Schedule C Worksheet Self Employed Provide All 1099s MISC & NEC Received and Form

Understanding the Schedule C Worksheet for Self-Employed Individuals

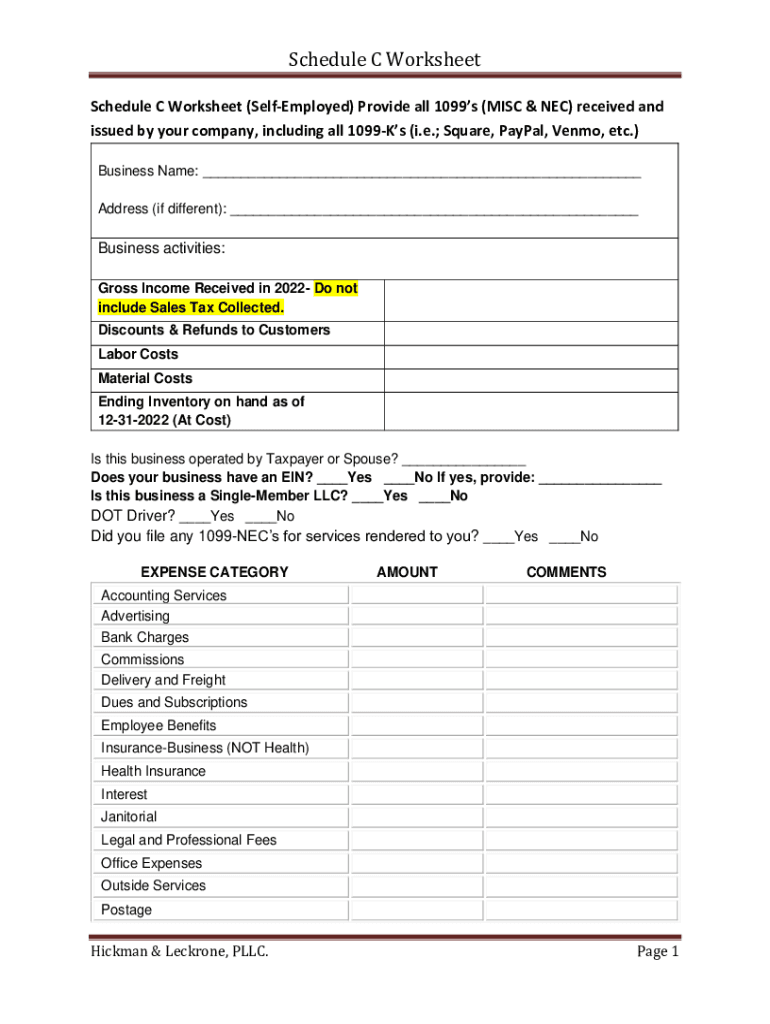

The Schedule C Worksheet is a crucial tool for self-employed individuals in the United States. It assists in reporting income or loss from a business operated as a sole proprietorship. This worksheet is particularly important for those who receive Form 1099-MISC or 1099-NEC, as it helps to organize income and expenses accurately. By using the Schedule C Worksheet, taxpayers can ensure they capture all necessary financial details for their tax filings, ultimately aiding in compliance with IRS regulations.

Steps to Complete the Schedule C Worksheet

Completing the Schedule C Worksheet involves several key steps:

- Gather all relevant documents: Collect all 1099 forms, receipts, and records of business expenses.

- Fill in your business information: Include your business name, address, and the type of business you operate.

- Report income: Enter all income received, including amounts from 1099 forms.

- Detail expenses: List all business-related expenses, categorizing them appropriately (e.g., supplies, utilities, travel).

- Calculate net profit or loss: Subtract total expenses from total income to determine your net profit or loss.

Key Elements of the Schedule C Worksheet

The Schedule C Worksheet includes several important sections:

- Income: This section captures all sources of income related to your business activities.

- Expenses: Here, you will categorize and list all deductible business expenses.

- Net Profit or Loss Calculation: This section summarizes your income and expenses to calculate your overall financial outcome for the year.

- Signature: A signature is required to validate the information provided on the worksheet.

IRS Guidelines for Using the Schedule C Worksheet

The IRS provides specific guidelines for completing the Schedule C Worksheet. It is essential to follow these guidelines to ensure compliance and avoid potential penalties:

- Accurate reporting: Ensure all income and expenses are reported accurately to reflect true business activity.

- Documentation: Maintain thorough documentation for all reported figures, as the IRS may request supporting evidence during audits.

- Filing deadlines: Be aware of the filing deadlines for submitting your Schedule C Worksheet along with your tax return.

Obtaining the Schedule C Worksheet

The Schedule C Worksheet can be easily obtained through various channels:

- IRS website: Download a printable version directly from the IRS website.

- Tax preparation software: Many tax preparation programs include a fillable version of the Schedule C Worksheet for convenience.

- Local tax offices: Visit local tax offices or libraries that may have printed copies available.

Filing Methods for the Schedule C Worksheet

There are several methods available for filing your Schedule C Worksheet:

- Online filing: Utilize tax preparation software that allows for electronic submission of your tax return, including the Schedule C Worksheet.

- Mail submission: Print and mail your completed Schedule C Worksheet along with your tax return to the appropriate IRS address.

- In-person filing: Some taxpayers may choose to file their returns in person at designated IRS offices or through tax professionals.

Quick guide on how to complete schedule c worksheet self employed provide all 1099s misc amp nec received and

Complete Schedule C Worksheet Self Employed Provide All 1099s MISC & NEC Received And effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule C Worksheet Self Employed Provide All 1099s MISC & NEC Received And on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Schedule C Worksheet Self Employed Provide All 1099s MISC & NEC Received And with ease

- Locate Schedule C Worksheet Self Employed Provide All 1099s MISC & NEC Received And and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes only moments and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule C Worksheet Self Employed Provide All 1099s MISC & NEC Received And and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c worksheet self employed provide all 1099s misc amp nec received and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule C worksheet form?

A Schedule C worksheet form is a tax form used by sole proprietors to report income and expenses for their business. This form provides a detailed summary of your business activities, allowing you to accurately calculate your net profit or loss. Utilizing the Schedule C worksheet form ensures compliance with IRS regulations and helps identify potential deductions.

-

How can airSlate SignNow help with completing a Schedule C worksheet form?

airSlate SignNow makes it easy to eSign and send your Schedule C worksheet form securely. Our platform allows you to streamline the process of gathering signatures and sharing documents. Additionally, you can access templates and create custom workflows that help you stay organized while completing your Schedule C worksheet form.

-

Is there a cost associated with using airSlate SignNow for my Schedule C worksheet form?

Yes, airSlate SignNow offers affordable pricing plans to cater to various needs. You can choose from several subscription options depending on your usage and features required. Investing in airSlate SignNow will save you time and enhance your efficiency when managing your Schedule C worksheet form.

-

Can I integrate airSlate SignNow with other applications for my Schedule C worksheet form?

Absolutely! airSlate SignNow integrates seamlessly with various applications and tools you may already use. By connecting with platforms like Google Drive or Dropbox, you can easily import and export your Schedule C worksheet form without hassle, ensuring a smooth workflow.

-

What features does airSlate SignNow offer for managing my Schedule C worksheet form?

airSlate SignNow offers a range of features that simplify the management of your Schedule C worksheet form. You can create templates for frequently used forms, utilize in-app reminders to avoid deadlines, and track your document's status in real-time. These features help streamline your process and increase productivity.

-

How secure is airSlate SignNow when handling my Schedule C worksheet form?

Security is a top priority for airSlate SignNow. We employ advanced security measures, including encryption and multi-factor authentication, to protect your Schedule C worksheet form and other sensitive documents. You can trust that your information is safe and secure when using our platform.

-

Can I collaborate with others on my Schedule C worksheet form using airSlate SignNow?

Yes, collaboration is a key feature of airSlate SignNow. You can invite team members or stakeholders to review or provide input on your Schedule C worksheet form, streamlining the review process. This collaborative approach ensures everyone stays in the loop and can contribute effectively to your business documents.

Get more for Schedule C Worksheet Self Employed Provide All 1099s MISC & NEC Received And

Find out other Schedule C Worksheet Self Employed Provide All 1099s MISC & NEC Received And

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe