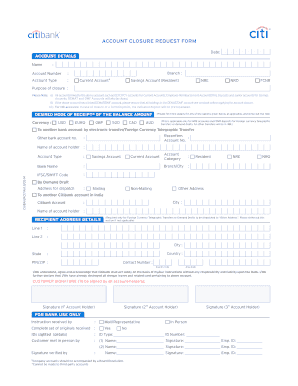

Account Accounts Form

What is the accounts group?

The accounts group refers to a collection of financial accounts that are categorized together for management and reporting purposes. This grouping allows businesses and individuals to track financial activities more effectively. Typically, an accounts group may include various types of accounts such as checking accounts, savings accounts, and investment accounts. Understanding the structure of an accounts group is essential for accurate financial reporting and analysis.

How to use the accounts group

Utilizing an accounts group involves organizing and managing your financial accounts to streamline operations. Users can categorize accounts based on their purpose, such as operational expenses, revenue generation, or savings. This organization helps in monitoring cash flow, budgeting, and preparing financial statements. By regularly reviewing the accounts group, users can make informed decisions about spending, investments, and savings strategies.

Steps to complete the accounts group

Completing an accounts group involves several key steps:

- Identify the different types of accounts needed for your financial activities.

- Group similar accounts together based on their functions or categories.

- Assign unique identifiers or names to each account for easy reference.

- Regularly update the accounts group to reflect any changes in financial status or objectives.

- Review and analyze the accounts group periodically to ensure alignment with financial goals.

Legal use of the accounts group

When managing an accounts group, it is crucial to adhere to legal standards and regulations. This includes maintaining accurate records, complying with tax laws, and ensuring that all financial transactions are documented properly. Legal compliance not only protects the business but also enhances credibility with stakeholders. Understanding the legal implications of financial reporting and management is essential for any accounts group.

Required documents

To effectively manage an accounts group, several documents may be required, including:

- Bank statements for each account within the group.

- Transaction records detailing inflows and outflows.

- Financial statements such as balance sheets and income statements.

- Tax documents related to income and expenses.

- Any agreements or contracts related to the accounts.

Form submission methods

Submitting documents related to an accounts group can be done through various methods, including:

- Online submissions via secure portals provided by financial institutions.

- Mailing physical copies to the appropriate addresses.

- In-person submissions at bank branches or financial offices.

Choosing the right submission method can enhance efficiency and ensure timely processing of documents.

Quick guide on how to complete account accounts

Complete Account Accounts effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delay. Handle Account Accounts on any device using the airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The easiest way to alter and eSign Account Accounts without hassle

- Find Account Accounts and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Account Accounts and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the account accounts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Citibank address for customer service inquiries?

The Citibank address for customer service inquiries is typically listed on their official website. It’s important for customers to have the correct Citibank address to ensure their communications are directed appropriately. Always verify the address from official sources to avoid any delays in services.

-

How can I find the nearest Citibank address?

To find the nearest Citibank address, you can use the bank's online branch locator tool available on their website. By entering your zip code, you can easily find the closest Citibank address. This tool helps in locating not just the address but also the hours of operation.

-

Does airSlate SignNow offer integration with Citibank services?

Yes, airSlate SignNow can integrate with various banking services, including Citibank, to streamline document signing and management. This feature allows users to easily send and eSign documents related to their Citibank account without hassle. Integrating airSlate SignNow with Citibank enhances productivity for businesses handling financial documents.

-

What are the pricing options for using airSlate SignNow with Citibank?

airSlate SignNow provides flexible pricing options suitable for various business sizes, allowing you to choose a plan that fits your budget. While using airSlate SignNow with Citibank, you can expect transparent pricing with no hidden fees for essential features. You may also enjoy signNow savings compared to traditional paper-based document management methods.

-

Can I access my Citibank account details through airSlate SignNow?

While airSlate SignNow itself does not provide direct access to Citibank account details, it does allow users to easily manage the documents associated with their account. This seamless experience ensures that all relevant documents can be sent and signed efficiently. For actual account details, you would need to log into your Citibank account separately.

-

What benefits does airSlate SignNow provide for Citibank customers?

For Citibank customers, airSlate SignNow offers a streamlined process for eSigning banking documents, which saves time and effort. The ability to manage documents online enhances efficiency and ensures compliance with legal standards. Additionally, eSignatures are legally binding, providing peace of mind for both personal and business transactions.

-

Is customer support available for Citibank users using airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support for all users, including those linked to Citibank services. If you experience any issues or have questions regarding your Citibank address or document signing, their support team is available to assist. Users can signNow out through various channels for prompt assistance.

Get more for Account Accounts

- Tenant welcome letter ohio form

- Warning of default on commercial lease ohio form

- Warning of default on residential lease ohio form

- Landlord tenant closing statement to reconcile security deposit ohio form

- Oh name change form

- Name change notification form ohio

- Commercial building or space lease ohio form

- Ohio workers compensation form

Find out other Account Accounts

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy