Cert 108 2005-2026

What is the Cert 108?

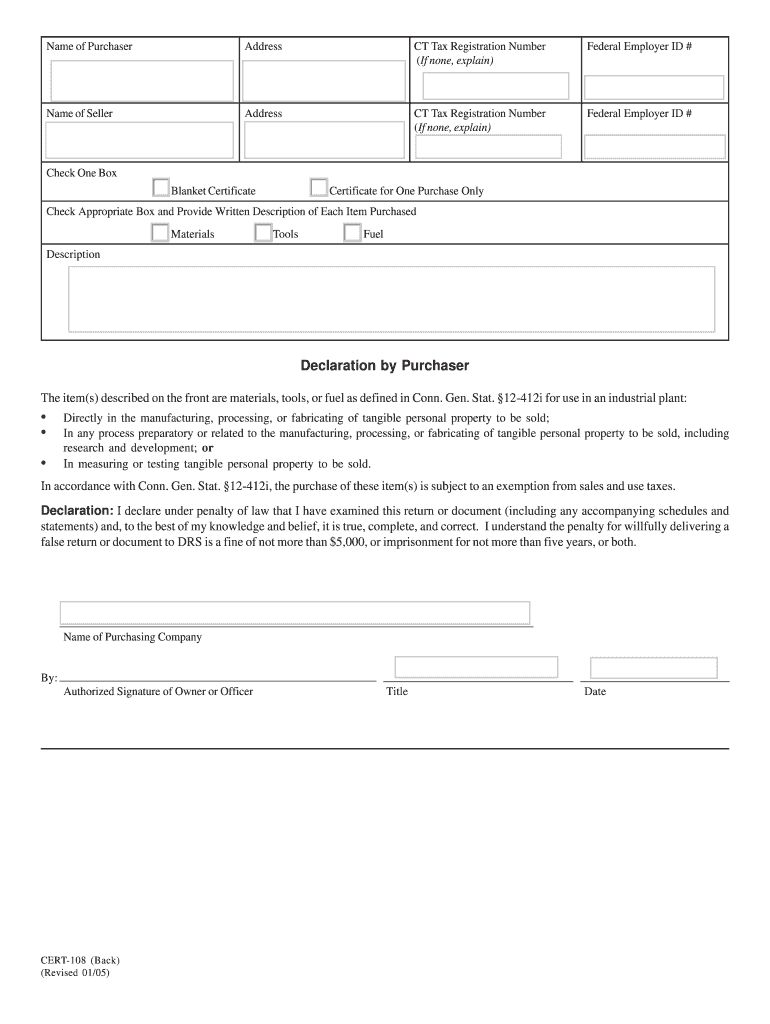

The Cert 108, also known as the Cert 108 CT form, is a tax exemption certificate used in the state of Connecticut. It is primarily utilized to claim exemptions on certain purchases of tangible personal property and services. This form is essential for businesses and individuals who qualify for the exemption, allowing them to avoid paying sales tax on eligible items. The Cert 108 is particularly relevant for materials that are directly used in manufacturing or production processes, thereby supporting economic activities within the state.

How to Use the Cert 108

Using the Cert 108 involves several key steps. First, the purchaser must ensure they meet the eligibility criteria for the exemption. Once confirmed, they can complete the form by providing necessary details such as the purchaser's name, address, and the specific items being purchased. The completed Cert 108 should then be presented to the seller at the time of purchase. It is important for sellers to retain a copy of the form for their records to demonstrate compliance with state tax regulations.

Steps to Complete the Cert 108

Completing the Cert 108 involves a straightforward process:

- Gather necessary information, including your business name, address, and tax identification number.

- Identify the specific items or services for which you are claiming the exemption.

- Fill out the Cert 108 form accurately, ensuring all required fields are completed.

- Sign and date the form to validate your claim.

- Provide the completed form to the seller at the time of purchase.

It is advisable to keep a copy of the form for your records, as it may be needed for future reference or audits.

Legal Use of the Cert 108

The Cert 108 is legally recognized in Connecticut as a valid means to claim sales tax exemptions. To ensure compliance, it is crucial that the form is used only for qualifying purchases. Misuse of the Cert 108, such as claiming exemptions on ineligible items, may result in penalties or fines from state tax authorities. Businesses should familiarize themselves with the specific legal requirements surrounding the use of this form to avoid potential legal issues.

Eligibility Criteria

To qualify for the Cert 108 exemption, purchasers must meet certain criteria set by the state of Connecticut. Generally, the exemption applies to businesses engaged in manufacturing, processing, or other specified activities that utilize the purchased items in their operations. Additionally, the purchaser must possess a valid sales and use tax permit issued by the Connecticut Department of Revenue Services. It is important to review the eligibility requirements thoroughly to ensure compliance when using the Cert 108.

Form Submission Methods

The Cert 108 can be submitted in various ways depending on the seller's preferences. Typically, the form is presented in person at the point of sale. However, some businesses may accept the form via email or fax, provided they maintain a copy for their records. It is essential for both buyers and sellers to confirm the acceptable submission methods to ensure proper processing of the exemption claim.

Quick guide on how to complete cert 108 partial exemption of materials tools ad fuels ctgov

Your assistance manual on how to prepare your Cert 108

If you’re interested in understanding how to complete and submit your Cert 108, here are some brief instructions on how to make tax filing signNowly simpler.

To commence, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and effective document solution that enables you to modify, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and electronic signatures and return to modify information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Adhere to the steps below to complete your Cert 108 in just a few moments:

- Create your account and start working on PDFs in moments.

- Utilize our directory to locate any IRS tax form; examine different versions and schedules.

- Click Obtain form to access your Cert 108 in our editor.

- Fill out the necessary form fields with your details (text, figures, check marks).

- Utilize the Signature Tool to insert your legally-valid eSignature (if needed).

- Review your document and rectify any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper may lead to return inaccuracies and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cert 108 partial exemption of materials tools ad fuels ctgov

How to generate an eSignature for your Cert 108 Partial Exemption Of Materials Tools Ad Fuels Ctgov online

How to generate an electronic signature for your Cert 108 Partial Exemption Of Materials Tools Ad Fuels Ctgov in Chrome

How to create an electronic signature for signing the Cert 108 Partial Exemption Of Materials Tools Ad Fuels Ctgov in Gmail

How to create an eSignature for the Cert 108 Partial Exemption Of Materials Tools Ad Fuels Ctgov straight from your smart phone

How to make an eSignature for the Cert 108 Partial Exemption Of Materials Tools Ad Fuels Ctgov on iOS devices

How to create an eSignature for the Cert 108 Partial Exemption Of Materials Tools Ad Fuels Ctgov on Android

People also ask

-

What is cert 108 in airSlate SignNow?

Cert 108 refers to a specific certification for eSignature compliance within the airSlate SignNow platform. It ensures that all documents signed through our service meet legal and regulatory standards, providing peace of mind for businesses.

-

How much does airSlate SignNow cost with cert 108 compliance?

The pricing for airSlate SignNow is competitive and varies based on the plan you choose. All plans include cert 108 compliance, ensuring that your eSigning processes remain legally valid without incurring additional costs.

-

What features does airSlate SignNow offer for cert 108 compliance?

airSlate SignNow includes features such as secure document storage, advanced encryption, and an intuitive signing interface to meet cert 108 compliance. These features empower users to confidently sign documents while maintaining legal integrity.

-

How does cert 108 enhance document security in airSlate SignNow?

Cert 108 enhances document security by ensuring that all signed documents are stored and transmitted using state-of-the-art encryption technology. This keeps sensitive information safe from unauthorized access while adhering to industry standards.

-

Does airSlate SignNow integrate with other software for cert 108 compliance?

Yes, airSlate SignNow can seamlessly integrate with various software applications, enhancing its capabilities while maintaining cert 108 compliance. Integrations with CRM systems, cloud storage services, and productivity tools streamline your workflow.

-

What benefits does cert 108 offer for businesses using airSlate SignNow?

Cert 108 offers numerous benefits, including enhanced legal protection and increased user confidence in your eSigning processes. By ensuring compliance with vital regulations, businesses can streamline their operations and avoid costly legal issues.

-

Can I trust airSlate SignNow with sensitive documents under cert 108?

Absolutely! airSlate SignNow is designed with security in mind and adheres to cert 108 guidelines, ensuring that your sensitive documents are handled appropriately. Our platform offers features like audit trails and secure access to protect your data.

Get more for Cert 108

- Legal last will and testament form for single person with adult and minor children south carolina

- Legal last will and testament form for single person with adult children south carolina

- Legal last will and testament for married person with minor children from prior marriage south carolina form

- Legal last will and testament form for married person with adult children from prior marriage south carolina

- Legal last will and testament form for divorced person not remarried with adult children south carolina

- Legal last will and testament form for divorced person not remarried with no children south carolina

- Legal last will and testament form for divorced person not remarried with minor children south carolina

- Legal last will and testament form for divorced person not remarried with adult and minor children south carolina

Find out other Cert 108

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online