Bank Guarantee Format 2009

What is the Bank Guarantee Format

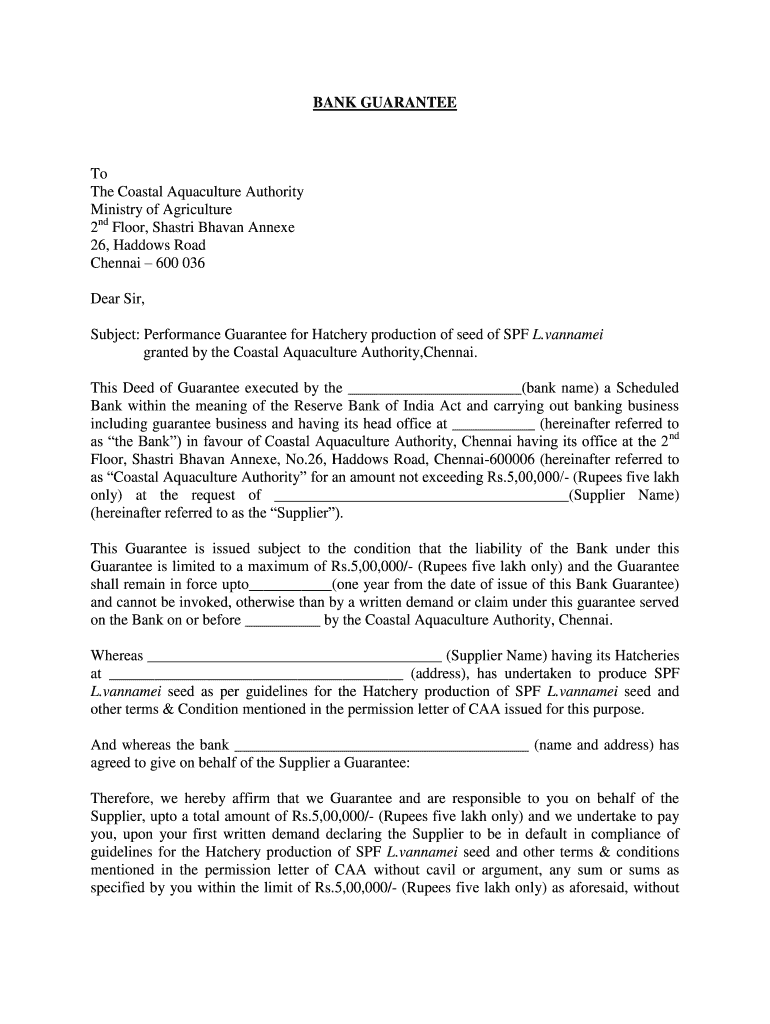

A bank guarantee format is a structured document that outlines the terms and conditions under which a bank agrees to pay a specified amount to a beneficiary if certain obligations are not met by the principal party. This format serves as a security mechanism in various transactions, ensuring that the beneficiary has a reliable source of payment in case of default. The bank guarantee can be used in numerous scenarios, including construction contracts, lease agreements, and international trade. Understanding the specific elements of this format is crucial for both parties involved in the transaction.

Key elements of the Bank Guarantee Format

The bank guarantee format typically includes several essential components that define its validity and enforceability:

- Parties Involved: Clearly identifies the principal (the party requesting the guarantee), the beneficiary (the party receiving the guarantee), and the bank issuing the guarantee.

- Amount: Specifies the maximum amount that the bank will pay under the guarantee.

- Conditions: Outlines the specific conditions under which the bank will make a payment to the beneficiary, such as default by the principal.

- Validity Period: States the duration for which the guarantee is valid, after which it will expire unless renewed.

- Governing Law: Indicates the jurisdiction and legal framework that will govern the guarantee.

Steps to complete the Bank Guarantee Format

Filling out a bank guarantee form requires careful attention to detail to ensure that all necessary information is included. Here are the steps to complete the bank guarantee format:

- Gather Information: Collect all relevant details about the principal, beneficiary, and transaction.

- Fill in the Parties: Clearly write the names and addresses of the principal and beneficiary.

- Specify the Amount: Enter the exact amount that the bank will guarantee.

- Outline Conditions: Clearly state the conditions under which the bank will pay the beneficiary.

- Set Validity: Indicate the start and end dates of the guarantee.

- Review and Sign: Ensure all information is accurate, then sign the document in accordance with bank requirements.

How to use the Bank Guarantee Format

Using the bank guarantee format effectively involves understanding its application in various contexts. Once the bank guarantee is completed and signed, it can be presented to the beneficiary as a form of security. The beneficiary can rely on this guarantee when entering into contracts or agreements with the principal. In the event that the principal fails to meet their obligations, the beneficiary can submit a claim to the bank, triggering the payment as outlined in the guarantee. It is essential for both parties to keep copies of the guarantee for their records.

Legal use of the Bank Guarantee Format

The legal use of a bank guarantee format is governed by specific regulations and standards. In the United States, the enforceability of a bank guarantee depends on compliance with relevant laws and the clarity of the document's terms. To ensure legal validity, the guarantee must be properly executed, with all parties consenting to the terms. Additionally, the bank must adhere to regulations regarding the issuance of guarantees, ensuring that the document meets all necessary legal requirements. Understanding these legal frameworks is vital for both the issuer and the beneficiary.

Quick guide on how to complete bank guarantee format

Complete Bank Guarantee Format seamlessly on any device

Online document management has gained traction among businesses and individuals. It serves as a perfect environmentally friendly substitute for traditional printed and signed paperwork, allowing for the appropriate form to be obtained and securely stored online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Bank Guarantee Format on any platform using airSlate SignNow Android or iOS applications and enhance any document-based task today.

The easiest way to alter and eSign Bank Guarantee Format without hassle

- Locate Bank Guarantee Format and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from your preferred device. Edit and eSign Bank Guarantee Format and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bank guarantee format

Create this form in 5 minutes!

How to create an eSignature for the bank guarantee format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank guarantee form, and why is it important?

A bank guarantee form is a document that ensures the fulfillment of a financial obligation or contract between parties. Understanding how to fill a bank guarantee form is crucial to prevent financial risks and ensure compliance with legal requirements, making it an essential tool for businesses.

-

How does airSlate SignNow help in filling out a bank guarantee form?

airSlate SignNow offers an intuitive platform that simplifies how to fill a bank guarantee form. With its user-friendly interface and guided templates, users can efficiently complete and eSign their documents without hassle, reducing time and errors in the process.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers several pricing tiers to accommodate various business needs. Users can explore affordable monthly and yearly plans that make it easy to utilize the service for filling out documents, including how to fill a bank guarantee form, without straining their budget.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow seamlessly integrates with a variety of applications such as Google Drive, Salesforce, and more. This functionality enhances efficiency by allowing you to access and fill documents like the bank guarantee form directly from your preferred platforms, simplifying your workflow.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as document storage, template creation, and team collaboration. These tools not only make it easier to understand how to fill a bank guarantee form but also facilitate efficient document management across your organization.

-

Is airSlate SignNow secure for filling confidential documents?

Absolutely. airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When learning how to fill a bank guarantee form, you can trust that your sensitive information is protected throughout the process.

-

How can I get support for using airSlate SignNow?

airSlate SignNow offers comprehensive customer support through various channels, including live chat, email, and a robust knowledge base. If you need assistance with how to fill a bank guarantee form or any other functionalities, their support team is ready to help.

Get more for Bank Guarantee Format

- Chronicles of darkness character sheet form

- Elevator reservation form dk condo

- Wwwpinterestcompin10 best printable fluid10 best printable fluid intake charts printableecom in form

- Siskin warranty form

- Attestation de vente chien royal canin form

- Op5 form

- Disguise a turkey scholastic form

- Student engagement walkthrough checklist 49241421 form

Find out other Bank Guarantee Format

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document