About Form 3520, Annual Return to Report Transactions with ForeignInstructions for Form 3520 Internal Revenue ServiceInstruction

Understanding Form 3520, Annual Return To Report Transactions With Foreign Trusts

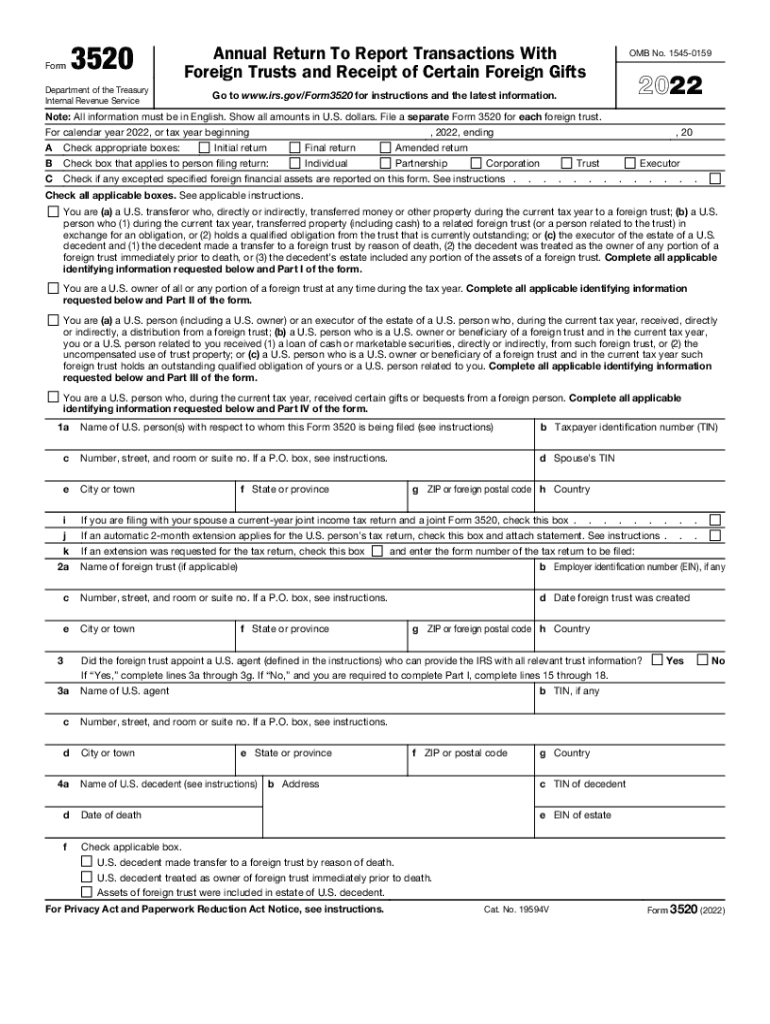

The 3520 form 2022 is a crucial document for U.S. taxpayers who engage in certain transactions with foreign trusts, foreign estates, or foreign gifts. This form is required by the Internal Revenue Service (IRS) to report these transactions accurately. It helps ensure compliance with U.S. tax laws and provides transparency regarding foreign financial activities. Failing to file this form when required can lead to significant penalties.

Steps to Complete Form 3520, Annual Return To Report Transactions With Foreign Trusts

Completing the 2022 form 3520 involves several key steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather Necessary Information: Collect details about the foreign trust, estate, or gift, including the names, addresses, and tax identification numbers.

- Complete the Form: Fill out the form accurately, ensuring all required sections are completed. Pay close attention to the specific instructions for each part.

- Review for Accuracy: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- File the Form: Submit the completed form to the IRS by the specified deadline, ensuring you keep a copy for your records.

Legal Use of Form 3520, Annual Return To Report Transactions With Foreign Trusts

The legal validity of the 3520 form 2022 is anchored in its compliance with IRS regulations. When filed correctly, it serves as a legal document that reports foreign transactions. This form must be submitted in accordance with the IRS guidelines to maintain its legal standing. Additionally, using a reliable eSignature solution can enhance the legal validity of the form, ensuring that electronic submissions meet all necessary legal requirements.

IRS Guidelines for Form 3520

The IRS provides specific guidelines for completing and submitting the 2022 form 3520. These guidelines outline who must file the form, what information needs to be reported, and the deadlines for submission. Taxpayers should refer to the IRS instructions for the 3520 form to understand their obligations and avoid potential penalties. Staying informed about these guidelines is essential for compliance and proper tax reporting.

Filing Deadlines for Form 3520

Timely submission of the 3 form is critical. The IRS generally requires that this form be filed by the same deadline as your income tax return. For most taxpayers, this means it is due on April 15, 2023. However, if you file for an extension on your tax return, the deadline for the 3520 form will also be extended. It is important to mark these dates on your calendar to ensure compliance and avoid late fees.

Penalties for Non-Compliance with Form 3520

Failure to file the 2022 form 3520 when required can result in substantial penalties. The IRS may impose a penalty of up to $10,000 for failing to file the form or for filing it late. In cases of willful neglect, penalties can be even higher. Understanding these potential consequences highlights the importance of timely and accurate filing of the form.

Quick guide on how to complete about form 3520 annual return to report transactions with foreigninstructions for form 3520 2021internal revenue

Complete About Form 3520, Annual Return To Report Transactions With ForeignInstructions For Form 3520 Internal Revenue ServiceInstruction effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents promptly without delays. Handle About Form 3520, Annual Return To Report Transactions With ForeignInstructions For Form 3520 Internal Revenue ServiceInstruction on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign About Form 3520, Annual Return To Report Transactions With ForeignInstructions For Form 3520 Internal Revenue ServiceInstruction without stress

- Obtain About Form 3520, Annual Return To Report Transactions With ForeignInstructions For Form 3520 Internal Revenue ServiceInstruction and click on Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your updates.

- Choose how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign About Form 3520, Annual Return To Report Transactions With ForeignInstructions For Form 3520 Internal Revenue ServiceInstruction and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 3520 annual return to report transactions with foreigninstructions for form 3520 2021internal revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3520 form 2022, and why is it important?

The 3520 form 2022 is a document required by the IRS for reporting foreign gifts and inheritances. It is important because failure to file can result in signNow penalties. Businesses and individuals receiving such gifts need to ensure compliance to avoid issues with tax authorities.

-

How can airSlate SignNow help with the 3520 form 2022?

airSlate SignNow simplifies the process of sending and eSigning your 3520 form 2022 securely and efficiently. Our platform allows users to manage document workflows easily, ensuring you don't miss important deadlines and compliance requirements for your form.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses. With cost-effective solutions, you can choose the plan that best fits your frequency of use and the number of documents you need to manage, including essential documents like the 3520 form 2022.

-

Is the 3520 form 2022 compatible with mobile devices?

Yes, the 3520 form 2022 can be completed using airSlate SignNow's mobile app. This flexibility allows users to fill out, sign, and send their forms in real-time from anywhere, making it easier to manage important documents like the 3520 form 2022 on the go.

-

What security features does airSlate SignNow offer for the 3520 form 2022?

Security is a priority with airSlate SignNow; we use advanced encryption technology to protect your 3520 form 2022 and other documents. Additionally, we provide secure cloud storage and custom permissions, ensuring that only authorized users have access to sensitive information.

-

Can I integrate airSlate SignNow with other software to manage the 3520 form 2022?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software solutions, making it easy to streamline your document management process for the 3520 form 2022. Connect with your CRM, ERP, or other applications to enhance productivity and efficiency.

-

What are the benefits of using airSlate SignNow for managing the 3520 form 2022?

Using airSlate SignNow for your 3520 form 2022 offers numerous benefits, including expedited processing, enhanced collaboration, and improved compliance tracking. Our user-friendly interface and comprehensive support make managing important documents easier for users at all levels.

Get more for About Form 3520, Annual Return To Report Transactions With ForeignInstructions For Form 3520 Internal Revenue ServiceInstruction

- Hal higdon 10k novice pdf form

- Fastrip application form

- Two peas phonological awareness assessment form

- Lactoa form

- Spinal screening form

- To be admitted to a time conflict the student mus form

- Wayne county human services plan sfy form

- Origins of sex differences in mast cell associated immune diseases form

Find out other About Form 3520, Annual Return To Report Transactions With ForeignInstructions For Form 3520 Internal Revenue ServiceInstruction

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile