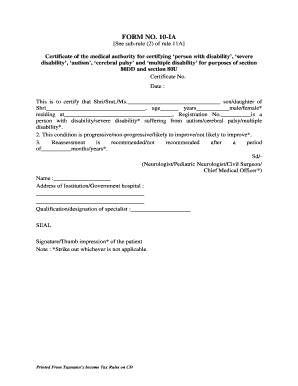

Form 10 Ia

What is the Form 10 IA

The Form 10 IA is a crucial document used in the United States for income tax purposes. It is specifically designed for individuals who need to report certain types of income or claim specific deductions. This form is essential for ensuring compliance with IRS regulations and accurately reflecting one’s financial situation. Understanding the purpose and requirements of the Form 10 IA can help taxpayers navigate their obligations effectively.

Steps to complete the Form 10 IA

Completing the Form 10 IA involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, previous tax returns, and any relevant receipts. Next, carefully fill out the form, paying close attention to each section to avoid errors. It is important to review the completed form for accuracy before submission. Finally, ensure that you sign and date the form, as an unsigned document may be considered invalid.

How to obtain the Form 10 IA

The Form 10 IA can be obtained through various means to facilitate easy access for taxpayers. It is available on the official IRS website, where individuals can download and print the form directly. Additionally, many tax preparation software programs include the Form 10 IA, allowing users to fill it out electronically. Local tax offices may also provide physical copies of the form for those who prefer a hard copy.

Legal use of the Form 10 IA

Understanding the legal use of the Form 10 IA is essential for compliance with tax laws. This form must be filled out accurately and submitted within the designated filing deadlines to avoid penalties. It serves as a formal declaration of income and deductions, and any inaccuracies may lead to legal repercussions. Taxpayers should familiarize themselves with the relevant IRS guidelines to ensure that their use of the Form 10 IA aligns with legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 10 IA are critical for taxpayers to keep in mind. Typically, the form must be submitted by April 15 of the tax year, although extensions may be available under certain circumstances. It is advisable to check the IRS website or consult a tax professional for any updates or changes to these deadlines, as they can vary from year to year.

Required Documents

When completing the Form 10 IA, certain documents are required to support the information provided. Taxpayers should gather income statements, such as W-2s or 1099s, along with receipts for any deductions claimed. Additionally, previous tax returns may be necessary for reference. Having these documents organized can streamline the completion process and ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Form 10 IA can be submitted through various methods, offering flexibility for taxpayers. Individuals can file the form electronically through approved tax software, which often provides a more efficient submission process. Alternatively, the form can be mailed to the appropriate IRS address, ensuring that it is sent well before the deadline. In-person submission may also be possible at local IRS offices, providing another option for those who prefer direct interaction.

Quick guide on how to complete form 10 ia 29387253

Effortlessly Prepare Form 10 Ia on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without unnecessary delays. Handle Form 10 Ia on any device using airSlate SignNow’s Android or iOS applications and streamline any document-centric process today.

The Simplest Way to Edit and eSign Form 10 Ia Without Stress

- Find Form 10 Ia and click Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes a few seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how to send your form: via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 10 Ia while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10 ia 29387253

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a I 10 form, and why do I need it?

A I 10 form is a document used for tax identification purposes, specifically for individuals who are not eligible for a Social Security Number (SSN). Understanding what is a I 10 form is crucial for complying with U.S. tax regulations, as it allows you to apply for an Individual Taxpayer Identification Number (ITIN) to report your income and file taxes correctly.

-

How do I complete a I 10 form?

Completing a I 10 form involves gathering the required information, such as your personal details and supporting documentation for identity verification. It's important to follow the guidelines provided by the IRS on what is a I 10 form to ensure that all sections are filled accurately to avoid processing delays or rejections.

-

What are the costs associated with filing a I 10 form?

The costs associated with filing a I 10 form typically include fees for obtaining necessary documentation and any paid services for assistance. While the form itself is free to file, understanding what is a I 10 form can help you budget for potential consulting or other associated expenses to ensure compliance.

-

What documents do I need to submit with a I 10 form?

When filing a I 10 form, you will need to submit proof of identity and foreign status, such as a passport or a national ID card. It's essential to know what is a I 10 form and its specific requirements, as incomplete submissions can lead to processing complications.

-

Can I use airSlate SignNow to eSign my I 10 form?

Yes, airSlate SignNow provides an efficient platform for eSigning your I 10 form securely and conveniently. Knowing what is a I 10 form and utilizing airSlate SignNow can streamline your document signing process, making it easier to submit your tax identification paperwork on time.

-

Is there a deadline for submitting a I 10 form?

Yes, there is a deadline for submitting a I 10 form, which is typically aligned with the tax filing deadlines. Being aware of what is a I 10 form will help you manage your timeline effectively, ensuring that you meet IRS requirements and avoid penalties.

-

What are the benefits of obtaining an ITIN through a I 10 form?

Obtaining an ITIN via a I 10 form allows you to fulfill U.S. tax obligations, access certain financial services, and possibly claim tax benefits. Understanding what is a I 10 form gives you clarity on the importance of ensuring compliance and maintaining your financial activities within the legal framework.

Get more for Form 10 Ia

- Warranty deed from limited partnership or llc is the grantor or grantee new jersey form

- Deed correction 497319683 form

- Sale covenants form

- Limited liability company 497319685 form

- New jersey joint form

- Quitclaim deed from two individuals to one individual new jersey form

- New jersey quitclaim form

- Deed jersey state form

Find out other Form 10 Ia

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile