Germany Individual Tax Administration 2023-2026

Overview of Alabama Form 40 for 2024

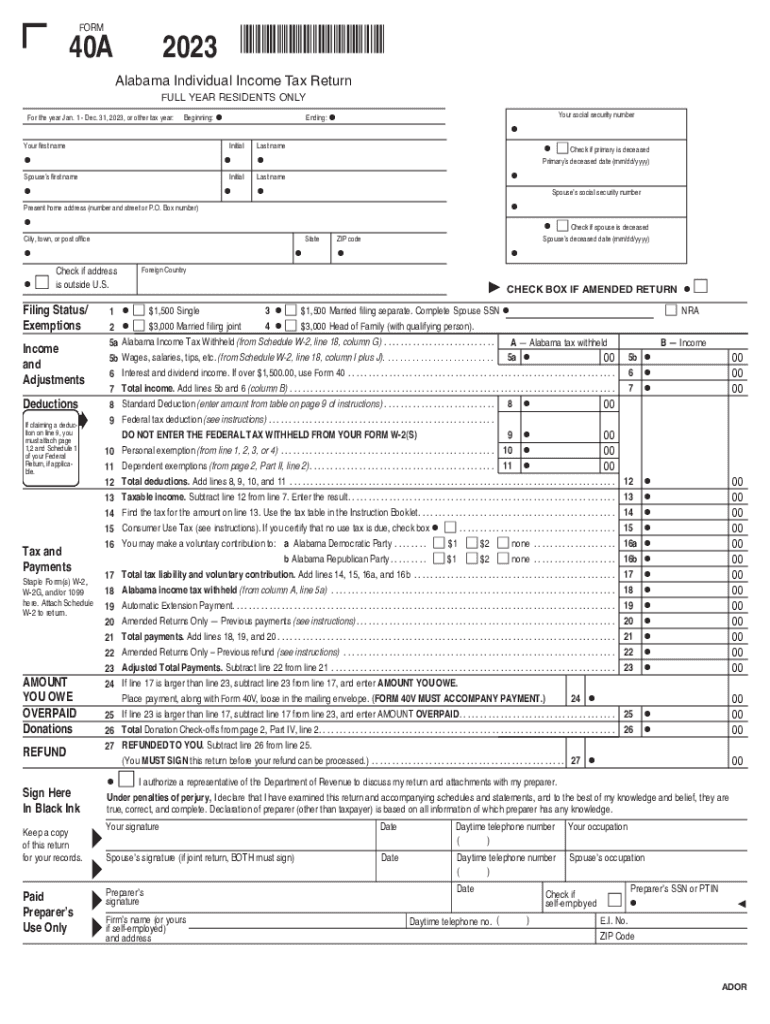

Alabama Form 40 is the state's individual income tax return form used by residents to report their income and calculate their tax liability. For the tax year 2024, this form includes updated tax rates, deductions, and credits that reflect the current tax laws. It is essential for residents to accurately complete this form to ensure compliance with Alabama state tax regulations.

Steps to Complete Alabama Form 40

Filling out the printable Alabama Form 40 involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and other income statements.

- Begin by entering personal information, such as your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and other sources.

- Calculate your deductions and credits, ensuring to follow the guidelines provided in the Alabama Form 40 instruction booklet.

- Determine your tax liability and any payments or refunds due.

- Review the completed form for accuracy before submitting it.

Required Documents for Filing

To complete Alabama Form 40, you will need to gather specific documents, including:

- W-2 forms from all employers.

- 1099 forms for any freelance or contract work.

- Documentation for any other income sources.

- Records of deductible expenses, such as medical bills or charitable contributions.

Filing Deadlines for Alabama Form 40

The deadline for filing Alabama Form 40 for the tax year 2024 is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these deadlines to avoid penalties for late filing.

Form Submission Methods

Alabama Form 40 can be submitted through various methods:

- Online filing through the Alabama Department of Revenue’s e-filing system.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices, if available.

Key Elements of Alabama Form 40

Understanding the key elements of Alabama Form 40 is crucial for accurate completion. These include:

- Personal information section for taxpayer identification.

- Income section for reporting all sources of income.

- Deductions and credits section to reduce taxable income.

- Tax calculation section to determine total tax owed or refund due.

Penalties for Non-Compliance

Failure to file Alabama Form 40 or inaccuracies in the submitted information can lead to penalties. Common penalties include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, which increases the total amount owed.

- Potential legal action for severe cases of non-compliance.

Quick guide on how to complete germany individual tax administration

Complete Germany Individual Tax Administration effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as a suitable eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents rapidly without any holdups. Manage Germany Individual Tax Administration on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The ideal method to modify and eSign Germany Individual Tax Administration with ease

- Find Germany Individual Tax Administration and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Germany Individual Tax Administration and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct germany individual tax administration

Create this form in 5 minutes!

How to create an eSignature for the germany individual tax administration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the printable Alabama Form 40 2024?

The printable Alabama Form 40 2024 is the state's official tax return form for individuals. This form is essential for accurately reporting your income and calculating your taxes for the year 2024. It can be conveniently filled out and printed for submission, ensuring compliance with Alabama tax laws.

-

How can I access the printable Alabama Form 40 2024?

You can easily access the printable Alabama Form 40 2024 through official state tax websites or trusted tax preparation services. Many online platforms, such as airSlate SignNow, offer a user-friendly interface to download and print the form directly. This ensures you have the most current version available for your filing needs.

-

Is there a cost associated with the printable Alabama Form 40 2024?

The printable Alabama Form 40 2024 itself is provided free by the Alabama Department of Revenue. However, using services that help you eSign or submit your tax forms online, like airSlate SignNow, may incur a fee. This represents a small but valuable investment to streamline your filing process.

-

What are the benefits of using airSlate SignNow for the printable Alabama Form 40 2024?

Using airSlate SignNow for the printable Alabama Form 40 2024 allows you to eSign documents quickly and securely. It simplifies the filing process, saving you time and reducing errors. Additionally, the platform’s cost-effective solution enhances productivity by providing easy access to all necessary tax documents.

-

Can I integrate airSlate SignNow with other tax software for using the printable Alabama Form 40 2024?

Yes, airSlate SignNow offers seamless integrations with various tax software applications. This allows for efficient management of your documents, including the printable Alabama Form 40 2024. Integrating these tools can further streamline your tax preparation and submission process.

-

What features does airSlate SignNow offer for preparing printable Alabama Form 40 2024?

AirSlate SignNow offers a range of features for preparing the printable Alabama Form 40 2024, including eSignature, form templates, and an intuitive document editor. These tools ensure that you can modify and sign forms efficiently, enhancing your overall filing experience. Additionally, users benefit from easy document tracking and storage.

-

Is my personal information secure when using the printable Alabama Form 40 2024 on airSlate SignNow?

Absolutely, airSlate SignNow prioritizes your security. When using the platform for the printable Alabama Form 40 2024, all your personal information is encrypted and protected with advanced security measures. This ensures that your sensitive data remains confidential and safeguarded throughout the filing process.

Get more for Germany Individual Tax Administration

Find out other Germany Individual Tax Administration

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure