Instructions for Form FTB 3843 Payment Voucher for Fiduciary E Filed Returns 2024-2026

Understanding the California Fiduciary Form 3843

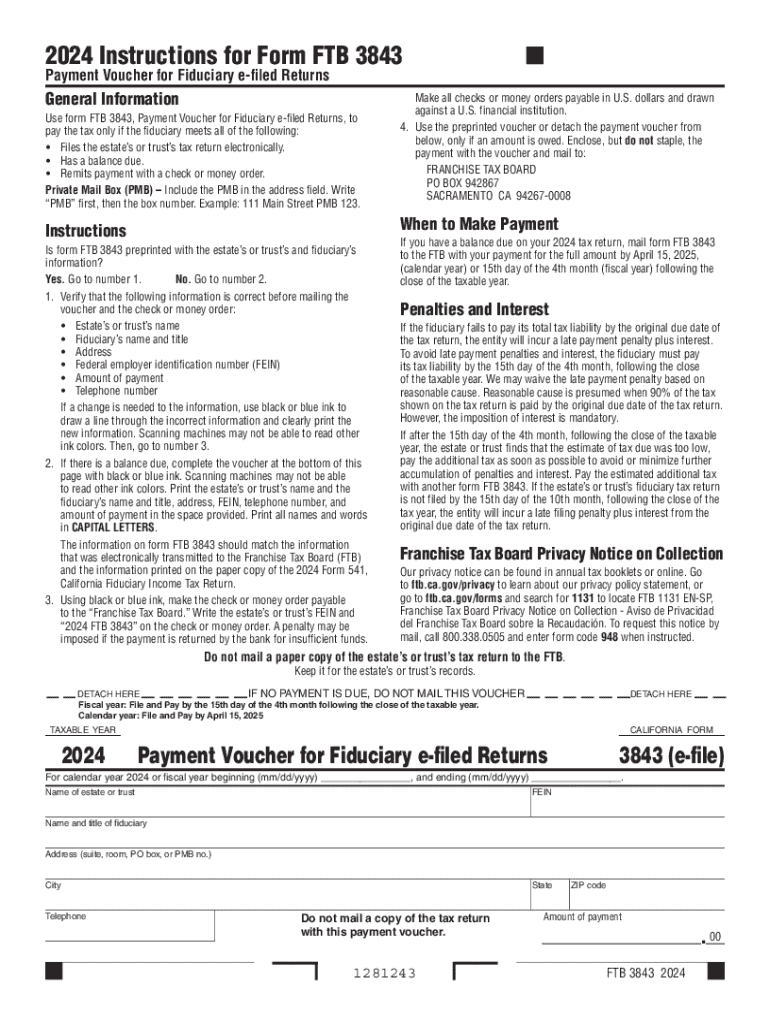

The California Fiduciary Form 3843, also known as the Payment Voucher for Fiduciary E-filed Returns, is designed for fiduciaries to submit payments associated with their tax returns. This form is crucial for ensuring compliance with California tax regulations. It allows fiduciaries to report and pay taxes owed on behalf of estates or trusts, streamlining the payment process for e-filed returns.

Steps to Complete the California 3843 Form

Completing the California 3843 form involves several key steps:

- Gather necessary information, including the fiduciary's name, address, and taxpayer identification number.

- Calculate the total amount due based on the fiduciary's taxable income.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, as per the guidelines provided.

Legal Use of the California 3843 Form

The California 3843 form is legally required for fiduciaries managing estates or trusts that owe taxes. It serves as a formal declaration of the payment due and ensures that fiduciaries remain compliant with state tax laws. Failure to submit this form can result in penalties or interest charges, emphasizing the importance of timely and accurate submission.

Filing Deadlines and Important Dates

Fiduciaries must be aware of specific filing deadlines associated with the California 3843 form. Generally, the payment voucher should be submitted along with the fiduciary tax return. It is essential to check for any updates or changes to deadlines each tax year, particularly for the 2024 tax season, to avoid late fees or penalties.

Required Documents for the California 3843 Form

When preparing to file the California 3843 form, fiduciaries should have the following documents ready:

- Completed fiduciary tax return.

- Documentation supporting the income and deductions claimed.

- Any correspondence received from the California Franchise Tax Board.

Form Submission Methods for the California 3843

The California 3843 form can be submitted through various methods, accommodating different preferences:

- Online submission via the California Franchise Tax Board's e-filing system.

- Mailing a paper copy to the designated address provided in the form instructions.

- In-person delivery at local Franchise Tax Board offices, if necessary.

Who Issues the California 3843 Form

The California 3843 form is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering tax laws and ensuring compliance among fiduciaries and other taxpayers. The FTB provides guidance and resources to assist fiduciaries in understanding their obligations and completing the form accurately.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ftb 3843 payment voucher for fiduciary e filed returns

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ftb 3843 payment voucher for fiduciary e filed returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 3843?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents electronically. The reference to '3843' highlights a specific feature or pricing tier that may be relevant for users looking for tailored solutions. With airSlate SignNow, you can streamline your document workflows efficiently.

-

How much does airSlate SignNow cost for the 3843 plan?

The pricing for the 3843 plan of airSlate SignNow is designed to be cost-effective, catering to businesses of all sizes. This plan includes essential features that enhance document management and eSigning capabilities. For detailed pricing information, visit our pricing page.

-

What features are included in the 3843 plan of airSlate SignNow?

The 3843 plan includes a variety of features such as customizable templates, advanced security options, and integration capabilities with other software. These features are designed to improve efficiency and ensure that your document signing process is seamless. Explore all the features to see how they can benefit your business.

-

Can I integrate airSlate SignNow with other applications under the 3843 plan?

Yes, the 3843 plan allows for integrations with various applications, enhancing your workflow. You can connect airSlate SignNow with popular tools like Google Drive, Salesforce, and more. This integration capability ensures that your document processes are streamlined across platforms.

-

What are the benefits of using airSlate SignNow's 3843 plan?

Using the 3843 plan of airSlate SignNow offers numerous benefits, including increased efficiency, reduced turnaround time for document signing, and enhanced security. Businesses can save time and resources by automating their document workflows. This plan is ideal for organizations looking to optimize their operations.

-

Is airSlate SignNow compliant with legal standards in the 3843 plan?

Absolutely, airSlate SignNow complies with all major legal standards for electronic signatures, including ESIGN and UETA. The 3843 plan ensures that your signed documents are legally binding and secure. This compliance gives businesses peace of mind when managing sensitive documents.

-

How does airSlate SignNow ensure document security in the 3843 plan?

The 3843 plan of airSlate SignNow incorporates advanced security measures, including encryption and secure access controls. These features protect your documents from unauthorized access and ensure that your data remains confidential. Security is a top priority for us, and we take it seriously.

Get more for Instructions For Form FTB 3843 Payment Voucher For Fiduciary E filed Returns

- Form 139rep authorized representative form dcf vermont

- Fullmakt privatperson pdf form

- Basha diagnostics price list form

- Hospersa online application form

- Sign over parental rights forms 100007920

- Conscious discipline arizona department of education form

- International partnership agreement template form

- Investor llc agreement template form

Find out other Instructions For Form FTB 3843 Payment Voucher For Fiduciary E filed Returns

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed