Property TaxRent Rebate Program Forms and Information 2023-2026

Understanding the Pennsylvania Property Tax Rent Rebate Program

The Pennsylvania Property Tax Rent Rebate Program is designed to provide financial relief to eligible residents who are either renters or homeowners. This program helps individuals with low to moderate incomes offset property taxes or rent paid during the previous year. The rebate amount varies based on income and the amount of property tax or rent paid. Eligible applicants can receive a rebate ranging from $0 to $650, depending on their financial situation and the specifics of their living arrangements.

Eligibility Criteria for the Rebate Program

To qualify for the Pennsylvania Property Tax Rent Rebate Program, applicants must meet certain criteria. Generally, eligible individuals include:

- Residents of Pennsylvania who are at least 65 years old, or

- Widows and widowers aged 50 or older, or

- Individuals with disabilities aged 18 or older.

Additionally, applicants must have an income that does not exceed the program limits, which are updated annually. It is essential to review the income thresholds each year to determine eligibility.

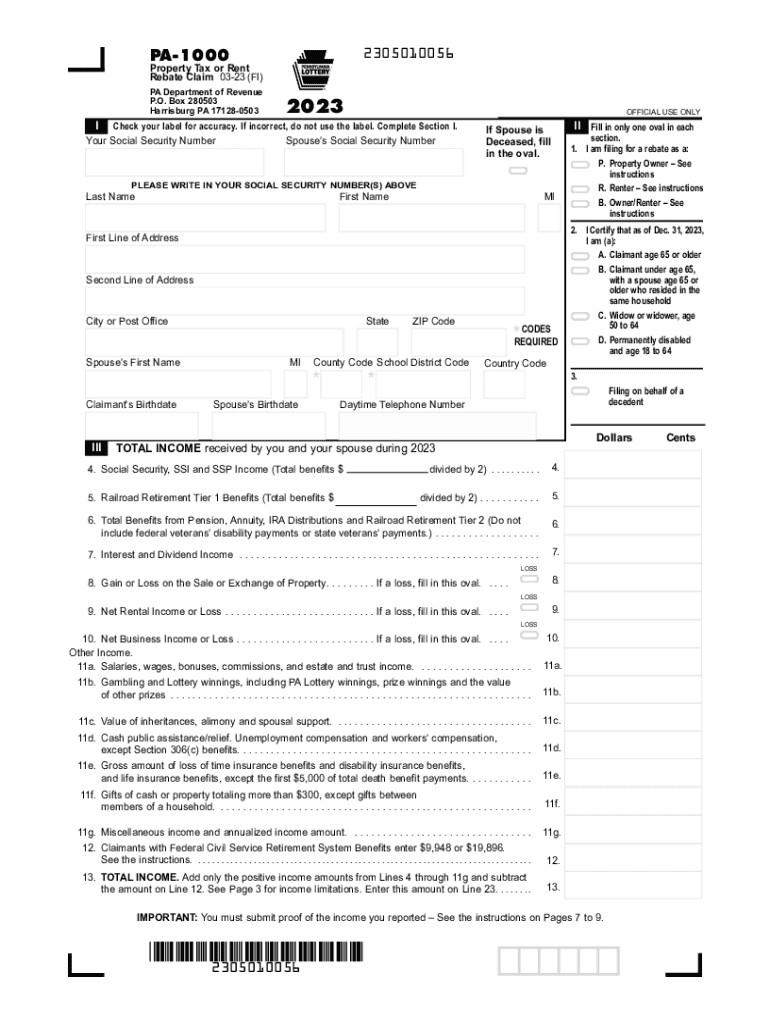

Steps to Complete the PA 1000 Property Tax Rent Rebate Form

Completing the PA 1000 Property Tax Rent Rebate Form involves several steps:

- Gather necessary documents, including proof of income and documentation of rent or property taxes paid.

- Obtain the PA 1000 form, which can be accessed online or through local government offices.

- Fill out the form accurately, ensuring all required information is provided.

- Submit the completed form by the deadline, either online, by mail, or in person.

It is crucial to double-check all entries for accuracy to avoid delays in processing.

Form Submission Methods for the Rebate Program

Applicants have multiple options for submitting the PA 1000 form. These methods include:

- Online submission through the Pennsylvania Department of Revenue's website.

- Mailing the completed form to the appropriate office address.

- In-person submission at designated government offices.

Each method has its own advantages, such as convenience with online submission or personal assistance when submitting in person.

Required Documents for the Rebate Application

When applying for the Pennsylvania Property Tax Rent Rebate, certain documents are necessary to support the application. These include:

- Proof of income, such as tax returns or pay stubs.

- Documentation of rent payments or property taxes, including receipts or landlord statements.

- Identification documents to verify age or disability status, if applicable.

Having these documents ready can streamline the application process and help ensure a successful submission.

Filing Deadlines for the Rebate Program

It is important to be aware of the filing deadlines for the Pennsylvania Property Tax Rent Rebate Program. Typically, applications must be submitted by June 30 of the year following the tax year for which the rebate is being claimed. For example, for rent or property taxes paid in 2022, the application would need to be submitted by June 30, 2023. Late submissions may not be accepted, so timely filing is essential.

Quick guide on how to complete property taxrent rebate program forms and information

Complete Property TaxRent Rebate Program Forms And Information seamlessly on any device

Digital document management has gained traction among enterprises and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to generate, modify, and eSign your documents promptly without delays. Manage Property TaxRent Rebate Program Forms And Information on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign Property TaxRent Rebate Program Forms And Information effortlessly

- Find Property TaxRent Rebate Program Forms And Information and click Get Form to begin.

- Utilize the tools available to submit your document.

- Highlight signNow portions of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Property TaxRent Rebate Program Forms And Information to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct property taxrent rebate program forms and information

Create this form in 5 minutes!

How to create an eSignature for the property taxrent rebate program forms and information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA tax rebate and who is eligible for it?

The PA tax rebate is a financial benefit provided to certain residents of Pennsylvania who meet specific income criteria. Eligible individuals typically include those over 65, widows, widowers, or people with disabilities. Understanding your eligibility is crucial for maximizing your potential PA tax rebate.

-

How can airSlate SignNow help with the PA tax rebate application process?

airSlate SignNow simplifies the PA tax rebate application process by allowing users to easily eSign and send necessary documents online. This ensures that your submissions are timely and secure, helping avoid potential delays in receiving your rebate. Our user-friendly platform supports a smoother application journey.

-

What features does airSlate SignNow offer for managing PA tax rebate documents?

With airSlate SignNow, users can access features like customizable templates, document editing, and secure eSigning, all designed to facilitate the PA tax rebate process. These features streamline document handling, making it quicker and easier to complete your applications. Efficient document management can signNowly reduce the stress of tax time.

-

Is there a cost associated with using airSlate SignNow for the PA tax rebate?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective while ensuring access to features beneficial for processing PA tax rebates. Investing in our solution can save you time and enhance your overall application experience.

-

Can airSlate SignNow integrate with other tax software for PA tax rebate applications?

Absolutely! airSlate SignNow seamlessly integrates with various tax software solutions, enabling a smooth exchange of information for your PA tax rebate applications. This capability enhances efficiency, allowing for synchronizing data and streamlining your application process without the hassle of manual entries.

-

What are the benefits of using airSlate SignNow for my PA tax rebate applications?

Using airSlate SignNow offers several benefits, including increased efficiency, reduced paperwork, and faster processing of your PA tax rebate applications. Our platform boosts productivity by digitizing the signing process, allowing for quicker submissions and access to your documents anytime, anywhere. Enjoy a hassle-free experience with our user-centric design.

-

How secure is the information I submit for the PA tax rebate through airSlate SignNow?

airSlate SignNow prioritizes the security of your data, employing advanced encryption and security protocols to protect your information. Your PA tax rebate documents are handled with the highest level of security, ensuring that sensitive data remains confidential throughout the application process. Trust in our platform for a secure experience.

Get more for Property TaxRent Rebate Program Forms And Information

- Bookout sheet form

- Pdf checking and savings account application digital federal dcu form

- Home equity application form

- How to open access bank account online form

- Cash disbursement policy form

- Second wind consultants reviews form

- Annuity partial withdrawal request login form

- Simple employee direct deposit form

Find out other Property TaxRent Rebate Program Forms And Information

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online