Owner Operator Tax Deductions Worksheet Form

Understanding the Owner Operator Tax Deductions Worksheet

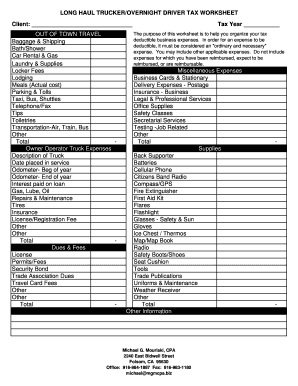

The Owner Operator Tax Deductions Worksheet is a vital tool for truck drivers who operate as independent contractors. This worksheet helps document and calculate eligible tax deductions, ensuring that drivers can maximize their tax savings. It includes various categories of expenses, such as fuel, maintenance, insurance, and lodging, which are essential for accurate tax reporting. By systematically organizing these expenses, truck drivers can simplify their tax filing process and reduce the risk of errors.

Steps to Complete the Owner Operator Tax Deductions Worksheet

Completing the Owner Operator Tax Deductions Worksheet involves several key steps:

- Gather Documentation: Collect all relevant receipts and invoices for expenses incurred during the tax year.

- Identify Deductible Expenses: Review the categories on the worksheet and determine which expenses qualify for deductions.

- Input Data: Enter the amounts for each expense category into the worksheet accurately.

- Calculate Totals: Sum up the total deductions to understand the overall impact on your taxable income.

- Review for Accuracy: Double-check all entries to ensure correctness before submission.

Legal Use of the Owner Operator Tax Deductions Worksheet

The Owner Operator Tax Deductions Worksheet is legally recognized when completed accurately and used in accordance with IRS guidelines. It is essential for truck drivers to maintain proper documentation and records to support their deductions. In the event of an audit, having a well-organized worksheet can substantiate claims and provide necessary evidence to the IRS. Compliance with tax laws ensures that drivers can take advantage of available deductions without facing penalties.

IRS Guidelines for Owner Operator Tax Deductions

The IRS provides specific guidelines regarding what expenses can be deducted by owner operators. Common deductible expenses include:

- Fuel costs

- Truck maintenance and repairs

- Insurance premiums

- Meals and lodging during trips

- Licensing and registration fees

Understanding these guidelines is crucial for truck drivers to ensure they are claiming all eligible deductions while remaining compliant with tax regulations.

Required Documents for Tax Deductions

To effectively use the Owner Operator Tax Deductions Worksheet, drivers must gather several key documents:

- Receipts for fuel purchases

- Invoices for maintenance and repairs

- Insurance policy documents

- Records of meals and lodging expenses

- Proof of licensing and registration payments

Having these documents readily available simplifies the completion of the worksheet and ensures accuracy in reporting.

Examples of Using the Owner Operator Tax Deductions Worksheet

Practical examples can illustrate how to utilize the Owner Operator Tax Deductions Worksheet effectively. For instance, if a truck driver spends two thousand dollars on fuel and five hundred dollars on truck repairs, these amounts should be recorded in their respective categories on the worksheet. By doing so, the driver can clearly see how these expenses contribute to their overall tax deductions, making it easier to calculate their taxable income.

Quick guide on how to complete owner operator tax deductions worksheet

Prepare Owner Operator Tax Deductions Worksheet effortlessly on any device

Online document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle Owner Operator Tax Deductions Worksheet across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and electronically sign Owner Operator Tax Deductions Worksheet without hassle

- Locate Owner Operator Tax Deductions Worksheet and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to preserve your changes.

- Select how you want to deliver your form: via email, text message (SMS), invite link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that necessitate reprinting new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign Owner Operator Tax Deductions Worksheet to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the owner operator tax deductions worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is included in the owner operator tax deductions list PDF?

The owner operator tax deductions list PDF includes a comprehensive overview of potential deductions available to owner-operators, such as vehicle expenses, maintenance costs, and business-related travel. This resource helps you identify deductible expenses that can signNowly reduce your taxable income, ensuring you take full advantage of tax savings.

-

How can I access the owner operator tax deductions list PDF?

You can easily access the owner operator tax deductions list PDF by visiting the airSlate SignNow website. We provide a convenient download option directly on our landing page, enabling you to obtain the list quickly and start planning your deductions effectively.

-

Are there any costs associated with downloading the owner operator tax deductions list PDF?

No, downloading the owner operator tax deductions list PDF is completely free of charge. We believe in empowering owner-operators with the necessary resources to maximize their tax benefits without any financial barriers, helping you save on costs.

-

How does the owner operator tax deductions list PDF help in tax preparation?

The owner operator tax deductions list PDF serves as a valuable guide during tax preparation, providing clarity on which expenses you can deduct. By organizing your eligible deductions, it simplifies the filing process and helps ensure compliance with tax regulations while maximizing your refunds.

-

Can the owner operator tax deductions list be updated for new tax laws?

Yes, the owner operator tax deductions list PDF is updated regularly to reflect the latest tax laws and regulations. This ensures that owner-operators have access to the most current information, aiding in accurate tax planning and preparation.

-

What are some key benefits of utilizing airSlate SignNow for document signing?

Utilizing airSlate SignNow for document signing provides an efficient, cost-effective solution for eSigning and managing documents. This not only streamlines workflows but also ensures that your important tax-related documents, including those related to the owner operator tax deductions list PDF, are securely handled and accessible anytime.

-

Does airSlate SignNow integrate with accounting software for tax deductions?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your finances and track your owner operator tax deductions. These integrations allow for streamlined document sharing and ensure your deduction records are organized and readily available during tax time.

Get more for Owner Operator Tax Deductions Worksheet

Find out other Owner Operator Tax Deductions Worksheet

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free