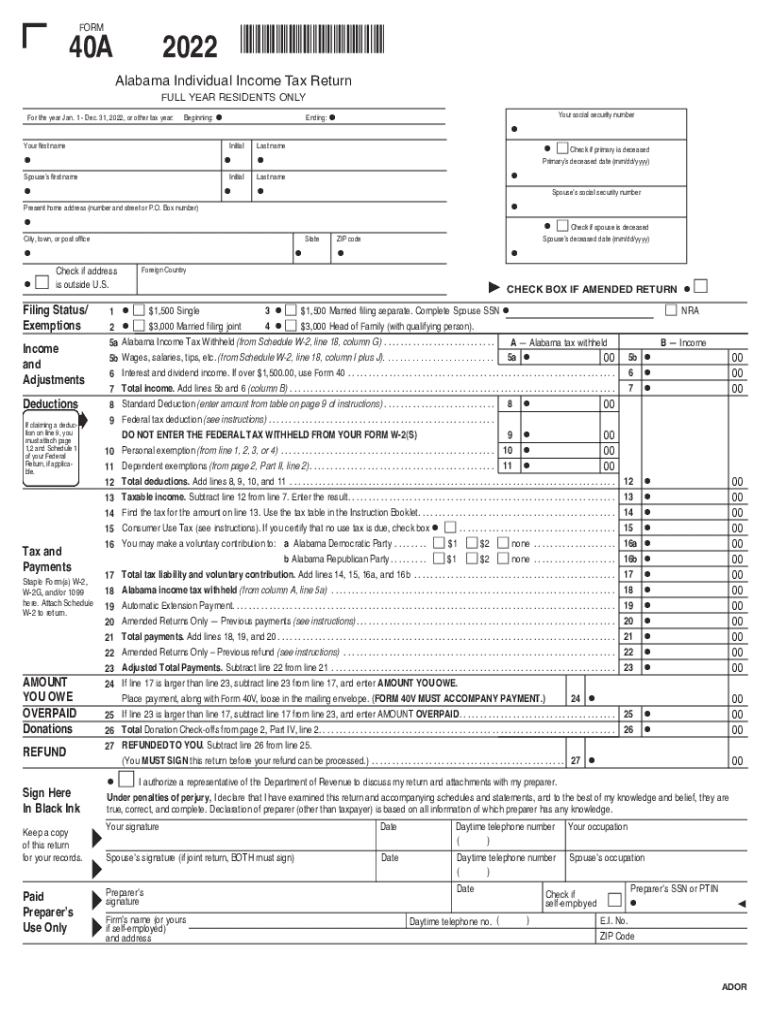

The Form 40A TY is a tax form used by residents of Alabama to report their income and calculate their state income tax obligations. This form is specifically designed for individuals who meet certain eligibility criteria, including those who may qualify for specific deductions and credits. Understanding the purpose of the Form 40A TY is essential for ensuring compliance with Alabama tax laws.

How to use the Form 40A TY

To effectively use the Form 40A TY, taxpayers need to gather all necessary financial information, including income statements, deductions, and any applicable credits. The form guides users through various sections, allowing them to report their income accurately and claim eligible deductions. It is crucial to follow the instructions carefully to ensure the form is completed correctly and submitted on time.

Steps to complete the Form 40A TY

Completing the Form 40A TY involves several important steps:

- Gather all relevant documents, such as W-2s, 1099s, and receipts for deductions.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Calculate deductions and credits based on eligibility.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Form 40A TY to avoid penalties. Typically, the deadline for filing state income tax returns in Alabama is April fifteenth of each year. Taxpayers should also note any extensions or changes to deadlines that may occur, especially in response to unforeseen circumstances.

Required Documents

When preparing to file the Form 40A TY, taxpayers must collect specific documents to support their income and deductions. Required documents include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical or educational costs.

- Any documentation related to tax credits claimed.

Penalties for Non-Compliance

Failing to file the Form 40A TY accurately or on time can result in penalties from the state of Alabama. Common penalties include late filing fees, interest on unpaid taxes, and potential legal action for severe non-compliance. It is crucial for taxpayers to adhere to all filing requirements to avoid these consequences.

Digital vs. Paper Version

The Form 40A TY can be completed in both digital and paper formats. Digital submissions may offer advantages such as faster processing times and reduced risk of errors. However, some taxpayers may prefer the traditional paper method for its familiarity. Regardless of the chosen method, ensuring that the form is filled out completely and accurately is vital for compliance.

Quick guide on how to complete form 40a ty 2022

Prepare Form 40A TY seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the right form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, adjust, and eSign your documents swiftly and without interruptions. Manage Form 40A TY across any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to alter and eSign Form 40A TY with ease

- Find Form 40A TY and click on Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Form 40A TY to guarantee effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 40a ty 2022

Create this form in 5 minutes!

How to create an eSignature for the form 40a ty 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing structure related to Alabama state income tax documents?

airSlate SignNow offers a competitive pricing structure that allows businesses to efficiently manage their documents, including those associated with Alabama state income tax. Plans are available to fit various budgets, ensuring effective document handling, eSigning, and compliance with Alabama tax regulations at a cost-effective rate.

-

How does airSlate SignNow simplify the process of managing Alabama state income tax forms?

With airSlate SignNow, managing Alabama state income tax forms becomes a breeze. The platform allows users to upload, eSign, and send forms electronically, reducing paperwork and streamlining the filing process by ensuring all necessary documents are easily accessible and securely stored.

-

Can I integrate airSlate SignNow with accounting software for Alabama state income tax filings?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, enhancing your capability to manage Alabama state income tax filings. This integration allows you to automate document preparation and ensure accurate tax submissions, reducing manual entry errors and improving overall efficiency.

-

What benefits does airSlate SignNow offer for small businesses dealing with Alabama state income tax?

Small businesses benefit from airSlate SignNow by gaining access to a user-friendly platform that simplifies eSigning and document management related to Alabama state income tax. This cost-effective solution allows for quicker turnaround times on tax documents, improving compliance and reducing stress during tax season.

-

Is airSlate SignNow secure for handling sensitive Alabama state income tax information?

Absolutely, airSlate SignNow employs top-notch security measures to protect sensitive information, including Alabama state income tax data. With features like encryption and secure access controls, users can confidently manage their tax documents without compromising on security.

-

How can I track the status of my Alabama state income tax documents in airSlate SignNow?

airSlate SignNow provides tracking features that allow you to monitor the status of your Alabama state income tax documents. You can receive notifications when documents are opened or signed, ensuring you stay updated on the progress of your tax submissions.

-

What types of documents can I send using airSlate SignNow related to Alabama state income tax?

You can send a variety of documents using airSlate SignNow related to Alabama state income tax, including tax forms, filing waivers, and other essential compliance papers. The platform supports multiple document types, making it easier for businesses to manage all relevant tax-related paperwork.

Get more for Form 40A TY

- Express employment pay card form

- Ohio waiver application pdf form

- Cara cek saldo asuransi astra life form

- Skin assessment form

- Artistry products catalogue form

- San bernardino family court forms

- Tipps application form in tamil pdf download

- Sample child support enforcement order qdro garnishment of monthly pension payments form

Find out other Form 40A TY

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online