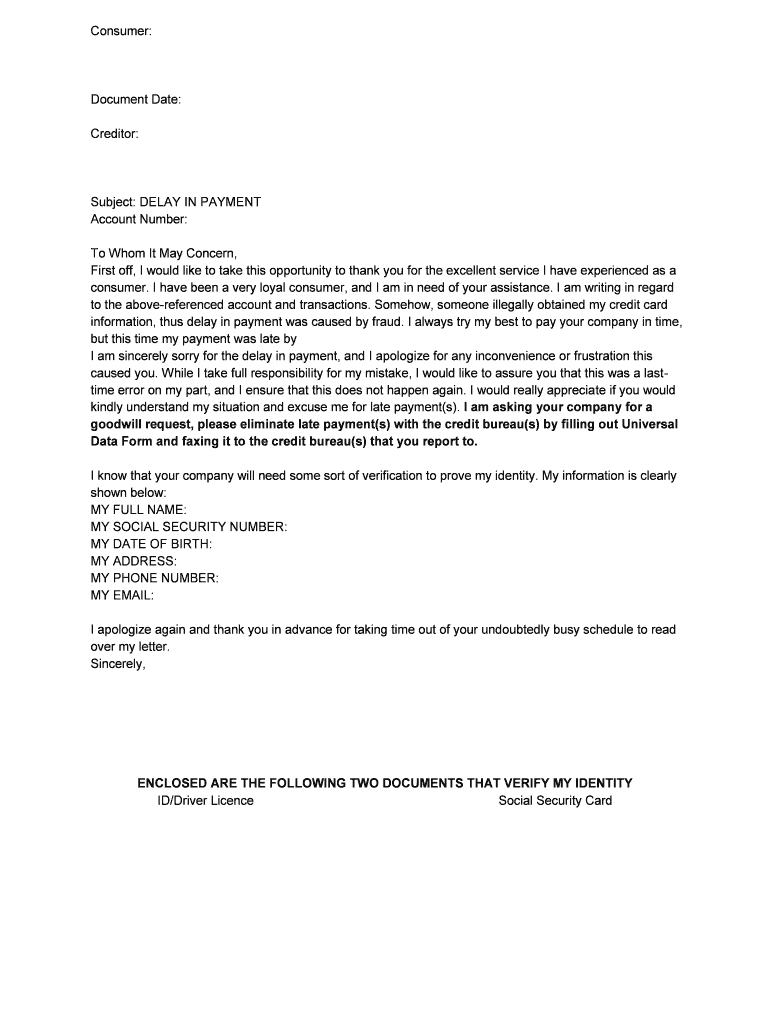

Late Payment Removal Letter PDF Form

What is the credit dispute letter?

A credit dispute letter is a formal document that individuals send to credit reporting agencies or creditors to challenge inaccuracies or errors in their credit reports. This letter serves as a request for the correction or removal of false information, such as late payments, accounts that do not belong to the individual, or incorrect balances. By utilizing a credit dispute letter, consumers can take proactive steps to ensure their credit reports accurately reflect their financial history, which is crucial for maintaining a healthy credit score.

Key elements of the credit dispute letter

When drafting a credit dispute letter, it is essential to include specific elements to ensure its effectiveness. The key components typically include:

- Your contact information: Include your full name, address, phone number, and email address at the top of the letter.

- Subject line: Clearly state that the letter is a credit dispute.

- Details of the dispute: Specify the items being disputed, including account numbers and the nature of the inaccuracies.

- Supporting documentation: Attach copies of relevant documents that support your claim, such as payment records or account statements.

- Request for action: Clearly state what you want the credit reporting agency or creditor to do, such as correcting or removing the disputed information.

- Signature: Sign the letter to authenticate your request.

Steps to complete the credit dispute letter

Completing a credit dispute letter involves several straightforward steps:

- Gather your information: Collect your personal details and the relevant information about the disputed items.

- Draft the letter: Use a clear and professional tone, following the key elements outlined above.

- Attach supporting documents: Include any evidence that substantiates your claim, ensuring to keep copies for your records.

- Send the letter: Choose your submission method, whether online or via mail, and ensure it is sent to the correct agency or creditor.

- Follow up: Keep track of your dispute and follow up if you do not receive a response within thirty days.

Legal use of the credit dispute letter

The legal framework surrounding credit dispute letters is primarily governed by the Fair Credit Reporting Act (FCRA). This law grants consumers the right to dispute inaccurate information on their credit reports. When a credit dispute letter is submitted, the credit reporting agency is obligated to investigate the claim and respond within a specific timeframe. If the disputed information is found to be incorrect, it must be corrected or removed, ensuring that consumers have the right to maintain accurate credit records.

How to use the credit dispute letter

Using a credit dispute letter effectively involves understanding the process and ensuring compliance with legal requirements. Begin by identifying inaccuracies in your credit report. Once identified, draft your letter according to the established guidelines, ensuring clarity and professionalism. After sending the letter, monitor your credit report for updates. If the dispute is resolved in your favor, verify that the corrections are accurately reflected in your report. This proactive approach can help improve your credit score over time.

Examples of using the credit dispute letter

There are various scenarios in which a credit dispute letter may be utilized. Common examples include:

- Incorrect late payments: If you notice a late payment recorded on your report that was paid on time, a dispute letter can help rectify this error.

- Accounts not belonging to you: If your report contains accounts that you did not open, a dispute letter is necessary to have these accounts removed.

- Inaccurate balances: If the balance reported on an account is incorrect, a dispute letter can prompt a review and correction.

Quick guide on how to complete late payment removal letter pdf

Prepare Late Payment Removal Letter Pdf effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Late Payment Removal Letter Pdf on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Late Payment Removal Letter Pdf with ease

- Locate Late Payment Removal Letter Pdf and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your updates.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Late Payment Removal Letter Pdf and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the late payment removal letter pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit dispute letter?

A credit dispute letter is a formal document that you can use to challenge inaccuracies in your credit report. By sending a credit dispute letter to credit bureaus, you can request corrections on erroneous information, which can improve your credit score.

-

How can airSlate SignNow help me with my credit dispute letter?

airSlate SignNow allows you to efficiently create, send, and eSign your credit dispute letter. Our user-friendly platform simplifies the process, ensuring your dispute is handled quickly and professionally.

-

Is airSlate SignNow cost-effective for sending credit dispute letters?

Yes, airSlate SignNow provides a cost-effective solution for sending credit dispute letters. With competitive pricing plans, you can manage all your document needs without exceeding your budget.

-

Can I customize my credit dispute letter using airSlate SignNow?

Absolutely! You can customize your credit dispute letter within the airSlate SignNow platform. Tailor the content to suit your specific situation, ensuring your letter is personal and effective.

-

Are there templates available for credit dispute letters on airSlate SignNow?

Yes, airSlate SignNow offers templates for credit dispute letters that make the drafting process easier. These templates can guide you through the necessary components, ensuring your letter meets all requirements.

-

How does eSigning a credit dispute letter work with airSlate SignNow?

eSigning a credit dispute letter with airSlate SignNow is simple and secure. You can sign the document electronically, eliminating the need for printing or scanning, which speeds up your dispute process.

-

What integrations does airSlate SignNow offer for managing credit dispute letters?

airSlate SignNow integrates with various apps and platforms, enhancing your workflow for managing credit dispute letters. Whether you use CRM tools or cloud storage, our integrations streamline the process and save you time.

Get more for Late Payment Removal Letter Pdf

- 1095 b2020pdf 560118 form 1095 b 1 do not attach to your tax return

- Irs instructions 8915 form fill online printable

- About schedule j form 1040 income irs tax formsfederal 1040 schedule j income averaging for farmersincome averaging for omb no

- About form 8843 statement for exempt individuals and individuals withabout form 8843 statement for exempt individuals and

- 943 employers annual federal tax return irs tax forms

- Form cdtfa 501 dg ampquotgovernment entity diesel fuel tax returnampquot california

- Instrucciones para el anexo b formulario 941 pr rev junio 2022 instrucciones para el anexo b formulario 941 pr registro de la

- 2022 instructions for schedule d 2022 instructions for schedule d capital gains and losses form

Find out other Late Payment Removal Letter Pdf

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document