Income Tax Preparation Client Information Questionnaire 2017

What is the Income Tax Preparation Client Information Questionnaire

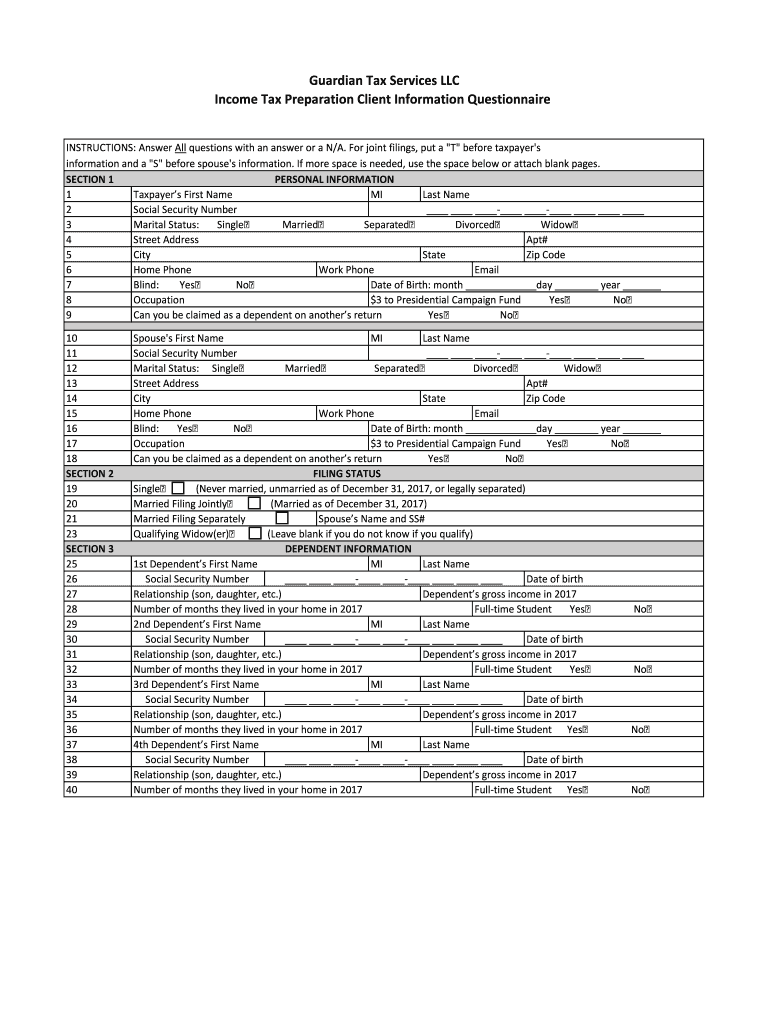

The Income Tax Preparation Client Information Questionnaire is a crucial document designed to gather essential information from clients preparing their tax returns. This questionnaire typically includes personal details such as name, address, Social Security number, and filing status. Additionally, it may request information about income sources, deductions, and credits relevant to the client's financial situation. By collecting this information, tax preparers can ensure accurate and compliant tax filings, ultimately helping clients maximize their potential refunds or minimize their tax liabilities.

Steps to complete the Income Tax Preparation Client Information Questionnaire

Completing the Income Tax Preparation Client Information Questionnaire involves several straightforward steps:

- Gather Personal Information: Collect your full name, address, and Social Security number.

- Document Income Sources: List all sources of income, including wages, self-employment earnings, and investment income.

- Identify Deductions and Credits: Review potential deductions and credits applicable to your situation, such as mortgage interest, student loan interest, and education credits.

- Review and Verify: Double-check all entries for accuracy and completeness before submission.

- Submit the Questionnaire: Send the completed questionnaire to your tax preparer, ensuring it is securely transmitted.

Legal use of the Income Tax Preparation Client Information Questionnaire

The legal use of the Income Tax Preparation Client Information Questionnaire is essential for ensuring compliance with tax regulations. This document serves as a formal record of the information provided by the client, which can be referenced in case of audits or disputes with the Internal Revenue Service (IRS). To maintain its legal validity, it is important that the questionnaire is completed truthfully and accurately. Additionally, utilizing a secure platform for submission can enhance the document's integrity and protect sensitive information.

Key elements of the Income Tax Preparation Client Information Questionnaire

Several key elements are vital to the Income Tax Preparation Client Information Questionnaire:

- Personal Information: Basic details such as name, address, and Social Security number.

- Income Details: Comprehensive information about all income sources, including wages, dividends, and rental income.

- Deductions: Information on potential deductions that can lower taxable income.

- Tax Credits: Identification of applicable tax credits that can reduce tax liability.

- Filing Status: Selection of the appropriate filing status, such as single, married filing jointly, or head of household.

Examples of using the Income Tax Preparation Client Information Questionnaire

Utilizing the Income Tax Preparation Client Information Questionnaire can streamline the tax preparation process. For instance, a self-employed individual might use the questionnaire to detail income from freelance work, business expenses, and potential deductions like home office expenses. Similarly, a family might complete the questionnaire to outline all sources of income, including wages and investment returns, while also identifying credits for education expenses. These examples illustrate how the questionnaire can help tax preparers gather comprehensive data tailored to each client's unique financial situation.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for timely submission of the Income Tax Preparation Client Information Questionnaire. Typically, the deadline for filing individual tax returns in the United States is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Clients should also be aware of any state-specific deadlines that may apply. Early completion of the questionnaire can help ensure that all necessary information is gathered well before the filing deadline, allowing ample time for review and adjustments.

Quick guide on how to complete income tax preparation client information questionnaire

Finish Income Tax Preparation Client Information Questionnaire effortlessly on any device

Digital document management has gained traction among enterprises and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents rapidly without delays. Manage Income Tax Preparation Client Information Questionnaire on any device with airSlate SignNow’s Android or iOS applications and enhance any document-driven procedure today.

The easiest method to modify and electronically sign Income Tax Preparation Client Information Questionnaire without hassle

- Locate Income Tax Preparation Client Information Questionnaire and then click Get Form to commence.

- Utilize the tools we provide to finalize your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, either by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form hunting, or mistakes requiring new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from any preferred device. Modify and electronically sign Income Tax Preparation Client Information Questionnaire and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax preparation client information questionnaire

Create this form in 5 minutes!

How to create an eSignature for the income tax preparation client information questionnaire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Income Tax Preparation Client Information Questionnaire?

An Income Tax Preparation Client Information Questionnaire is a structured document designed to gather essential financial information from clients to streamline the tax preparation process. It aids accountants in collecting necessary data efficiently, ensuring all aspects of a client’s financial situation are considered during their income tax filing.

-

How can airSlate SignNow help with the Income Tax Preparation Client Information Questionnaire?

airSlate SignNow offers a user-friendly platform that allows you to create, send, and eSign your Income Tax Preparation Client Information Questionnaire effortlessly. This solution simplifies obtaining client information, allowing tax preparers to focus on delivering quality service instead of getting bogged down by paperwork.

-

What features are included in the Income Tax Preparation Client Information Questionnaire?

The Income Tax Preparation Client Information Questionnaire includes customizable templates, secure eSignature capabilities, and easy document sharing. These features ensure that tax professionals can tailor the questionnaire to their specific needs while maintaining a seamless experience for clients.

-

Is the Income Tax Preparation Client Information Questionnaire compliant with tax regulations?

Yes, the Income Tax Preparation Client Information Questionnaire created through airSlate SignNow is designed to comply with tax regulations, ensuring that all collected information adheres to legal standards. This compliance is crucial for maintaining the integrity of the tax preparation process.

-

What are the benefits of using the Income Tax Preparation Client Information Questionnaire?

Using the Income Tax Preparation Client Information Questionnaire simplifies data collection, improves accuracy, and speeds up the tax preparation process. Clients can provide their financial information in a structured format, reducing the chances of errors and enhancing overall efficiency for tax professionals.

-

Are there any integration options for the Income Tax Preparation Client Information Questionnaire?

Absolutely! airSlate SignNow integrates with various accounting and tax software, making it easy to connect your Income Tax Preparation Client Information Questionnaire with the tools you already use. This seamless integration helps ensure that your workflows remain efficient and organized.

-

What kind of pricing plans does airSlate SignNow offer for the Income Tax Preparation Client Information Questionnaire?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses regarding the Income Tax Preparation Client Information Questionnaire. Whether you are a solo practitioner or part of a larger firm, you can find a plan that suits your budget and volume of document management.

Get more for Income Tax Preparation Client Information Questionnaire

- Anatomical gift act 497431244 form

- Wisconsin process form

- Revocation of anatomical gift donation wisconsin form

- Authorization final disposition form

- Employment or job termination package wisconsin form

- Newly widowed individuals package wisconsin form

- Employment interview package wisconsin form

- Employment employee personnel file package wisconsin form

Find out other Income Tax Preparation Client Information Questionnaire

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure