Fbla Insurance and Risk Management Form

What is the FBLA Insurance and Risk Management?

The FBLA Insurance and Risk Management program focuses on equipping students with essential knowledge about the insurance industry and risk management principles. This program covers various topics, including types of insurance, risk assessment, and the role of insurance in business operations. Students learn how to identify potential risks, evaluate them, and implement strategies to mitigate those risks effectively. The curriculum is designed to prepare students for careers in the insurance sector and related fields.

How to Use the FBLA Insurance and Risk Management

Using the FBLA Insurance and Risk Management resources involves engaging with the curriculum and practice tests designed for students. Participants should familiarize themselves with key concepts and terminology related to insurance and risk management. Accessing practice tests can help reinforce learning and assess understanding, ensuring students are well-prepared for competitions or exams. Utilizing these resources effectively can enhance knowledge retention and application in real-world scenarios.

Steps to Complete the FBLA Insurance and Risk Management

Completing the FBLA Insurance and Risk Management program typically involves several steps:

- Enroll in the program through your school's FBLA chapter.

- Study the curriculum materials provided, focusing on key topics.

- Participate in practice tests to evaluate your understanding.

- Engage in discussions and group studies with peers for collaborative learning.

- Prepare for any competitions or assessments based on the program.

Legal Use of the FBLA Insurance and Risk Management

The legal use of the FBLA Insurance and Risk Management resources ensures that students understand the laws and regulations governing the insurance industry. This includes knowledge of compliance with state and federal regulations, as well as ethical considerations in insurance practices. Understanding these legal aspects is crucial for anyone pursuing a career in insurance and risk management, as it helps to navigate the complexities of the industry.

Key Elements of the FBLA Insurance and Risk Management

Key elements of the FBLA Insurance and Risk Management program include:

- Types of insurance products and their purposes.

- Risk management strategies and their implementation.

- Understanding the insurance market and its dynamics.

- Legal and ethical considerations in insurance practices.

- Real-world applications of risk assessment techniques.

Examples of Using the FBLA Insurance and Risk Management

Examples of applying concepts from the FBLA Insurance and Risk Management program can include:

- Conducting a risk assessment for a small business to identify vulnerabilities.

- Creating an insurance policy proposal for a hypothetical company.

- Analyzing case studies of insurance claims and their resolutions.

- Participating in role-playing scenarios to practice client interactions and policy explanations.

Quick guide on how to complete fbla insurance and risk management

Complete Fbla Insurance And Risk Management effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed materials, as you can access the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Fbla Insurance And Risk Management on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Fbla Insurance And Risk Management with ease

- Locate Fbla Insurance And Risk Management and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Modify and electronically sign Fbla Insurance And Risk Management and ensure outstanding communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fbla insurance and risk management

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

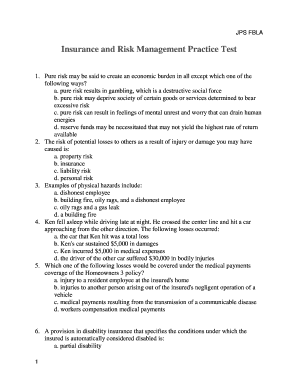

What is the fbla insurance and risk management practice test?

The fbla insurance and risk management practice test is designed to help students prepare for their FBLA competitions. It covers key concepts and principles in the field of insurance and risk management, ensuring you have a thorough understanding of the material. Practicing with this test can enhance your skills and boost your confidence for the competition.

-

How can the fbla insurance and risk management practice test benefit me?

By taking the fbla insurance and risk management practice test, you can identify your strengths and weaknesses in the subject matter. This targeted approach allows you to focus on areas needing improvement. The practice test will ultimately prepare you more effectively for actual exams or competitions.

-

Is the fbla insurance and risk management practice test available online?

Yes, the fbla insurance and risk management practice test is available online, making it accessible from anywhere. This convenience allows you to study at your own pace and revisit questions as needed. The online format also often includes instant feedback to enhance your learning experience.

-

What features are included in the fbla insurance and risk management practice test?

The fbla insurance and risk management practice test typically includes a variety of question formats, instant scoring, and detailed explanations for each answer. Additionally, some platforms may offer performance tracking to monitor your progress over time. These features make the test a comprehensive studying tool.

-

Are there any costs associated with accessing the fbla insurance and risk management practice test?

Access to the fbla insurance and risk management practice test may vary in cost depending on the provider. Some platforms might offer free practice tests, while others may charge a fee for premium access or additional resources. It's essential to research and choose an option that fits your budget and needs.

-

How does the fbla insurance and risk management practice test compare to classroom learning?

The fbla insurance and risk management practice test complements classroom learning by providing real-world application of concepts covered in class. It serves as an interactive way to reinforce knowledge. While classroom instruction is vital, the practice test gives you the opportunity to assess your understanding and readiness.

-

Can I track my progress while using the fbla insurance and risk management practice test?

Many platforms offering the fbla insurance and risk management practice test include progress tracking features. You can monitor your scores over time, allowing you to see how your understanding improves. This feedback is crucial for identifying persistent weaknesses that you may need to address before the competition.

Get more for Fbla Insurance And Risk Management

Find out other Fbla Insurance And Risk Management

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile