Pennsylvania State Income Tax Brackets, Forms, and 2020

Understanding the Pennsylvania State Income Tax Brackets

The Pennsylvania state income tax is a flat tax, meaning that all taxpayers are subject to the same rate regardless of their income level. As of the latest updates, the tax rate is set at three point seven five percent (3.75%). This rate applies to all taxable income, which includes wages, salaries, and other forms of compensation. Understanding these brackets is crucial for accurate tax planning and compliance.

Steps to Complete the Pennsylvania State Income Tax Forms

Completing the Pennsylvania state income tax forms involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and deductions.

- Fill out the appropriate forms, such as the PA-40 for residents or the PA-40-NR for non-residents.

- Calculate your total income and apply any deductions or credits that you qualify for.

- Review your completed forms for accuracy before submission.

Filing Deadlines for Pennsylvania State Income Tax

Taxpayers in Pennsylvania must be aware of important filing deadlines to avoid penalties. Typically, the deadline for filing state income tax returns is April fifteenth (April 15) of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Extensions may also be available, but they require filing specific forms to avoid late fees.

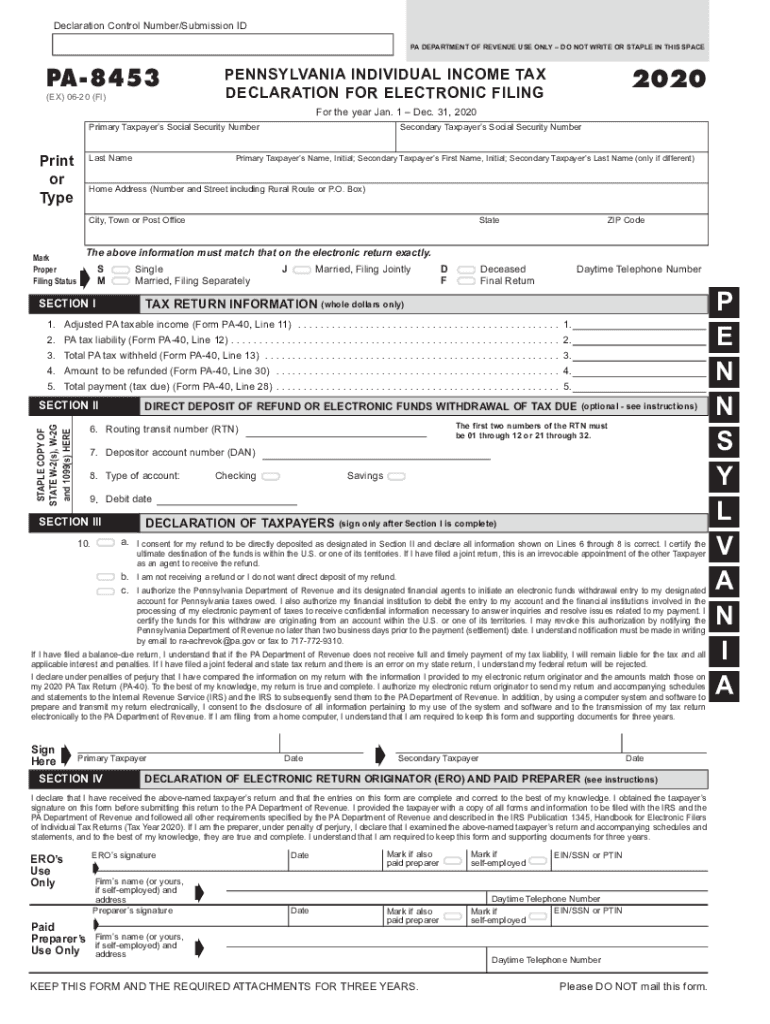

Legal Use of the Pennsylvania State Income Tax Forms

The Pennsylvania state income tax forms, including the 8453 tax electronic form, must be used in compliance with state regulations. This ensures that all information provided is accurate and complete, as any discrepancies can lead to penalties or audits. Digital signatures are accepted, provided that they meet the legal requirements set forth by Pennsylvania law.

Who Issues the Pennsylvania State Income Tax Forms

The Pennsylvania Department of Revenue is responsible for issuing all state income tax forms. This department provides resources and guidance for taxpayers, ensuring they have access to the latest forms and instructions. It is advisable to check their official website for updates and any changes to the forms or filing procedures.

Penalties for Non-Compliance with Pennsylvania Tax Regulations

Failure to comply with Pennsylvania state tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Taxpayers should be aware of their obligations and ensure timely filing and payment to avoid these consequences. Understanding the implications of non-compliance is essential for maintaining good standing with the state.

Quick guide on how to complete pennsylvania state income tax brackets forms and

Complete Pennsylvania State Income Tax Brackets, Forms, And effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an optimal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Pennsylvania State Income Tax Brackets, Forms, And on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Pennsylvania State Income Tax Brackets, Forms, And seamlessly

- Locate Pennsylvania State Income Tax Brackets, Forms, And and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Pennsylvania State Income Tax Brackets, Forms, And and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pennsylvania state income tax brackets forms and

Create this form in 5 minutes!

People also ask

-

What is the 8453 tax electronic form?

The 8453 tax electronic form is a declaration document used by taxpayers to authenticate electronic forms filed with the IRS. It serves as an essential part of the e-filing process, ensuring that your tax return is accurately submitted. airSlate SignNow simplifies this process by enabling users to electronically sign and send the 8453 tax electronic form securely.

-

How does airSlate SignNow help with the 8453 tax electronic form?

airSlate SignNow allows users to easily create, sign, and send the 8453 tax electronic form through a user-friendly interface. With its eSigning capabilities, you can streamline the process of submitting tax forms electronically without the need for printing or mailing. This efficiency supports timely filings, minimizing the chance of penalties.

-

Is airSlate SignNow cost-effective for filing the 8453 tax electronic form?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to file the 8453 tax electronic form. With competitive pricing plans tailored for various needs, users can manage document workflows efficiently without breaking the bank. The investment signNowly reduces the overall costs associated with tax preparation and submission.

-

What features does airSlate SignNow provide for electronic signing?

airSlate SignNow includes robust features for electronic signing that make handling the 8453 tax electronic form straightforward. These features include real-time tracking, advanced security measures, and customizable signing workflows. Such capabilities ensure that your documents are signed promptly and securely.

-

Are there any integrations available for the 8453 tax electronic form with airSlate SignNow?

Absolutely! airSlate SignNow offers a range of integrations that enhance the filing of the 8453 tax electronic form. These integrations include popular accounting and tax software, allowing users to seamlessly sync their data and streamline their workflows for greater efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for the 8453 tax electronic form comes with multiple benefits, including increased efficiency, enhanced security, and reduced paper usage. The platform's automated features save time and minimize errors, while its compliance with regulatory standards ensures that your submissions are secure and legitimate. Organizations can also better manage their documentation process.

-

How can I get started with airSlate SignNow for the 8453 tax electronic form?

Getting started with airSlate SignNow is simple! You can sign up for an account and access templates specifically designed for the 8453 tax electronic form. Once registered, you can utilize the platform's tools to create, send, and eSign your tax documents with ease.

Get more for Pennsylvania State Income Tax Brackets, Forms, And

Find out other Pennsylvania State Income Tax Brackets, Forms, And

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors