Pennsylvania Individual Income Tax Declaration for Electronic Filing PA 8453 FormsPublications 2022

Understanding the Pennsylvania Individual Income Tax Declaration for Electronic Filing (PA 8453)

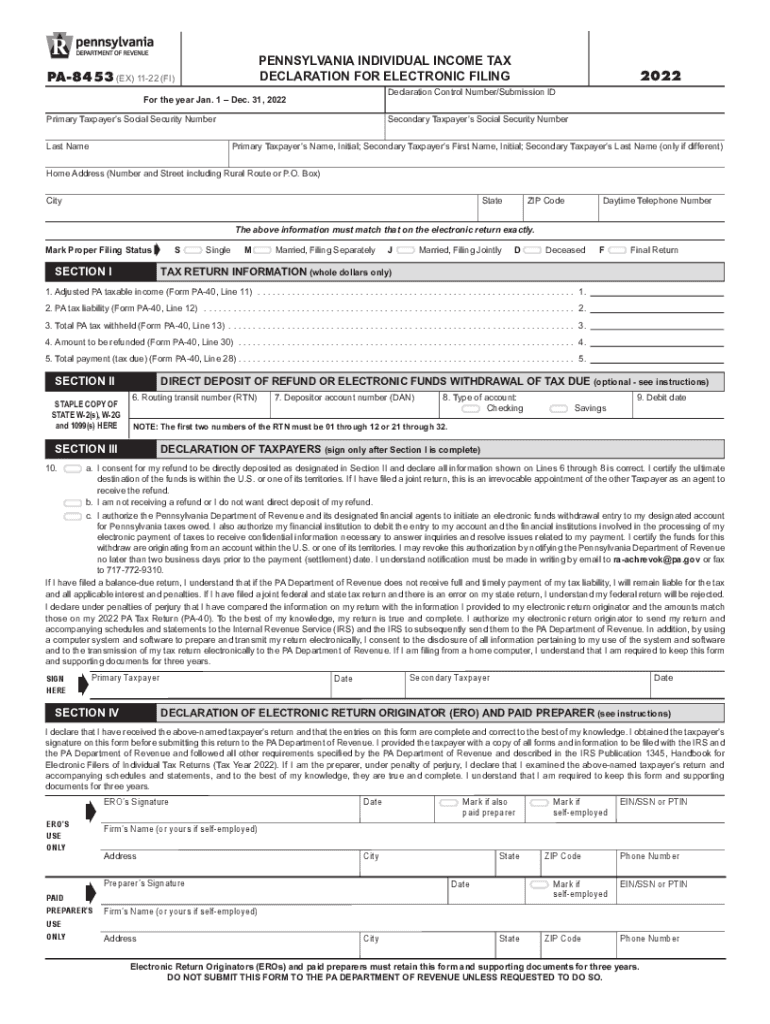

The Pennsylvania Individual Income Tax Declaration for Electronic Filing, commonly referred to as the PA 8453, is a crucial document for individuals filing their state taxes electronically. This form serves as a declaration of the taxpayer's intent to file electronically and confirms that the information provided is accurate. It is essential for ensuring compliance with Pennsylvania tax regulations and is a key component of the electronic filing process.

Steps to Complete the Pennsylvania Individual Income Tax Declaration for Electronic Filing (PA 8453)

Completing the PA 8453 involves several important steps:

- Gather necessary information, including your Social Security number, income details, and any deductions.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for any errors or omissions.

- Sign the form electronically, using a secure eSignature solution to validate your submission.

- Submit the completed form along with your electronic tax return to the appropriate state tax authority.

Legal Use of the Pennsylvania Individual Income Tax Declaration for Electronic Filing (PA 8453)

The PA 8453 is legally recognized under Pennsylvania state law as a valid declaration for electronic filing. To ensure its legal standing, it must be filled out completely and accurately. Utilizing a reliable eSignature solution, such as signNow, provides a digital certificate that enhances the form's authenticity and compliance with eSignature laws, including ESIGN and UETA. This legal backing is crucial for both the taxpayer and the state.

Filing Deadlines and Important Dates for the PA 8453

Timely submission of the PA 8453 is essential to avoid penalties. The filing deadline for Pennsylvania state taxes typically aligns with the federal tax deadline, which is usually April 15. However, taxpayers should verify specific dates each year, as they may vary. It is advisable to complete the PA 8453 and any accompanying forms well in advance of this deadline to ensure a smooth filing process.

Required Documents for the Pennsylvania Individual Income Tax Declaration for Electronic Filing (PA 8453)

Before completing the PA 8453, gather all necessary documents to ensure accurate reporting. These documents typically include:

- W-2 forms from employers

- 1099 forms for additional income

- Records of deductions and credits

- Previous year's tax return for reference

Having these documents on hand will facilitate a more efficient and accurate completion of the PA 8453.

Who Issues the Pennsylvania Individual Income Tax Declaration for Electronic Filing (PA 8453)

The PA 8453 is issued by the Pennsylvania Department of Revenue. This governmental body oversees the administration of state tax laws and provides the necessary forms and guidance for taxpayers. It is important to refer to the official resources from the Pennsylvania Department of Revenue for the most current version of the PA 8453 and any updates regarding filing procedures.

Quick guide on how to complete 2022 pennsylvania individual income tax declaration for electronic filing pa 8453 formspublications

Prepare Pennsylvania Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the instruments needed to create, modify, and eSign your documents swiftly and without delays. Manage Pennsylvania Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Pennsylvania Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications effortlessly

- Locate Pennsylvania Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Pennsylvania Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 pennsylvania individual income tax declaration for electronic filing pa 8453 formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2022 pennsylvania individual income tax declaration for electronic filing pa 8453 formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of airSlate SignNow in managing PA state income tax documents?

airSlate SignNow simplifies the process of managing PA state income tax documents by allowing users to eSign and send documents efficiently. This ensures that all tax-related paperwork is handled promptly, reducing errors and streamlining your filing process. With our platform, you can easily track and store your signed documents for future reference.

-

How does airSlate SignNow handle electronic signatures for PA state income tax forms?

With airSlate SignNow, electronic signatures for PA state income tax forms are legally binding and secure. The platform adheres to industry standards for eSignature legality, making it a reliable choice for signing tax documents. This feature allows users to complete and submit their forms without the hassle of printing and mailing.

-

Are there any specific integrations with accounting software for managing PA state income tax?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, which helps users manage their PA state income tax more effectively. These integrations simplify data transfer, reduce manual entry, and enhance overall efficiency. With this capability, users can prepare and sign their tax documents effortlessly from their preferred accounting tools.

-

What are the pricing options for using airSlate SignNow for PA state income tax needs?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs, ensuring that users can find a solution for their PA state income tax requirements. Our cost-effective options allow businesses of all sizes to access essential features without breaking the bank. We encourage prospective customers to explore our website for detailed pricing information.

-

How can airSlate SignNow benefit my business when dealing with PA state income tax filings?

Utilizing airSlate SignNow can signNowly benefit your business by streamlining the PA state income tax filing process. Our platform enhances productivity by allowing for quick eSigning and efficient document management. This means less time spent on paperwork and more focus on core business activities, leading to better compliance and efficiency.

-

Can airSlate SignNow help me track my PA state income tax documents?

Absolutely! airSlate SignNow provides robust tracking features for all your PA state income tax documents. Users can easily monitor the status of their documents, ensuring that they are filed on time and without errors. This tracking functionality adds peace of mind that your important tax documents are handled safely and promptly.

-

Is airSlate SignNow compliant with PA state income tax regulations?

Yes, airSlate SignNow is fully compliant with PA state income tax regulations concerning electronic signatures and document management. We prioritize legal conformity, ensuring that our users meet all state requirements when submitting their tax documents. This compliance helps prevent any potential issues that could arise from using non-compliant solutions.

Get more for Pennsylvania Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications

Find out other Pennsylvania Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter