Bank of Baroda Fatca Form

What is the Bank Of Baroda Fatca Form

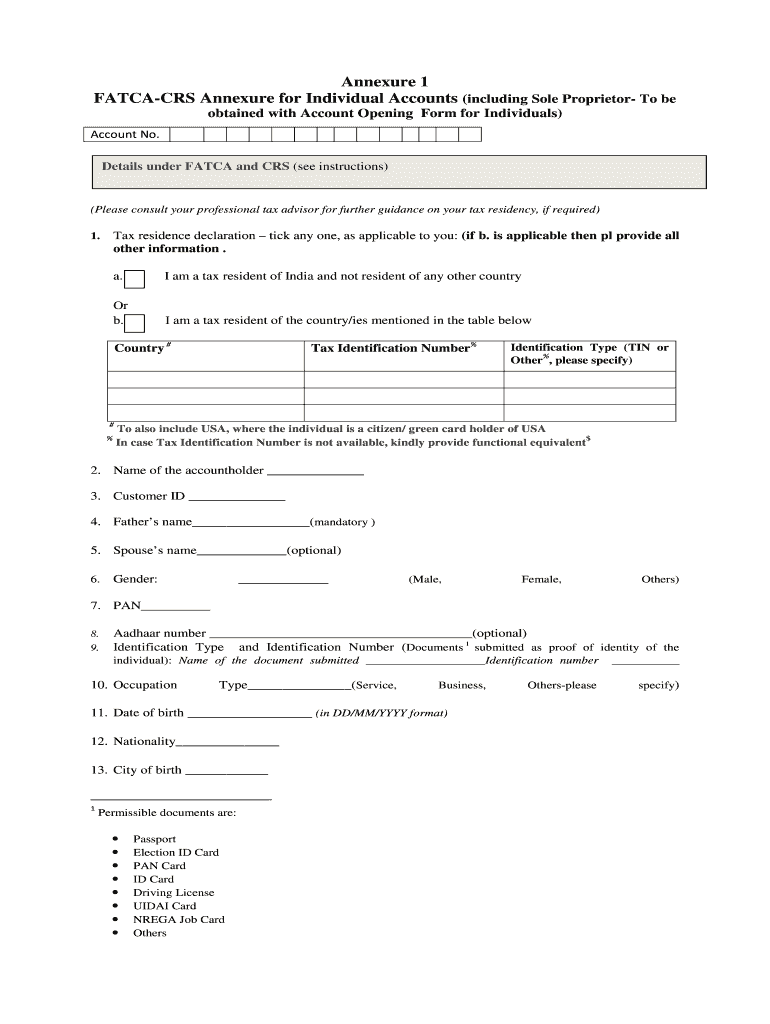

The Bank Of Baroda FATCA form is a crucial document designed to comply with the Foreign Account Tax Compliance Act (FATCA). This form is used by U.S. taxpayers to report their foreign financial accounts and ensure that they meet the necessary tax obligations. By filling out this form, individuals can declare their financial interests in foreign accounts, which is essential for maintaining transparency and avoiding potential penalties from the IRS.

Steps to complete the Bank Of Baroda Fatca Form

Completing the Bank Of Baroda FATCA form involves several important steps:

- Gather necessary personal information, including your name, address, and taxpayer identification number.

- Provide details of your foreign financial accounts, including account numbers and the financial institution's name.

- Indicate your ownership percentage in each account, if applicable.

- Review the form for accuracy and completeness before submission.

Ensuring that all information is correct is vital, as inaccuracies can lead to delays or compliance issues.

How to obtain the Bank Of Baroda Fatca Form

The Bank Of Baroda FATCA form can be obtained through various channels. Customers can visit their local Bank Of Baroda branch and request a physical copy of the form. Additionally, the form may be available for download on the official Bank Of Baroda website or through customer service. It is advisable to ensure that you are using the most recent version of the form to comply with current regulations.

Legal use of the Bank Of Baroda Fatca Form

The legal use of the Bank Of Baroda FATCA form is essential for U.S. citizens and residents who hold foreign financial accounts. This form must be filled out accurately to comply with U.S. tax laws. Failure to submit the form or providing false information can result in significant penalties, including fines and legal repercussions. Therefore, understanding the legal implications of the form is crucial for all filers.

Required Documents

When completing the Bank Of Baroda FATCA form, several documents may be required to support your application:

- Proof of identity, such as a passport or driver's license.

- Taxpayer identification number (TIN) or Social Security number (SSN).

- Details of foreign financial accounts, including bank statements or account opening documents.

Having these documents ready can streamline the process and ensure compliance with all requirements.

Form Submission Methods (Online / Mail / In-Person)

The Bank Of Baroda FATCA form can be submitted through various methods, depending on your preference and the bank's policies:

- Online: Some branches may offer online submission through their secure banking portal.

- Mail: You can send the completed form to the designated address provided by the bank.

- In-Person: Visiting a local branch allows you to submit the form directly to a bank representative.

Choosing the right submission method can help ensure that your form is processed efficiently.

Quick guide on how to complete bank of baroda fatca form

Prepare Bank Of Baroda Fatca Form effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow offers all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Bank Of Baroda Fatca Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Bank Of Baroda Fatca Form without hassle

- Obtain Bank Of Baroda Fatca Form and then click Get Form to begin.

- Utilize the tools provided to fill in your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Review the details and then click on the Done button to save your edits.

- Decide how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Bank Of Baroda Fatca Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank of baroda fatca form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FATCA full form?

The FATCA full form is the Foreign Account Tax Compliance Act. This U.S. federal law was enacted to combat tax evasion by U.S. citizens and residents holding accounts outside the country. Understanding the FATCA full form is essential for businesses dealing with international clients.

-

How does airSlate SignNow help with FATCA compliance?

AirSlate SignNow provides a secure platform for sending and eSigning important documents related to FATCA compliance. By ensuring the legal integrity of forms and contracts, it simplifies the process of gathering and managing documentation required by the FATCA full form. This aids businesses in maintaining adherence to international tax regulations.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers various features including customizable templates, automated workflows, and real-time collaboration tools. These features enhance the efficiency of managing documents, making it easier to ensure compliance with regulations like those specified in the FATCA full form. This user-friendly interface provides businesses with an effective solution for eSignature needs.

-

Is airSlate SignNow cost-effective?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. It offers various pricing plans that cater to different budgets while ensuring essential features for compliance and documentation, including those related to the FATCA full form. This affordability makes it accessible for any organization looking to streamline their eSigning processes.

-

Can airSlate SignNow integrate with other software?

AirSlate SignNow integrates seamlessly with various third-party applications, including CRMs and cloud storage solutions. This allows businesses to efficiently manage their documents in relation to the FATCA full form without disrupting existing workflows. The integration capabilities enhance productivity and ensure compliance across multiple platforms.

-

What benefits can businesses expect from using airSlate SignNow?

By using airSlate SignNow, businesses can expect increased efficiency, reduced paperwork, and enhanced compliance with regulations like the FATCA full form. The platform's user-friendly interface facilitates quick document processing and eSigning, resulting in time and cost savings. Additionally, it provides an audit trail for compliance assurance.

-

How does airSlate SignNow ensure document security?

AirSlate SignNow employs advanced security measures, including encryption and two-factor authentication, to protect sensitive documents. This is particularly important for handling documents related to the FATCA full form, as they often contain confidential information. Users can trust that their documents are safe and compliant within the platform.

Get more for Bank Of Baroda Fatca Form

Find out other Bank Of Baroda Fatca Form

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form