Corporation EFile Louisiana Department of Revenue 2022-2026

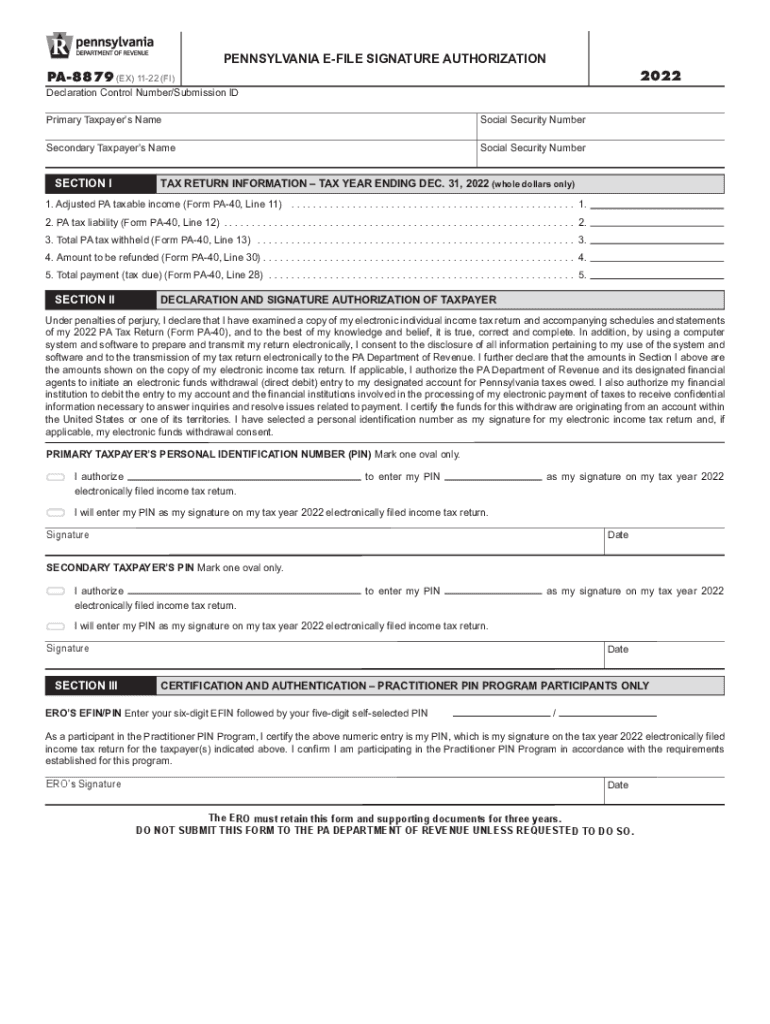

What is form 8879?

Form 8879, also known as the IRS e-file Signature Authorization, is a crucial document used by taxpayers in the United States to authorize an electronic return originator (ERO) to file their tax returns electronically. This form serves as a declaration that the taxpayer has reviewed the information on their tax return and agrees to its submission. It is particularly relevant for individuals who are filing their taxes through a tax professional or software that supports e-filing.

Steps to complete form 8879

Completing form 8879 involves several key steps:

- Gather necessary information, including your Social Security number, filing status, and income details.

- Review your tax return to ensure all information is accurate and complete.

- Fill out form 8879, entering your personal information and the details of your tax return.

- Sign the form electronically, which may involve entering a PIN or other identifying information.

- Submit the completed form to your ERO, who will then file your tax return electronically.

Legal use of form 8879

The legal use of form 8879 is governed by the IRS guidelines for electronic filing. By signing this form, taxpayers confirm that they understand the implications of e-filing and that they are authorizing their ERO to submit their tax return on their behalf. Compliance with the IRS regulations ensures that the electronic signature is valid and that the submission is legally binding.

Filing deadlines for form 8879

Taxpayers must be aware of the filing deadlines associated with form 8879. Typically, the deadline for submitting your tax return is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to ensure that form 8879 is completed and submitted in a timely manner to avoid any penalties or late fees.

Required documents for form 8879

To complete form 8879, taxpayers should have the following documents on hand:

- Your completed tax return (Form 1040 or other applicable forms).

- W-2 forms and any other income statements.

- Documentation for deductions and credits claimed.

- Identification information, such as your Social Security number.

Form submission methods for 8879

Form 8879 can be submitted electronically through your ERO or printed and submitted via mail. Most taxpayers prefer the electronic method for its convenience and speed. If submitting by mail, ensure that the form is sent to the correct address as specified by the IRS to avoid processing delays.

Quick guide on how to complete corporation efile louisiana department of revenue

Complete Corporation EFile Louisiana Department Of Revenue seamlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and efficiently. Manage Corporation EFile Louisiana Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Corporation EFile Louisiana Department Of Revenue without effort

- Locate Corporation EFile Louisiana Department Of Revenue and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Corporation EFile Louisiana Department Of Revenue and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporation efile louisiana department of revenue

Create this form in 5 minutes!

How to create an eSignature for the corporation efile louisiana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the keyword 8879?

AirSlate SignNow is a powerful eSignature solution that allows businesses to efficiently send and eSign documents. The reference to the keyword 8879 highlights our commitment to providing a secure, user-friendly experience that enhances document management and workflow efficiency.

-

How does airSlate SignNow pricing compare to competitors for the 8879 plan?

The airSlate SignNow pricing for the 8879 plan is designed to be cost-effective, offering competitive rates compared to other eSignature solutions. We believe in providing exceptional value without compromising on features, ensuring businesses can meet their document signing needs affordably.

-

What features does airSlate SignNow offer under the 8879 plan?

The 8879 plan includes features such as unlimited document signing, customizable templates, and advanced security measures. These functionalities empower businesses to streamline their document workflows, making signing and sending documents easier than ever.

-

What are the benefits of using airSlate SignNow with the 8879 plan?

Using airSlate SignNow under the 8879 plan allows businesses to enhance efficiency by reducing turnaround times for document signing. Additionally, features like automatic reminders and tracking provide a seamless experience that improves customer interactions and satisfaction.

-

Can I integrate airSlate SignNow with other applications using the 8879 plan?

Yes, the 8879 plan supports various integrations with popular applications like Salesforce, Google Drive, and more. This flexibility enables businesses to incorporate airSlate SignNow into their existing workflows, ensuring a unified approach to document management.

-

Is there a free trial available for the 8879 plan of airSlate SignNow?

Absolutely! We offer a free trial for the 8879 plan, allowing prospective customers to explore the robust features of airSlate SignNow without any initial investment. This trial helps businesses assess how our solution can meet their document signing needs.

-

How secure is airSlate SignNow with the 8879 plan?

The 8879 plan includes top-notch security features, such as encryption, two-factor authentication, and compliance with industry standards. AirSlate SignNow prioritizes user data protection, ensuring that your documents remain secure throughout the signing process.

Get more for Corporation EFile Louisiana Department Of Revenue

Find out other Corporation EFile Louisiana Department Of Revenue

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading