NH Department of Revenue Administration Welcome 2022

Eligibility criteria for the PA 1000 property tax rent rebate form

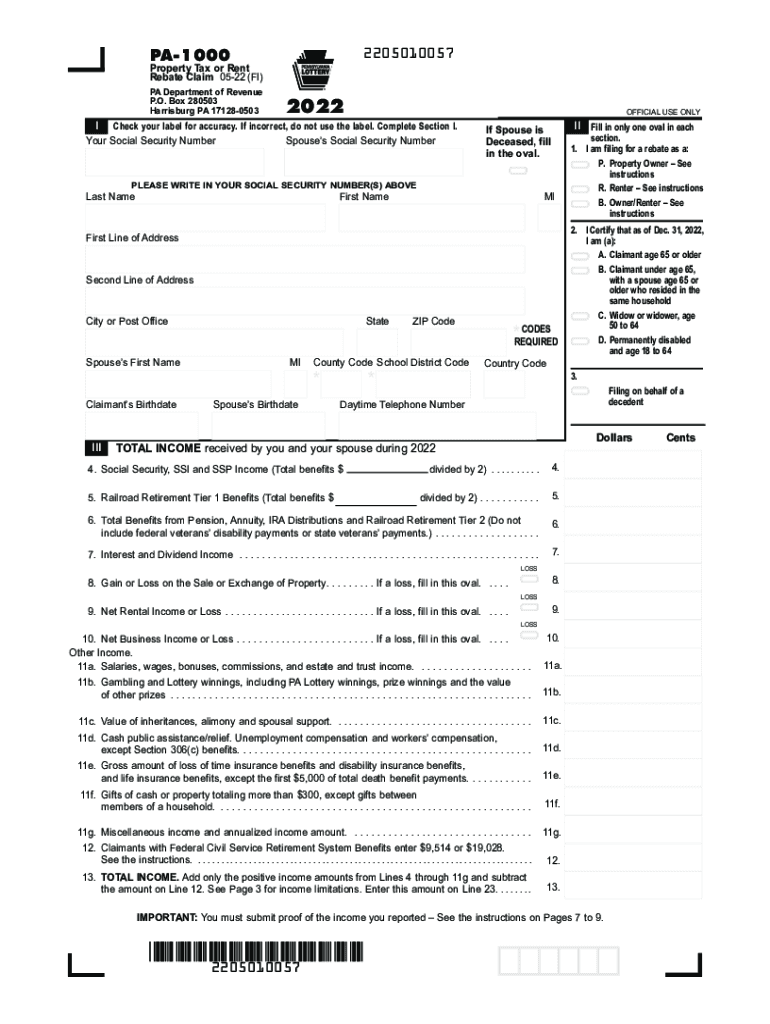

To qualify for the Pennsylvania property rent rebate program, applicants must meet specific eligibility criteria. Generally, individuals must be at least sixty-five years old, or be a widow or widower aged fifty-one or older, or be permanently disabled. Income limits also apply, with total income not exceeding the established threshold, which is adjusted annually. This income includes Social Security, pensions, and any other sources of income. It is essential for applicants to review these criteria carefully to ensure they qualify before submitting the PA 1000 tax form.

Required documents for the PA 1000 property tax rent rebate form

When completing the PA 1000 property tax rent rebate form, certain documents are necessary to support your application. Applicants should gather proof of age, such as a birth certificate or driver's license, and documentation of income, including tax returns or Social Security statements. Additionally, if applicable, proof of rental payments, such as lease agreements or rent receipts, may be required. Having these documents ready can streamline the application process and help ensure that your submission is complete.

Steps to complete the PA 1000 property tax rent rebate form

Completing the PA 1000 property tax rent rebate form involves several steps. First, ensure you meet the eligibility criteria outlined earlier. Next, gather all required documents to support your application. Begin filling out the form by providing your personal information, including name, address, and date of birth. Then, report your income sources accurately. If you rent your home, include your rental information. Once the form is complete, review it for accuracy before submitting it either online or by mail. This thorough approach can help avoid delays in processing your rebate.

Form submission methods for the PA 1000 property tax rent rebate form

The PA 1000 property tax rent rebate form can be submitted through various methods to accommodate different preferences. Applicants can choose to file online through the Pennsylvania Department of Revenue's website, which offers a user-friendly interface for electronic submissions. Alternatively, the form can be printed and mailed to the appropriate address listed on the form. In-person submissions may also be possible at designated offices, allowing applicants to receive assistance if needed. Each method has its benefits, so consider which option works best for your situation.

Penalties for non-compliance with the PA 1000 property tax rent rebate form

Failure to comply with the requirements of the PA 1000 property tax rent rebate form can lead to penalties. If an applicant provides false information or fails to report income accurately, they may face fines or disqualification from receiving future rebates. Additionally, late submissions may result in the loss of eligibility for that tax year. It is crucial to ensure that all information provided is truthful and complete to avoid these potential consequences.

Digital vs. paper version of the PA 1000 property tax rent rebate form

When deciding between the digital and paper versions of the PA 1000 property tax rent rebate form, consider the advantages of each. The digital version allows for quicker submission and may offer immediate confirmation of receipt, reducing processing time. On the other hand, the paper version can be filled out manually, which some may find more comfortable. Both versions require the same information, so choose the method that best fits your needs and preferences.

Quick guide on how to complete nh department of revenue administration welcome

Effortlessly Prepare NH Department Of Revenue Administration Welcome on Any Device

Managing documents online has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle NH Department Of Revenue Administration Welcome on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign NH Department Of Revenue Administration Welcome

- Find NH Department Of Revenue Administration Welcome and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign NH Department Of Revenue Administration Welcome to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nh department of revenue administration welcome

Create this form in 5 minutes!

How to create an eSignature for the nh department of revenue administration welcome

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 1000 property tax rent rebate form?

The PA 1000 property tax rent rebate form is a state-sponsored application for Pennsylvania residents to claim rebates on rent or property taxes. This form helps eligible individuals receive financial assistance, making it essential for those looking to alleviate housing costs.

-

Who is eligible to fill out the PA 1000 property tax rent rebate form?

Eligibility for the PA 1000 property tax rent rebate form generally includes Pennsylvania residents aged 65 or older, individuals with disabilities, and specific income criteria. It’s important to review the requirements to ensure you qualify before applying.

-

How can airSlate SignNow assist with filling out the PA 1000 property tax rent rebate form?

airSlate SignNow can streamline the process of filling out the PA 1000 property tax rent rebate form by enabling easy electronic signing and sharing of documents. Users can complete the form online, ensuring a hassle-free experience while maintaining compliance with state requirements.

-

Are there any fees associated with the PA 1000 property tax rent rebate form?

There are no fees to submit the PA 1000 property tax rent rebate form; however, using services like airSlate SignNow may involve subscription costs for electronic signing. Investing in such solutions could expedite your application process and save time.

-

What features does airSlate SignNow offer for managing the PA 1000 property tax rent rebate form?

airSlate SignNow offers features like intuitive document editing and easy eSignature options for the PA 1000 property tax rent rebate form. These tools enhance user productivity and ensure that your application is completed accurately and efficiently.

-

Can I track the status of my PA 1000 property tax rent rebate form submission with airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities for your submissions, including the PA 1000 property tax rent rebate form. This helps you stay informed about the status of your application and any further actions needed.

-

What are the benefits of using airSlate SignNow for the PA 1000 property tax rent rebate form?

Using airSlate SignNow for the PA 1000 property tax rent rebate form enhances efficiency and ensures secure document management. The platform simplifies electronic signing and allows for quick retrieval of your documents when needed.

Get more for NH Department Of Revenue Administration Welcome

- Residuals practice worksheet pdf form

- Nato orders template form

- Chkd doctors note form

- The grand review ap human geography form

- Lesson 7 skills practice subtract linear expressions form

- Codeigniter 3 book pdf form

- This rental application is london property management association form

- Box 129261 san diego ca 92112 9261 form

Find out other NH Department Of Revenue Administration Welcome

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple