Pennsylvania Form CT V PA Corporation Taxes FedState 2022-2026

Understanding the Pennsylvania Form RCT-106

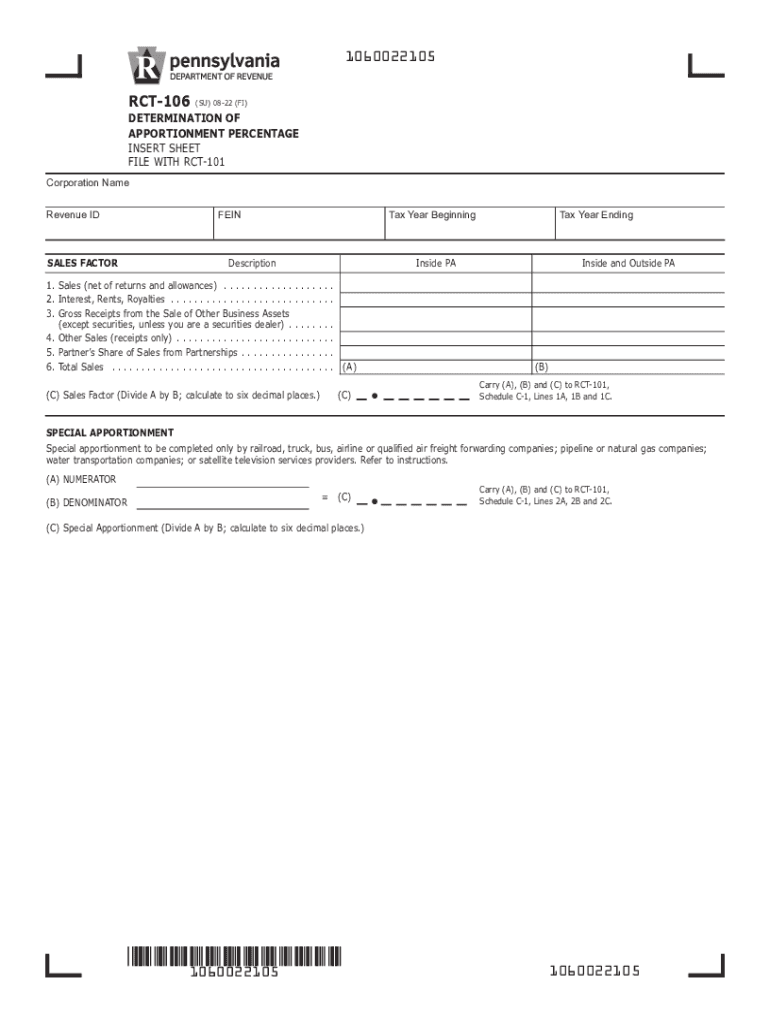

The Pennsylvania Form RCT-106 is a crucial document for corporations operating within the state. This form is specifically designed for the reporting of corporate net income tax. It is essential for businesses to accurately complete and submit this form to comply with state tax regulations. The RCT-106 helps determine the amount of tax owed based on the corporation's income, ensuring that businesses meet their legal obligations.

Steps to Complete the Pennsylvania Form RCT-106

Completing the RCT-106 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Begin filling out the form by entering the corporation's identification details, such as name, address, and federal employer identification number (EIN).

- Calculate the corporation's taxable income, adjusting for any deductions or credits applicable under Pennsylvania law.

- Complete the tax calculation section, ensuring all figures are accurate and reflect the corporation's financial activities.

- Review the entire form for completeness and accuracy before submission.

Filing Deadlines for the Pennsylvania Form RCT-106

Timely submission of the RCT-106 is critical to avoid penalties. The form is typically due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is advisable for businesses to mark this date on their calendars and prepare their documents in advance to ensure compliance.

Legal Use of the Pennsylvania Form RCT-106

The RCT-106 is legally binding when completed and submitted in accordance with Pennsylvania's tax laws. It is important for corporations to ensure that all information provided is truthful and accurate, as any discrepancies can lead to audits or penalties. Utilizing electronic signature solutions can enhance the security and validity of the submission, ensuring compliance with eSignature regulations.

Obtaining the Pennsylvania Form RCT-106

Businesses can obtain the RCT-106 from the Pennsylvania Department of Revenue's official website. The form is available in a downloadable format, making it accessible for all corporations. Additionally, businesses may contact the Department of Revenue directly for assistance or clarification regarding the form and its requirements.

Penalties for Non-Compliance with the Pennsylvania Form RCT-106

Failure to file the RCT-106 on time can result in significant penalties. Corporations may face fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to adhere to filing deadlines and ensure that their submissions are accurate to avoid these consequences.

Quick guide on how to complete pennsylvania form ct v pa corporation taxes fedstate

Finalize Pennsylvania Form CT V PA Corporation Taxes FedState effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely save it online. airSlate SignNow supplies you with all the tools you need to create, modify, and eSign your documents rapidly without delays. Handle Pennsylvania Form CT V PA Corporation Taxes FedState on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Pennsylvania Form CT V PA Corporation Taxes FedState with ease

- Find Pennsylvania Form CT V PA Corporation Taxes FedState and then click Acquire Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Finish button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced paperwork, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow handles your needs in document management in just a few clicks from any device of your choice. Modify and eSign Pennsylvania Form CT V PA Corporation Taxes FedState and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pennsylvania form ct v pa corporation taxes fedstate

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania form ct v pa corporation taxes fedstate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rct 106 in the context of airSlate SignNow?

The rct 106 refers to a specific compliance and documentation feature within the airSlate SignNow platform. It is designed to help businesses meet regulatory requirements by providing a secure method for sending and eSigning documents. With rct 106, users can ensure their transactions remain accountable and legally binding.

-

How does rct 106 enhance document security?

RCT 106 enhances document security through advanced encryption and authentication methods. By utilizing this feature, airSlate SignNow ensures that only authorized individuals can access and sign documents. This level of security helps businesses protect sensitive information while complying with industry standards.

-

What are the pricing options for using rct 106 features?

Pricing for airSlate SignNow's features, including rct 106, varies based on subscription plans tailored to different business needs. We offer flexible pricing models suitable for small businesses to large enterprises. For detailed pricing and features, it's best to visit our website or contact our sales team.

-

Can rct 106 integrate with other applications?

Yes, rct 106 can seamlessly integrate with a variety of applications and platforms. This includes popular tools like Salesforce, Google Drive, and Dropbox, allowing for a more streamlined workflow. Such integrations enable businesses to leverage the power of airSlate SignNow alongside their existing systems.

-

What benefits does rct 106 offer to businesses?

RCT 106 offers numerous benefits, including improved compliance, faster document processing, and enhanced security. By using this feature, businesses can reduce the risk of errors and streamline their document workflows. Furthermore, it helps in maintaining a clear audit trail for all transactions.

-

Is training available for using rct 106 features?

Yes, airSlate SignNow provides comprehensive training resources for users to maximize the benefits of rct 106 features. Resources include documentation, video tutorials, and live webinars. Our support team is also available to assist users with any questions they might have.

-

How can rct 106 improve collaboration within teams?

RCT 106 enhances collaboration by enabling multiple users to access and sign documents in real time. With airSlate SignNow, team members can easily share, review, and provide feedback on documents. This feature ensures faster decision-making and a more cohesive team dynamic within organizations.

Get more for Pennsylvania Form CT V PA Corporation Taxes FedState

Find out other Pennsylvania Form CT V PA Corporation Taxes FedState

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement